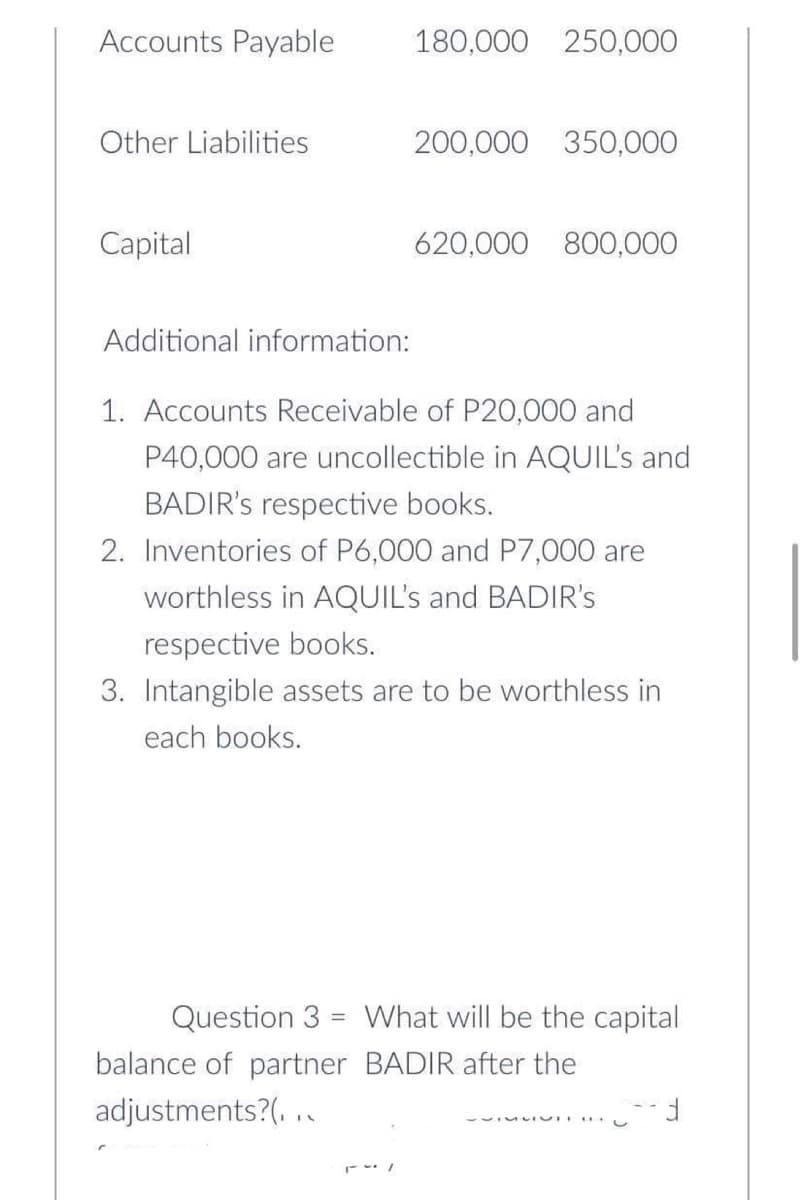

Accounts Payable Other Liabilities Capital Additional information: 180,000 250,000 200,000 350,000 620,000 800,000 1. Accounts Receivable of P20,000 and P40,000 are uncollectible in AQUIL's and BADIR's respective books. 2. Inventories of P6,000 and P7,000 are worthless in AQUIL's and BADIR's respective books. 3. Intangible assets are to be worthless in each books. Question 3 What will be the capital balance of partner BADIR after the adjustments?(...

Accounts Payable Other Liabilities Capital Additional information: 180,000 250,000 200,000 350,000 620,000 800,000 1. Accounts Receivable of P20,000 and P40,000 are uncollectible in AQUIL's and BADIR's respective books. 2. Inventories of P6,000 and P7,000 are worthless in AQUIL's and BADIR's respective books. 3. Intangible assets are to be worthless in each books. Question 3 What will be the capital balance of partner BADIR after the adjustments?(...

Chapter21: Partnerships

Section: Chapter Questions

Problem 28P

Related questions

Question

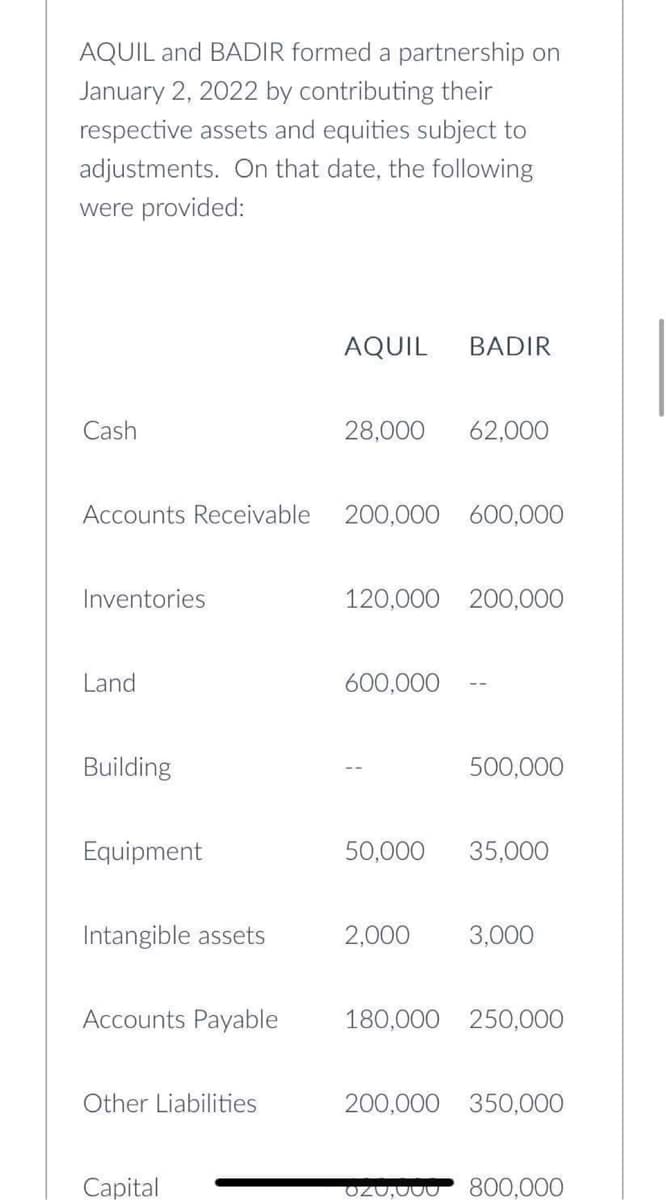

Transcribed Image Text:AQUIL and BADIR formed a partnership on

January 2, 2022 by contributing their

respective assets and equities subject to

adjustments. On that date, the following

were provided:

Cash

Accounts Receivable

Inventories

Land

Building

Equipment

Intangible assets

Accounts Payable

Other Liabilities

Capital

AQUIL BADIR

28,000 62,000

200,000 600,000

120,000 200,000

600,000

500,000

50,000 35,000

2,000 3,000

180,000

250,000

200,000 350,000

OZU,UUU 800,000

Transcribed Image Text:Accounts Payable

Other Liabilities

Capital

Additional information:

180,000 250,000

200,000 350,000

620,000 800,000

1. Accounts Receivable of P20,000 and

P40,000 are uncollectible in AQUIL's and

BADIR's respective books.

2. Inventories of P6,000 and P7,000 are

worthless in AQUIL's and BADIR's

respective books.

3. Intangible assets are to be worthless in

each books.

Question 3 What will be the capital

=

balance of partner BADIR after the

adjustments?(...

d

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT