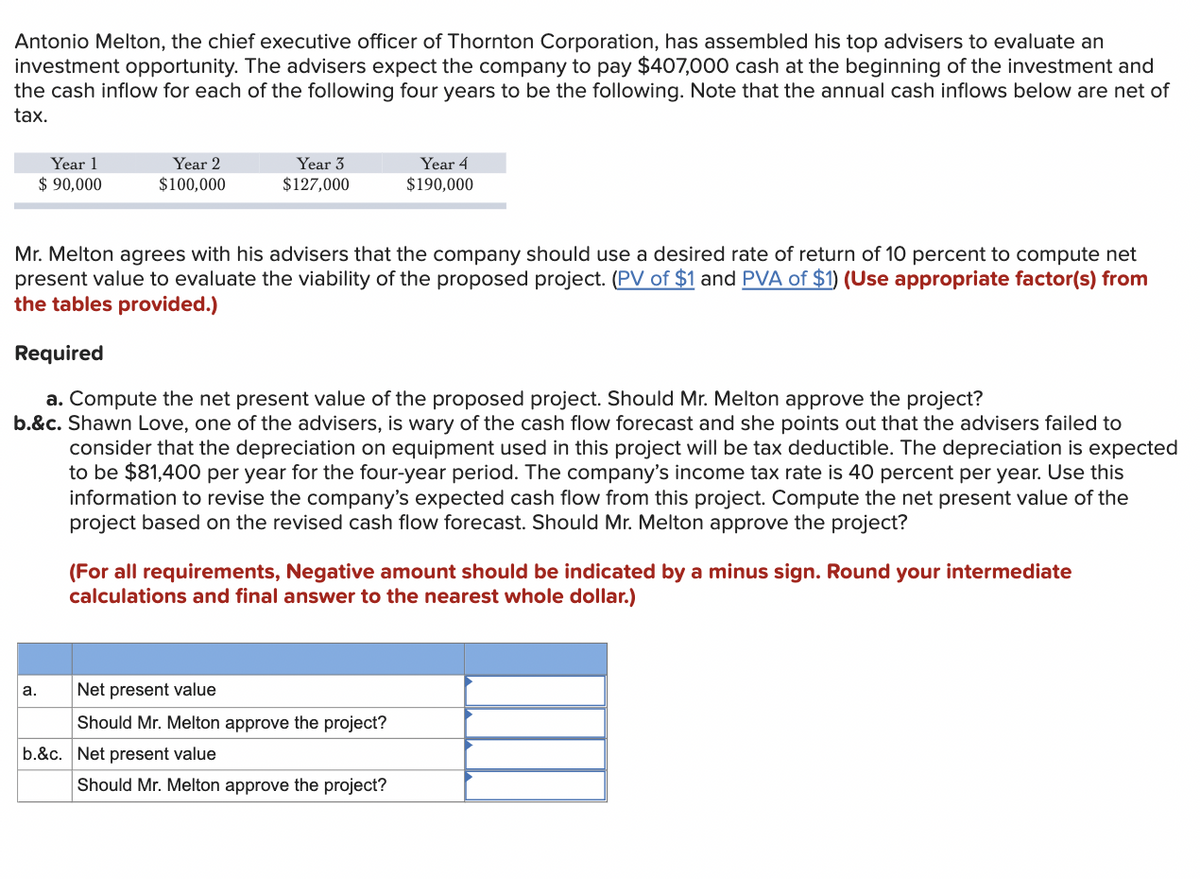

Antonio Melton, the chief executive officer of Thornton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $407,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 Year 3 Year 2 $100,000 Year 4 $190,000 $ 90,000 $127,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 10 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax deductible. The depreciation is expected to be $81,400 per year for the four-year period. The company's income tax rate is 40 percent per year. Use this information to revise the company's expected cash flow from this project. Compute the net present value of the project based on the revised cash flow forecast. Should Mr. Melton approve the project? (For all requirements, Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar.) Net present value Should Mr. Melton approve the project? Should Mr. Melton approve the project? a. b.&c. Net present value

Antonio Melton, the chief executive officer of Thornton Corporation, has assembled his top advisers to evaluate an investment opportunity. The advisers expect the company to pay $407,000 cash at the beginning of the investment and the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of tax. Year 1 Year 3 Year 2 $100,000 Year 4 $190,000 $ 90,000 $127,000 Mr. Melton agrees with his advisers that the company should use a desired rate of return of 10 percent to compute net present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Compute the net present value of the proposed project. Should Mr. Melton approve the project? b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to consider that the depreciation on equipment used in this project will be tax deductible. The depreciation is expected to be $81,400 per year for the four-year period. The company's income tax rate is 40 percent per year. Use this information to revise the company's expected cash flow from this project. Compute the net present value of the project based on the revised cash flow forecast. Should Mr. Melton approve the project? (For all requirements, Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar.) Net present value Should Mr. Melton approve the project? Should Mr. Melton approve the project? a. b.&c. Net present value

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

Transcribed Image Text:Antonio Melton, the chief executive officer of Thornton Corporation, has assembled his top advisers to evaluate an

investment opportunity. The advisers expect the company to pay $407,000 cash at the beginning of the investment and

the cash inflow for each of the following four years to be the following. Note that the annual cash inflows below are net of

tax.

Year 1

Year 3

Year 2

$100,000

Year 4

$190,000

$ 90,000

$127,000

Mr. Melton agrees with his advisers that the company should use a desired rate of return of 10 percent to compute net

present value to evaluate the viability of the proposed project. (PV of $1 and PVA of $1) (Use appropriate factor(s) from

the tables provided.)

Required

a. Compute the net present value of the proposed project. Should Mr. Melton approve the project?

b.&c. Shawn Love, one of the advisers, is wary of the cash flow forecast and she points out that the advisers failed to

consider that the depreciation on equipment used in this project will be tax deductible. The depreciation is expected

to be $81,400 per year for the four-year period. The company's income tax rate is 40 percent per year. Use this

information to revise the company's expected cash flow from this project. Compute the net present value of the

project based on the revised cash flow forecast. Should Mr. Melton approve the project?

(For all requirements, Negative amount should be indicated by a minus sign. Round your intermediate

calculations and final answer to the nearest whole dollar.)

Net present value

Should Mr. Melton approve the project?

Should Mr. Melton approve the project?

a.

b.&c. Net present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College