On Dec. 31, 2021 Sweets Inc. sold an old delivery truck to a local farmer for 5,000 The following additional information was provided: The farmer paid Sweets Inc. the full amount in cash on December 31. The old delivery truck was on the books as follows: Equipment - Delivery Truck Accumulated Depreciation - Equipment - Delivery Truck 50,000 $ 50,000 On Dec. 31, 2021 Sweets Inc. sold production equipment to a small candy manufacturer in Vermont for $ 40,000 The following additional information was provided: The small candy manufacturer offered a note in payment. The note is an agreement to pay Sweets Inc. $ 50,000 on June 30, 2022. | The production equipment was on the books as follows: Sweets Inc. Equipment $ 200,000 Accumulated Depreciation - Equipment $ 185,000 Instructor Note: Make sure you prepare the necessary journal entry(s) for each of the four transactions. The President is not an accountant. Your memorandum needs to walk the President from the accounting detail to the big picture. %24 Sweets Inc. made several capital purchases during the last month of the year. As part of the purchases the company sold some existing fixed assets. Yesterday, as you were walking to the company cafeteria, you saw the President of Sweets Inc. While walking with the President you mentioned that recent capital purchases would significantly impact the financial statements. Today, the President called you directly and asked you to write a memorandum explaining the impact of the capital purchases (and related sale of some existing fixed assets) on each of the following financial statements; Income Statement Balance Sheet Statement of Cash Flows Summary of December Capital Transactions On Dec. 1, 2021 Sweets Inc. purchased a new delivery truck for $ 100,000 The following additional information was provided: The truck was paid for with cash. The truck is expected to have a service life of No salvage value is expected after the service life. The company uses straight-line depreciation for their financial reporting. 10 years. On Dec. 1, 2021 Sweets Inc. purchased equipment for new production line at the lowa Plant. The cost of the equipment was $ 1,500,000 The following additional information was provided: The equipment was paid for with cash. The equipment has an expected service life of 20 years. Salvage value at the end of the service life is estimated to be 2$ 150,000 The company uses straight-line depreciation for their financial reporting. The equipment was installed in December 15, 2021. The installation cost was $ 50,000 Trial runs were also completed on December 15, 2021. The cost of the trial run was $ 10,000 1

On Dec. 31, 2021 Sweets Inc. sold an old delivery truck to a local farmer for 5,000 The following additional information was provided: The farmer paid Sweets Inc. the full amount in cash on December 31. The old delivery truck was on the books as follows: Equipment - Delivery Truck Accumulated Depreciation - Equipment - Delivery Truck 50,000 $ 50,000 On Dec. 31, 2021 Sweets Inc. sold production equipment to a small candy manufacturer in Vermont for $ 40,000 The following additional information was provided: The small candy manufacturer offered a note in payment. The note is an agreement to pay Sweets Inc. $ 50,000 on June 30, 2022. | The production equipment was on the books as follows: Sweets Inc. Equipment $ 200,000 Accumulated Depreciation - Equipment $ 185,000 Instructor Note: Make sure you prepare the necessary journal entry(s) for each of the four transactions. The President is not an accountant. Your memorandum needs to walk the President from the accounting detail to the big picture. %24 Sweets Inc. made several capital purchases during the last month of the year. As part of the purchases the company sold some existing fixed assets. Yesterday, as you were walking to the company cafeteria, you saw the President of Sweets Inc. While walking with the President you mentioned that recent capital purchases would significantly impact the financial statements. Today, the President called you directly and asked you to write a memorandum explaining the impact of the capital purchases (and related sale of some existing fixed assets) on each of the following financial statements; Income Statement Balance Sheet Statement of Cash Flows Summary of December Capital Transactions On Dec. 1, 2021 Sweets Inc. purchased a new delivery truck for $ 100,000 The following additional information was provided: The truck was paid for with cash. The truck is expected to have a service life of No salvage value is expected after the service life. The company uses straight-line depreciation for their financial reporting. 10 years. On Dec. 1, 2021 Sweets Inc. purchased equipment for new production line at the lowa Plant. The cost of the equipment was $ 1,500,000 The following additional information was provided: The equipment was paid for with cash. The equipment has an expected service life of 20 years. Salvage value at the end of the service life is estimated to be 2$ 150,000 The company uses straight-line depreciation for their financial reporting. The equipment was installed in December 15, 2021. The installation cost was $ 50,000 Trial runs were also completed on December 15, 2021. The cost of the trial run was $ 10,000 1

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 6CE

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

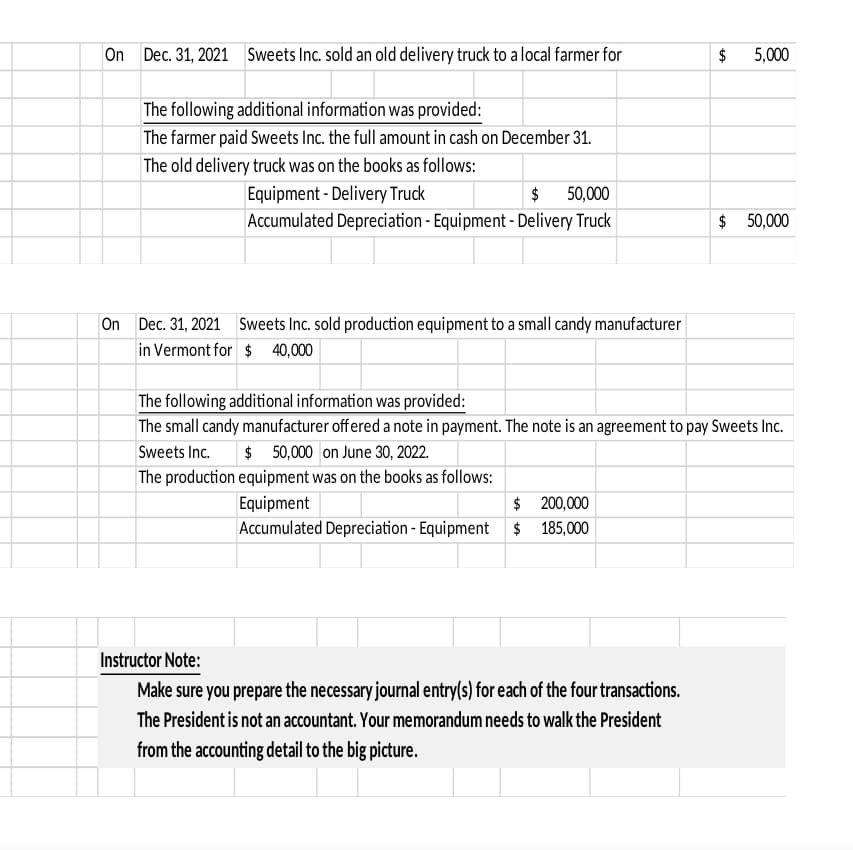

Transcribed Image Text:On Dec. 31, 2021 Sweets Inc. sold an old delivery truck to a local farmer for

5,000

The following additional information was provided:

The farmer paid Sweets Inc. the full amount in cash on December 31.

The old delivery truck was on the books as follows:

Equipment - Delivery Truck

Accumulated Depreciation - Equipment - Delivery Truck

50,000

$ 50,000

On Dec. 31, 2021

Sweets Inc. sold production equipment to a small candy manufacturer

in Vermont for $ 40,000

The following additional information was provided:

The small candy manufacturer offered a note in payment. The note is an agreement to pay Sweets Inc.

$ 50,000 on June 30, 2022.

| The production equipment was on the books as follows:

Sweets Inc.

Equipment

$ 200,000

Accumulated Depreciation - Equipment $ 185,000

Instructor Note:

Make sure you prepare the necessary journal entry(s) for each of the four transactions.

The President is not an accountant. Your memorandum needs to walk the President

from the accounting detail to the big picture.

%24

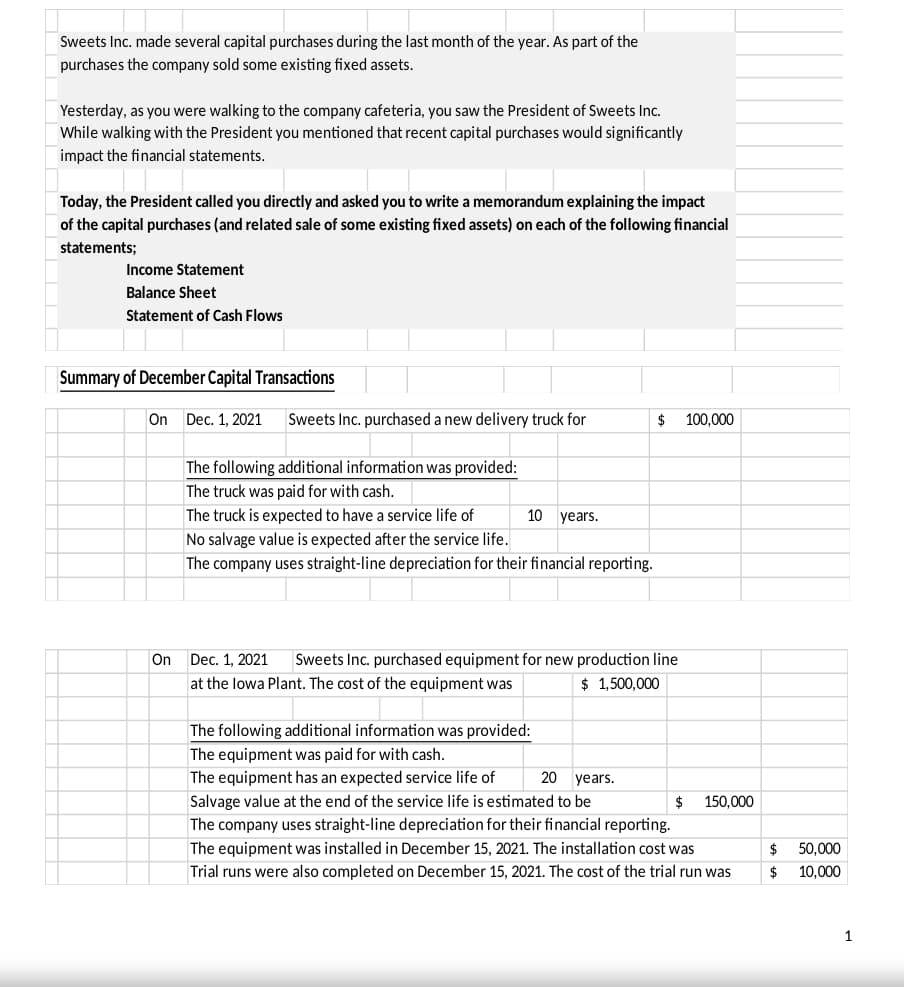

Transcribed Image Text:Sweets Inc. made several capital purchases during the last month of the year. As part of the

purchases the company sold some existing fixed assets.

Yesterday, as you were walking to the company cafeteria, you saw the President of Sweets Inc.

While walking with the President you mentioned that recent capital purchases would significantly

impact the financial statements.

Today, the President called you directly and asked you to write a memorandum explaining the impact

of the capital purchases (and related sale of some existing fixed assets) on each of the following financial

statements;

Income Statement

Balance Sheet

Statement of Cash Flows

Summary of December Capital Transactions

On

Dec. 1, 2021

Sweets Inc. purchased a new delivery truck for

$

100,000

The following additional information was provided:

The truck was paid for with cash.

The truck is expected to have a service life of

No salvage value is expected after the service life.

The company uses straight-line depreciation for their financial reporting.

10 years.

On

Dec. 1, 2021

Sweets Inc. purchased equipment for new production line

at the lowa Plant. The cost of the equipment was

$ 1,500,000

The following additional information was provided:

The equipment was paid for with cash.

The equipment has an expected service life of

20

years.

Salvage value at the end of the service life is estimated to be

2$

150,000

The company uses straight-line depreciation for their financial reporting.

The equipment was installed in December 15, 2021. The installation cost was

$

50,000

Trial runs were also completed on December 15, 2021. The cost of the trial run was

$

10,000

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning