Gruman Company purchased a machine for $220,000 on January 2, 2019. It made the following estimates: Service life 5 years or 10,000 hours Production 200,000 units Residual value $20,000 In 2019, Gruman uses the machine for 1,800 hours and produces 44,000 units. In 2020, Gruman uses the machine for 1,500 hours and produces 35,000 units. If required, round your final answers to the nearest c Required: 1. Compute the depreciation for 2019 and 2020 under each of the following methods: a. Straight-line method 40,000 2019 $ 2020 $ 40,000 b. Sum-of-the-years'-digits method 2019 $ 2020 $

Gruman Company purchased a machine for $220,000 on January 2, 2019. It made the following estimates: Service life 5 years or 10,000 hours Production 200,000 units Residual value $20,000 In 2019, Gruman uses the machine for 1,800 hours and produces 44,000 units. In 2020, Gruman uses the machine for 1,500 hours and produces 35,000 units. If required, round your final answers to the nearest c Required: 1. Compute the depreciation for 2019 and 2020 under each of the following methods: a. Straight-line method 40,000 2019 $ 2020 $ 40,000 b. Sum-of-the-years'-digits method 2019 $ 2020 $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 32BE: Depreciation Methods On January 1, 2019, Loeffler Company acquired a machine at a cost of $200,000....

Related questions

Question

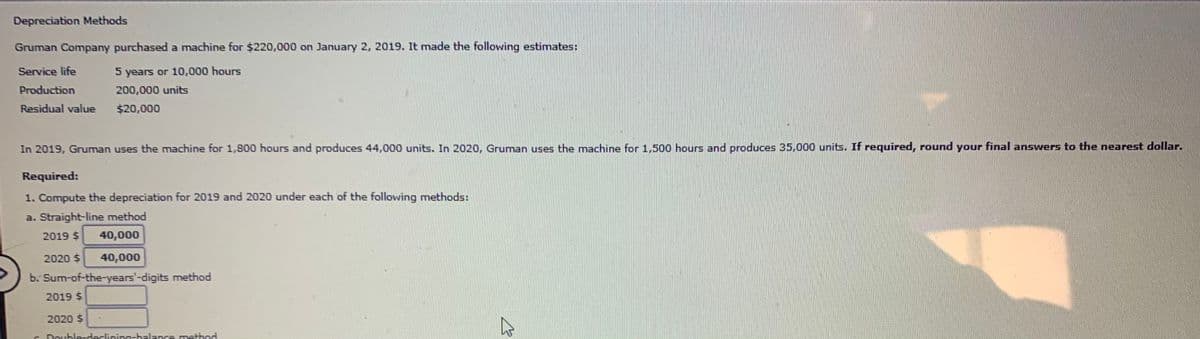

Transcribed Image Text:Depreciation Methods

Gruman Company purchased a machine for $220,000 on January 2, 2019. It made the following estimates:

Service life

5 years or 10,000 hours

Production

200,000 units

Residual value

$20,000

In 2019, Gruman uses the machine for 1,800 hours and produces 44,000 units. In 2020, Gruman uses the machine for 1,500 hours and produces 35,000 units. If required, round your final answers to the nearest dollar.

Required:

1. Compute the depreciation for 2019 and 2020 under each of the following methods:

a. Straight-line method

2019 $

40,000

2020 $

40,000

b. Sum-of-the-years'-digits method

2019 $

2020 $

Doubla-daclining-halance method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning