(8) %24 23 Purchase Company recently acquired several businesses and recognized goodwill in each acquisition. Purchase has allocated the resulting goodwill to its three reporting units: RU-1, RU-2, and RU-3. Purchase opts to skip the qualitative assessment and therefore performs a quantitative goodwill impairment review annually. In its current-year assessment of goodwill, Purchase provides the following individual asset and liability carrying amounts for each of its reporting units: Carrying Amounts RU-2 $291,000 RU-1 RU-3 Tangible assets Trademark $191,000 $154,500 Customer list 00000 128, 250 Unpatented technology Licenses 117,500 Copyrights 71,500 156,550 226,950 Liabilities 000'DET (000') The total fair values for each reporting unit (including goodwill) are S614,800 for RU-1, $802.450 for RU-2, and $676,550 for RU-3. To date, Purchase has reported no goodwill impairments. How much goodwill impairment should Purchase report this year for each of its reporting units? RU-1 RU-2 RU-3 Goodwill impairment loss Mc Graw 11 of 15 Type here to search dy f12 ins prt sc delete f6 6) f5 81 f3 米 & L. backspa 4 %3D 8. 6. 3. 5. 7. pause N. alt ctrl

(8) %24 23 Purchase Company recently acquired several businesses and recognized goodwill in each acquisition. Purchase has allocated the resulting goodwill to its three reporting units: RU-1, RU-2, and RU-3. Purchase opts to skip the qualitative assessment and therefore performs a quantitative goodwill impairment review annually. In its current-year assessment of goodwill, Purchase provides the following individual asset and liability carrying amounts for each of its reporting units: Carrying Amounts RU-2 $291,000 RU-1 RU-3 Tangible assets Trademark $191,000 $154,500 Customer list 00000 128, 250 Unpatented technology Licenses 117,500 Copyrights 71,500 156,550 226,950 Liabilities 000'DET (000') The total fair values for each reporting unit (including goodwill) are S614,800 for RU-1, $802.450 for RU-2, and $676,550 for RU-3. To date, Purchase has reported no goodwill impairments. How much goodwill impairment should Purchase report this year for each of its reporting units? RU-1 RU-2 RU-3 Goodwill impairment loss Mc Graw 11 of 15 Type here to search dy f12 ins prt sc delete f6 6) f5 81 f3 米 & L. backspa 4 %3D 8. 6. 3. 5. 7. pause N. alt ctrl

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Transcribed Image Text:(8)

%24

23

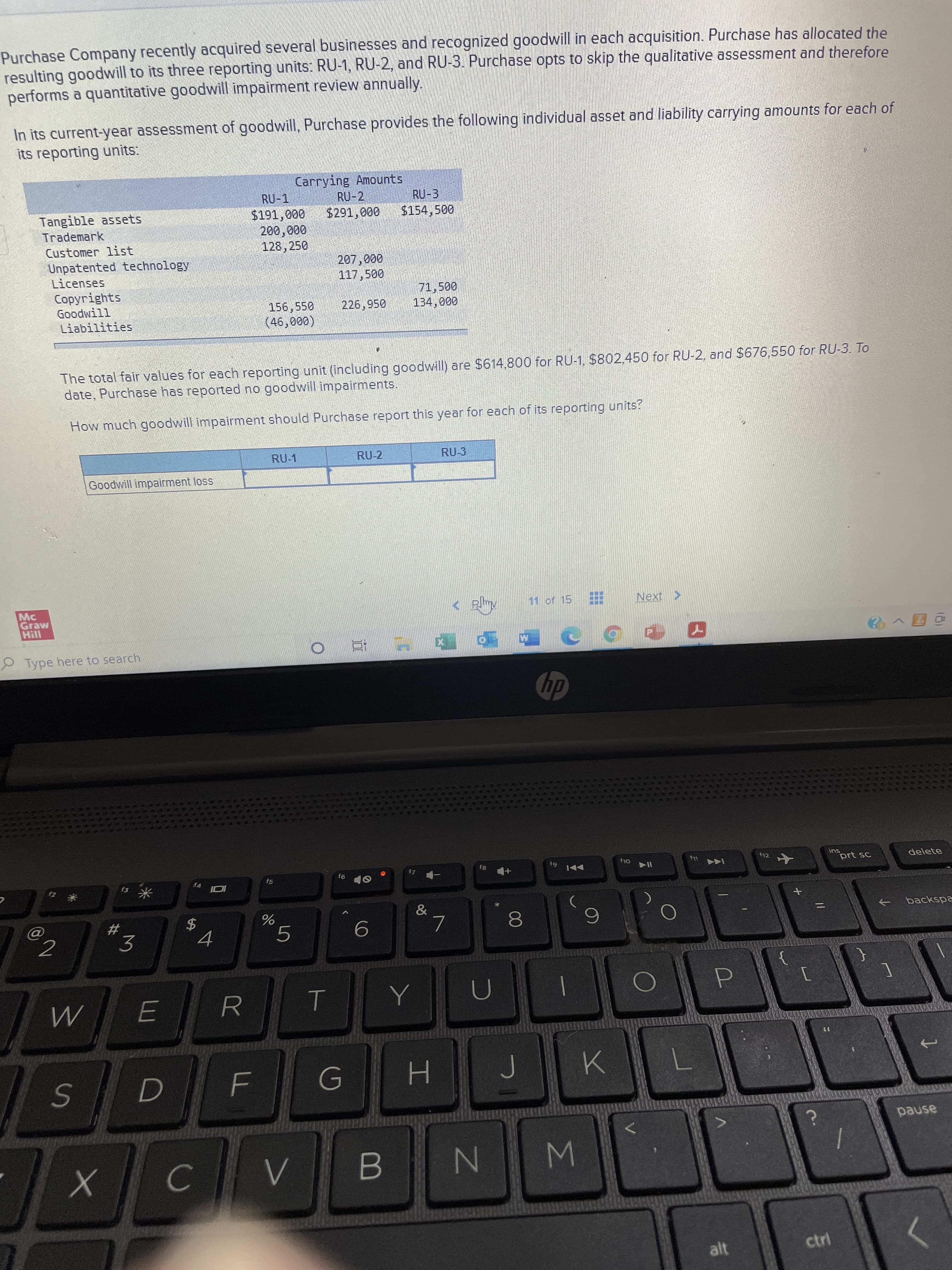

Purchase Company recently acquired several businesses and recognized goodwill in each acquisition. Purchase has allocated the

resulting goodwill to its three reporting units: RU-1, RU-2, and RU-3. Purchase opts to skip the qualitative assessment and therefore

performs a quantitative goodwill impairment review annually.

In its current-year assessment of goodwill, Purchase provides the following individual asset and liability carrying amounts for each of

its reporting units:

Carrying Amounts

RU-2

$291,000

RU-1

RU-3

Tangible assets

Trademark

$191,000

$154,500

Customer list

00000

128, 250

Unpatented technology

Licenses

117,500

Copyrights

71,500

156,550

226,950

Liabilities

000'DET

(000')

The total fair values for each reporting unit (including goodwill) are S614,800 for RU-1, $802.450 for RU-2, and $676,550 for RU-3. To

date, Purchase has reported no goodwill impairments.

How much goodwill impairment should Purchase report this year for each of its reporting units?

RU-1

RU-2

RU-3

Goodwill impairment loss

Mc

Graw

11 of 15

Type here to search

dy

f12

ins

prt sc

delete

f6

6)

f5

81

f3

米

&

L.

backspa

4

%3D

8.

6.

3.

5.

7.

pause

N.

alt

ctrl

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education