During the year ended December 31, 2020, Kelly's Camera Equlpment had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2020, Accounts Recelvable showed a $10,000 debit balance, and the Allowance for Doubtful Accounts showed an $800 credit balance. Collections of accounts recelvable during 2020 amounted to $68,000. Use the following data for 2020 to answer the questions: a. On December 10, 2020, a customer balance of $1.500 from a prlor year was determined to be uncollectible, so It was written off. b. On December 31, 2020, a declsion was made to contlnue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Requlred: 1. Prepare the required Journal entries for the two events In December 2020. (If no entry Is requlred for a transaction/event, select "No Journal entry requlred" In the first account fleld.) View transaction list View journal entry worksheet No Date General Journal Debit Credit Dec. 10, 2020 Sales returns and allowances 1,500 Accounts receivable 1,500 Dec. 31, 2020 Bad debt expense 1,700 Allowance for doubtful accounts 1.700

During the year ended December 31, 2020, Kelly's Camera Equlpment had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2020, Accounts Recelvable showed a $10,000 debit balance, and the Allowance for Doubtful Accounts showed an $800 credit balance. Collections of accounts recelvable during 2020 amounted to $68,000. Use the following data for 2020 to answer the questions: a. On December 10, 2020, a customer balance of $1.500 from a prlor year was determined to be uncollectible, so It was written off. b. On December 31, 2020, a declsion was made to contlnue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Requlred: 1. Prepare the required Journal entries for the two events In December 2020. (If no entry Is requlred for a transaction/event, select "No Journal entry requlred" In the first account fleld.) View transaction list View journal entry worksheet No Date General Journal Debit Credit Dec. 10, 2020 Sales returns and allowances 1,500 Accounts receivable 1,500 Dec. 31, 2020 Bad debt expense 1,700 Allowance for doubtful accounts 1.700

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Need help with accounting homework question ASAP!

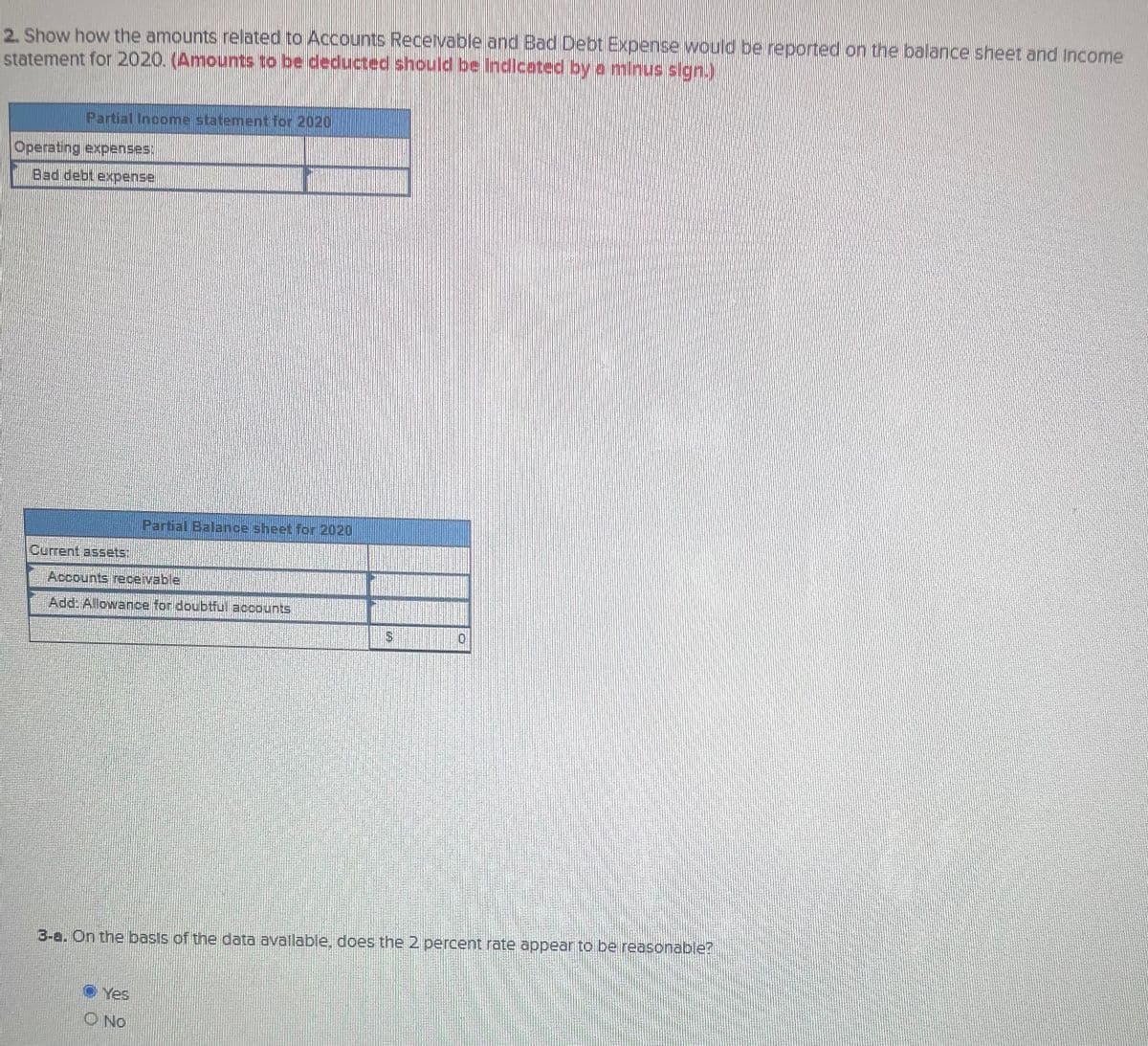

Transcribed Image Text:2. Show how the amounts related to Accounts Recelvable and Bad Debt Expense would be reported on the balance sheet and Income

statement for 2020. (Amounts to be deducted should be Indiceted by a minus slgn.)

Partial Income statement for 2020

Operating expenses:

Bad debt expense

Partial Balance sheet for 2020

Current assets:

Accounts receivable

Add: Allowance for doubtiul accounts

3-a. On the basis of the data avallable, does the 2 percent rate appear to be reasonable?

O Yes

O No

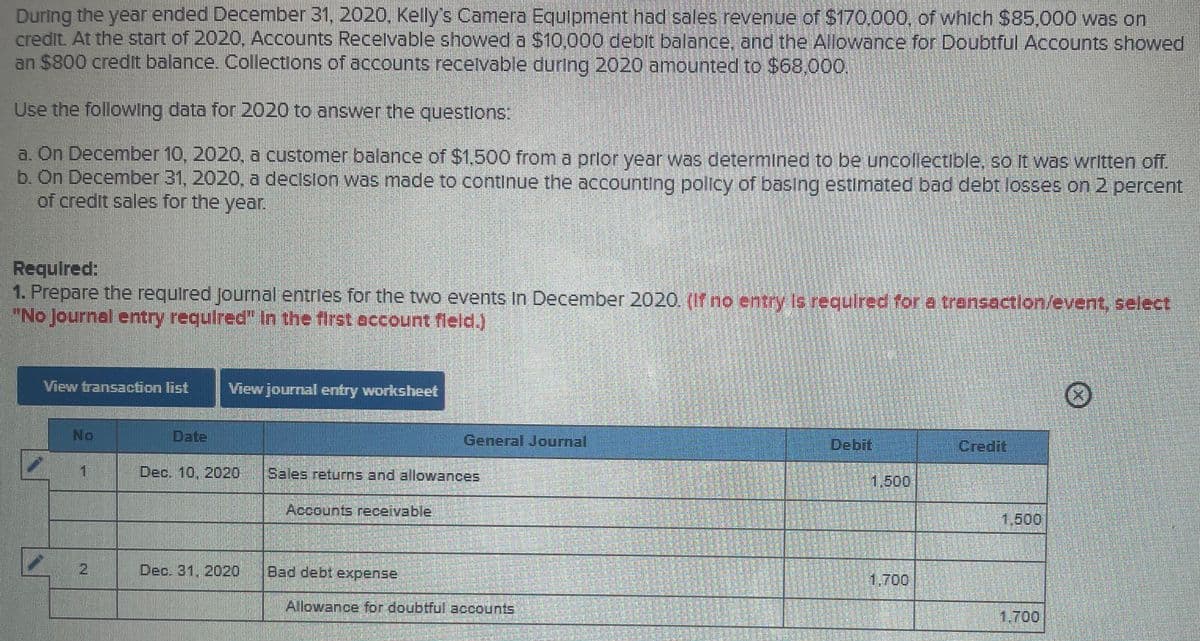

Transcribed Image Text:During the year ended December 31, 2020, Kelly's Camera Equipment had sales revenue of S170.000, of which $85.000 was on

credit. At the start of 2020, Accounts Recelvable showed a S10,000 deoit balace; and the Allowance for Doubtful Accounts showed

an $800 credt balance. Collections of accounts recetvable during 2020 amounted to S68,000.

Use the following data for 2020 to answer the questlons:

a. On December 10, 2020, a customer balance of $1,500 from a prtor year was determined to be uncollectible, so It was written off.

b. On December 31, 2020, a declsion was made to continue the accounting policy of basing estimated bad debt losses on 2 percent

of credit sales for the year.

Required:

1. Prepare the required Journhal entries for the two events in December 2020 (If no erntry Is required for a transoatlon/event, select

"No Journal entry requlred" In the first occount fleld.)

View transaction list

View journal entry worksheet

No

Date

General Journal

Debit

Credit

1.

Dec. 10, 2020

Sales returns and allowances

1,500

Accounts receivable

1,600

21

Dec. 31, 2020

Bad debt expense

1.700

Allowance for doubtful accounts

1,700.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning