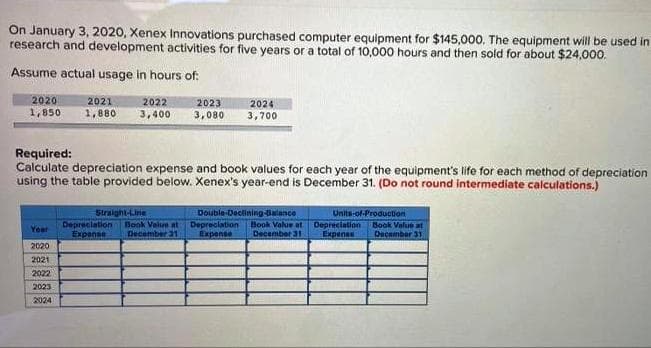

On January 3, 2020, Xenex Innovations purchased computer equipment for $145,000. The equipment will be used in research and development activities for five years or a total of 10,000 hours and then sold for about $24,000. Assume actual usage in hours of: 2020 2021 2022 2023 3,080 2024 1,850 1,880 3,400 3,700 Required: Calculate depreciation expense and book values for each year of the equipment's life for each method of depreciation using the table provided below. Xenex's year-end is December 31. (Do not round intermediate calculations.) Double Declining-Balance Book Value at December 31 Straight-Line Units-of-Producdion Depreciation Expenas Depreciation Book Value at Depreciation December 31 Book Value at December 31 Year Expense Expense 2020 2021 2022 2023 2024

On January 3, 2020, Xenex Innovations purchased computer equipment for $145,000. The equipment will be used in research and development activities for five years or a total of 10,000 hours and then sold for about $24,000. Assume actual usage in hours of: 2020 2021 2022 2023 3,080 2024 1,850 1,880 3,400 3,700 Required: Calculate depreciation expense and book values for each year of the equipment's life for each method of depreciation using the table provided below. Xenex's year-end is December 31. (Do not round intermediate calculations.) Double Declining-Balance Book Value at December 31 Straight-Line Units-of-Producdion Depreciation Expenas Depreciation Book Value at Depreciation December 31 Book Value at December 31 Year Expense Expense 2020 2021 2022 2023 2024

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 11E: On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated...

Related questions

Question

Please answer all

Transcribed Image Text:On January 3, 2020, Xenex Innovations purchased computer equipment for $145,000. The equipment will be used in

research and development activities for five years or a total of 10,000 hours and then sold for about $24,000.

Assume actual usage in hours of:

2020

2021

1,880

2022

2023

3,080

2024

3,700

1,850

3,400

Required:

Calculate depreciation expense and book values for each year of the equipment's life for each method of depreciation

using the table provided below. Xenex's year-end is December 31. (Do not round intermediate calculations.)

Double-Declining Balance

Depreciation Book Value at Depreclation Book Valuw t Depreciation Book Value at

Straight-Line

Units-of-Production

Year

Expense

December 31

December 31

Expenas

Decamber 31

Expense

2020

2021

2022

2023

2024

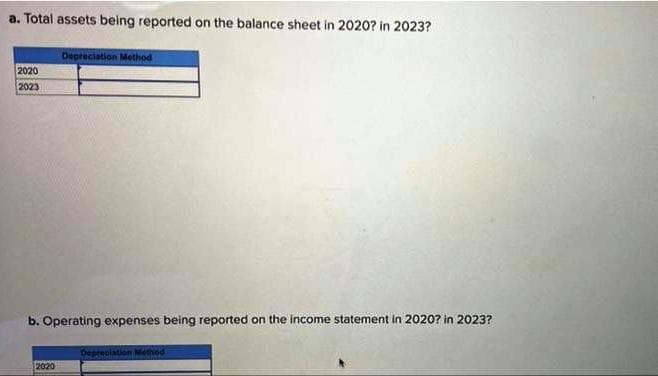

Transcribed Image Text:a. Total assets being reported on the balance sheet in 2020? in 2023?

Depreciation Method

2020

2023

b. Operating expenses being reported on the income statement in 2020? in 2023?

Depreclation Mathod

2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT