Accounts Receivable Equipment Accounts Payable re the transactions of Jab Less Services. ab invested P125,000 in the business Purchased equipment from X. Co.; P35,000 on account tendered services on account to various customers P75,000 "aid salary for the month P15,000 Paid utilities for the month P2,300 tion: reciation of equipment is P1,000 tful accounts at year end are estimated to be P800 Service Income Salary Expense Utilities Expense

Accounts Receivable Equipment Accounts Payable re the transactions of Jab Less Services. ab invested P125,000 in the business Purchased equipment from X. Co.; P35,000 on account tendered services on account to various customers P75,000 "aid salary for the month P15,000 Paid utilities for the month P2,300 tion: reciation of equipment is P1,000 tful accounts at year end are estimated to be P800 Service Income Salary Expense Utilities Expense

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter6: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 6PA: Selected accounts and related amounts for Clairemont Co. for the fiscal year ended May 31, 2016, are...

Related questions

Question

100%

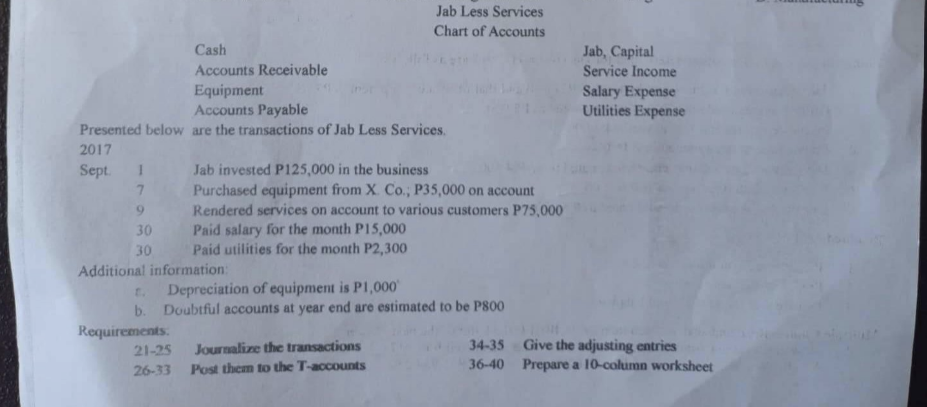

Transcribed Image Text:Jab Less Services

Chart of Accounts

Jab, Capital

Service Income

Salary Expense

Utilities Expense

Give the adjusting entries

Prepare a 10-column worksheet

Cash

Accounts Receivable

Equipment

Accounts Payable

Presented below are the transactions of Jab Less Services.

2017

Sept. 1

Jab invested P125,000 in the business

7

Purchased equipment from X. Co., P35,000 on account

9

Rendered services on account to various customers P75,000

Paid salary for the month P15,000

30

30

Paid utilities for the month P2,300

Additional information:

E.

Depreciation of equipment is P1,000

b. Doubtful accounts at year end are estimated to be P800

Requirements:

Journalize the transactions

34-35

21-25

26-33

Post them to the T-accounts

36-40

Transcribed Image Text:X

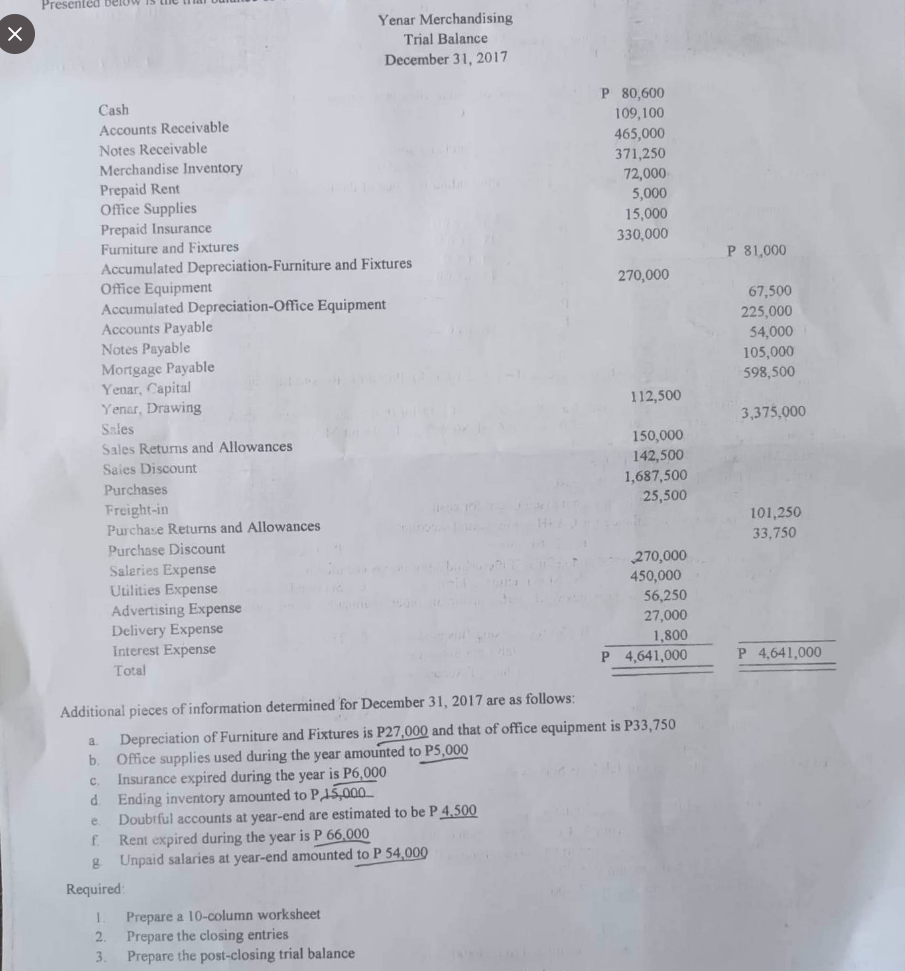

Presented below

Cash

Accounts Receivable

Notes Receivable

Merchandise Inventory

Prepaid Rent

Office Supplies

Prepaid Insurance

Furniture and Fixtures

Accumulated Depreciation-Furniture and Fixtures

Office Equipment

Accumulated Depreciation-Office Equipment

Accounts Payable

Notes Payable

Mortgage Payable

Yenar, Capital

Yenar, Drawing

112,500

Sales

Sales Returns and Allowances

150,000

Sales Discount

142,500

Purchases

1,687,500

Freight-in

25,500

Purchase Returns and Allowances

Purchase Discount

Salaries Expense

270,000

Utilities Expense

450,000

Advertising Expense

56,250

27,000

Delivery Expense

Interest Expense

1,800

Total

P 4,641,000

Additional pieces of information determined for December 31, 2017 are as follows:

a.

Depreciation of Furniture and Fixtures is P27,000 and that of office equipment is P33,750

b.

Office supplies used during the year amounted to P5,000

C. Insurance expired during the year is P6,000

d. Ending inventory amounted to P15,000

e. Doubtful accounts at year-end are estimated to be P 4,500

f

Rent expired during the year is P 66,000

g. Unpaid salaries at year-end amounted to P 54,000

Required:

1

Prepare a 10-column worksheet

2. Prepare the closing entries

3.

Prepare the post-closing trial balance

Yenar Merchandising

Trial Balance

December 31, 2017

P 80,600

109,100

465,000

371,250

72,000

5,000

15,000

330,000

270,000

P 81,000

67,500

225,000

54,000

105,000

598,500

3,375,000

101,250

33,750

P 4,641,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,