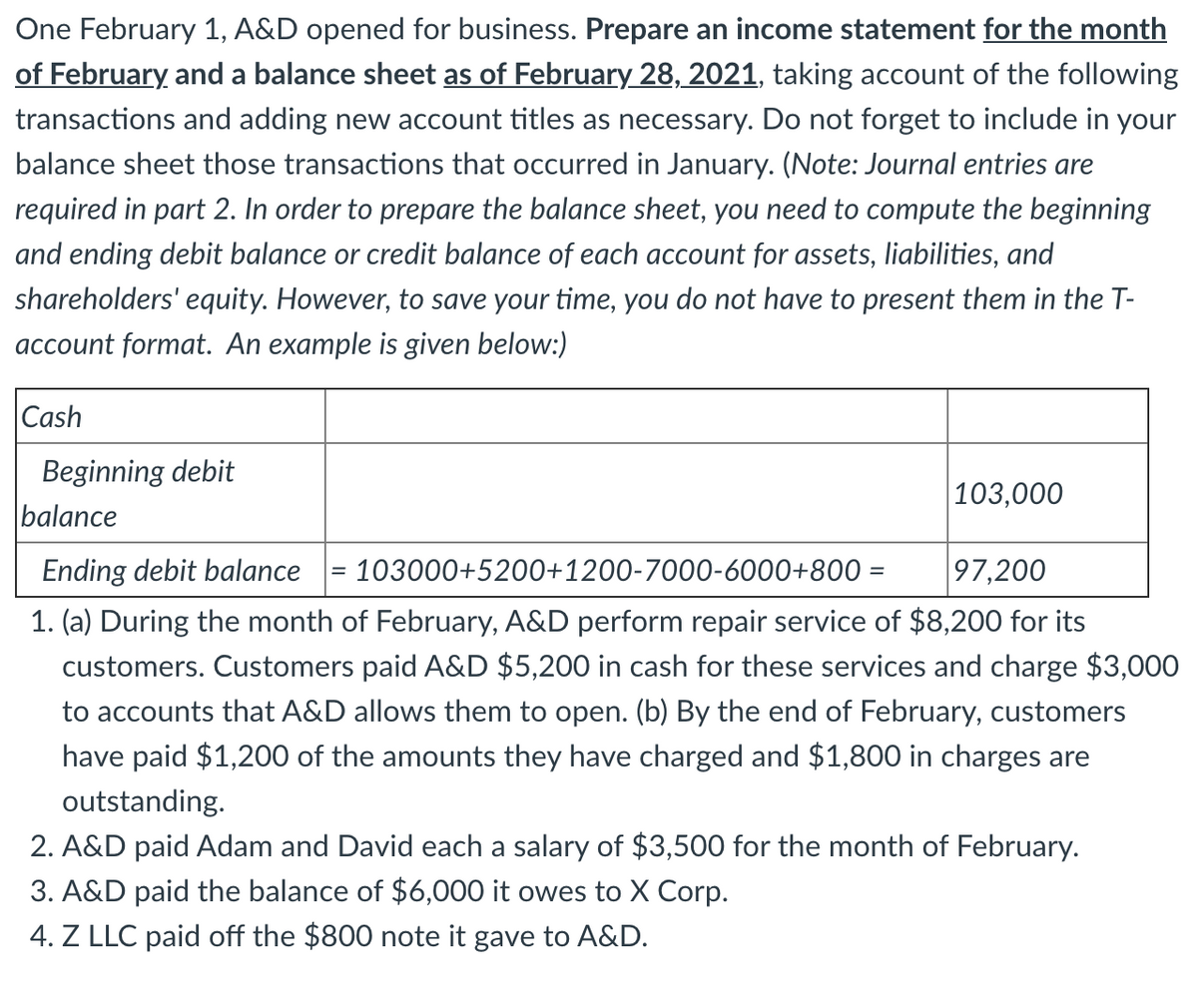

One February 1, A&D opened for business. Prepare an income statement for the month of February and a balance sheet as of February 28, 2021, taking account of the following transactions and adding new account titles as necessary. Do not forget to include in your balance sheet those transactions that occurred in January. (Note: Journal entries are required in part 2. In order to prepare the balance sheet, you need to compute the beginning and ending debit balance or credit balance of each account for assets, liabilities, and shareholders' equity. However, to save your time, you do not have to present them in the T- account format. An example is given below:) Cash Beginning debit balance 103,000 Ending debit balance = 103000+5200+1200-7000-6000+800 = 97,200 %3D 1. (a) During the month of February, A&D perform repair service of $8,200 for its customers. Customers paid A&D $5,200 in cash for these services and charge $3,000 to accounts that A&D allows them to open. (b) By the end of February, customers have paid $1,200 of the amounts they have charged and $1,800 in charges are outstanding. 2. A&D paid Adam and David each a salary of $3,500 for the month of February. 3. A&D paid the balance of $6,000 it owes to X Corp. 4. Z LLC paid off the $800 note it gave to A&D.

One February 1, A&D opened for business. Prepare an income statement for the month of February and a balance sheet as of February 28, 2021, taking account of the following transactions and adding new account titles as necessary. Do not forget to include in your balance sheet those transactions that occurred in January. (Note: Journal entries are required in part 2. In order to prepare the balance sheet, you need to compute the beginning and ending debit balance or credit balance of each account for assets, liabilities, and shareholders' equity. However, to save your time, you do not have to present them in the T- account format. An example is given below:) Cash Beginning debit balance 103,000 Ending debit balance = 103000+5200+1200-7000-6000+800 = 97,200 %3D 1. (a) During the month of February, A&D perform repair service of $8,200 for its customers. Customers paid A&D $5,200 in cash for these services and charge $3,000 to accounts that A&D allows them to open. (b) By the end of February, customers have paid $1,200 of the amounts they have charged and $1,800 in charges are outstanding. 2. A&D paid Adam and David each a salary of $3,500 for the month of February. 3. A&D paid the balance of $6,000 it owes to X Corp. 4. Z LLC paid off the $800 note it gave to A&D.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter3: The General Journal And The General Ledger

Section: Chapter Questions

Problem 5PA: Following is the chart of accounts of Sanchez Realty Company: Sanchez completed the following...

Related questions

Question

Transcribed Image Text:One February 1, A&D opened for business. Prepare an income statement for the month

of February and a balance sheet as of February 28, 2021, taking account of the following

transactions and adding new account titles as necessary. Do not forget to include in your

balance sheet those transactions that occurred in January. (Note: Journal entries are

required in part 2. In order to prepare the balance sheet, you need to compute the beginning

and ending debit balance or credit balance of each account for assets, liabilities, and

shareholders' equity. However, to save your time, you do not have to present them in the T-

account format. An example is given below:)

Cash

Beginning debit

balance

103,000

Ending debit balance = 103000+5200+1200-7000-6000+800 =

97,200

%3D

1. (a) During the month of February, A&D perform repair service of $8,200 for its

customers. Customers paid A&D $5,200 in cash for these services and charge $3,000

to accounts that A&D allows them to open. (b) By the end of February, customers

have paid $1,200 of the amounts they have charged and $1,800 in charges are

outstanding.

2. A&D paid Adam and David each a salary of $3,500 for the month of February.

3. A&D paid the balance of $6,000 it owes to X Corp.

4. Z LLC paid off the $800 note it gave to A&D.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning