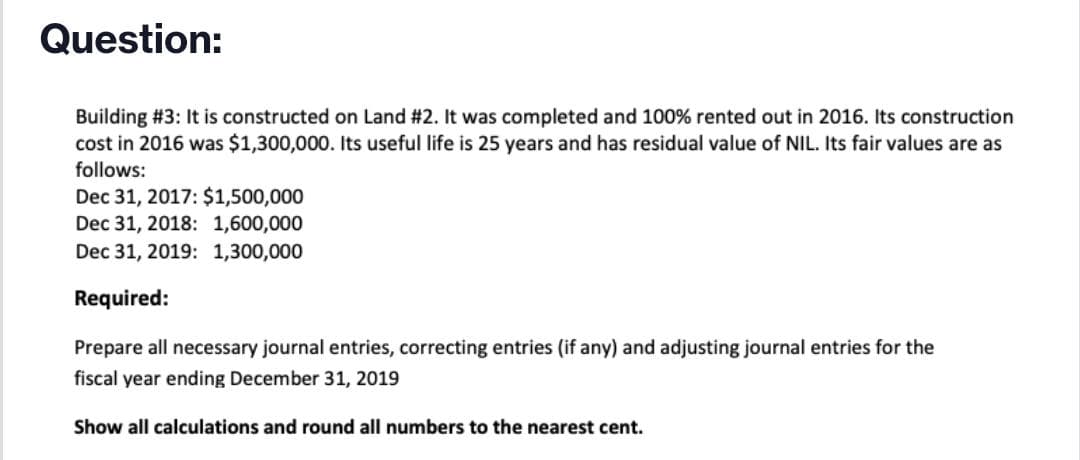

Question: Building #3: It is constructed on Land #2. It was completed and 100% rented out in 2016. Its construction cost in 2016 was $1,300,000. Its useful life is 25 years and has residual value of NIL. Its fair values are as follows: Dec 31, 2017: $1,500,000 Dec 31, 2018: 1,600,000 Dec 31, 2019: 1,300,000 Required: Prepare all necessary journal entries, correcting entries (if any) and adjusting journal entries for the fiscal year ending December 31, 2019 Show all calculations and round all numbers to the nearest cent.

Question: Building #3: It is constructed on Land #2. It was completed and 100% rented out in 2016. Its construction cost in 2016 was $1,300,000. Its useful life is 25 years and has residual value of NIL. Its fair values are as follows: Dec 31, 2017: $1,500,000 Dec 31, 2018: 1,600,000 Dec 31, 2019: 1,300,000 Required: Prepare all necessary journal entries, correcting entries (if any) and adjusting journal entries for the fiscal year ending December 31, 2019 Show all calculations and round all numbers to the nearest cent.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Question

100%

Transcribed Image Text:Question:

Building #3: It is constructed on Land #2. It was completed and 100% rented out in 2016. Its construction

cost in 2016 was $1,300,000. Its useful life is 25 years and has residual value of NIL. Its fair values are as

follows:

Dec 31, 2017: $1,500,000

Dec 31, 2018: 1,600,000

Dec 31, 2019: 1,300,000

Required:

Prepare all necessary journal entries, correcting entries (if any) and adjusting journal entries for the

fiscal year ending December 31, 2019

Show all calculations and round all numbers to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT