Required: Answer the following questions: The Cash flow to total liabilities ratio is: Net free cash flow is $ (Enter to two 3 decimal places)

Required: Answer the following questions: The Cash flow to total liabilities ratio is: Net free cash flow is $ (Enter to two 3 decimal places)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 54P

Related questions

Question

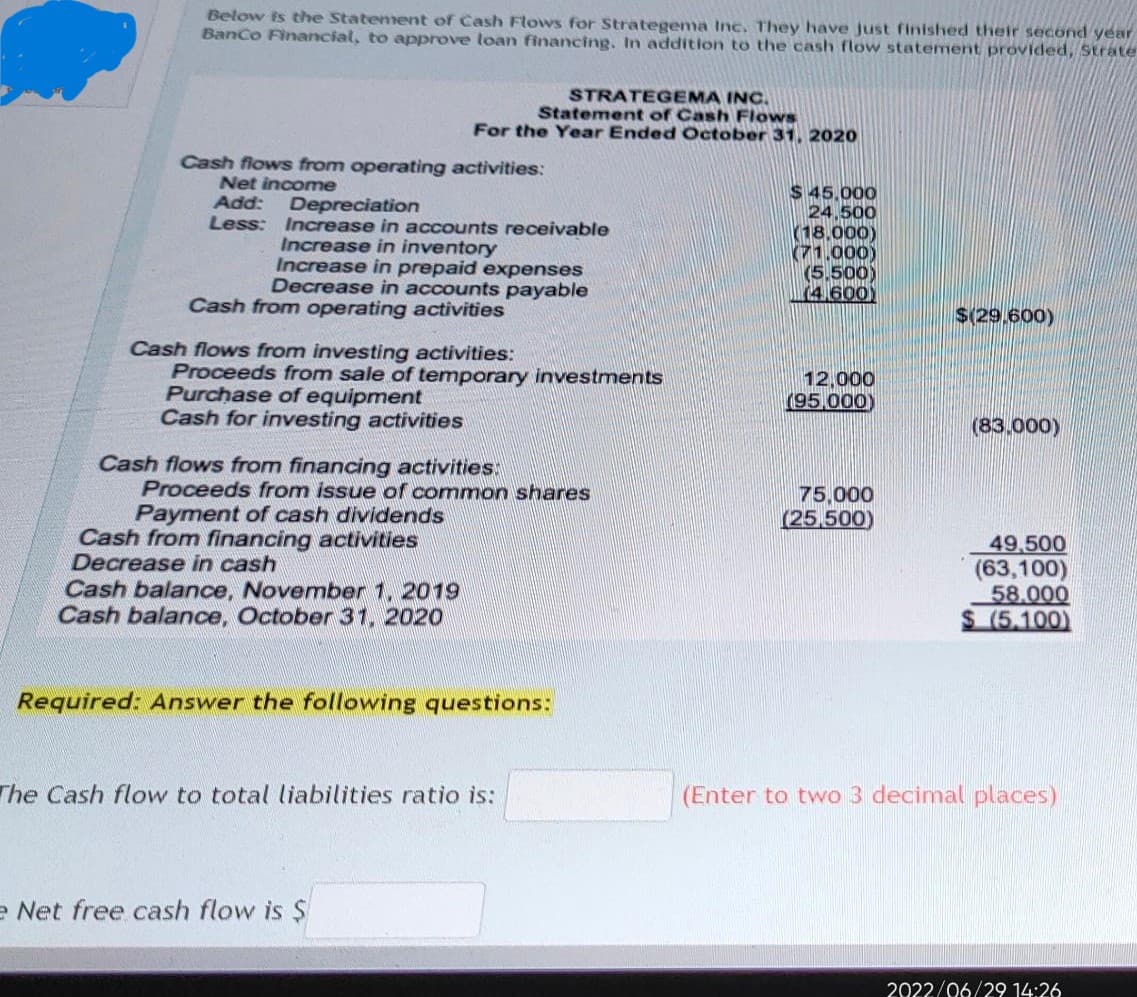

Transcribed Image Text:Below is the Statement of Cash Flows for Strategema Inc. They have just finished their second year

Banco Financial, to approve loan financing. In addition to the cash flow statement provided, Strate

Cash flows from operating activities:

Net income

Add: Depreciation

Less:

Increase in accounts receivable

Increase in inventory

Increase in prepaid expenses

Decrease in accounts payable

STRATEGEMA INC.

Statement of Cash Flows

For the Year Ended October 31, 2020

Cash from operating activities

Cash flows from investing activities:

Proceeds from sale of temporary investments

Purchase of equipment

Cash for investing activities

Cash flows from financing activities

Proceeds from issue of common shares

Payment of cash dividends

Cash from financing activities

Decrease in cash

Cash balance, November 1, 2019

Cash balance, October 31, 2020

Required: Answer the following questions:

The Cash flow to total liabilities ratio is:

e Net free cash flow is $

$ 45,000

24,500

(18,000)

(71.000)

(5.500)

(4.600)

12,000

(95,000)

75,000

(25,500)

$(29.600)

(83.000)

49,500

(63,100)

58.000

$ (5.100)

(Enter to two 3 decimal places)

2022/06/29 14:26

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning