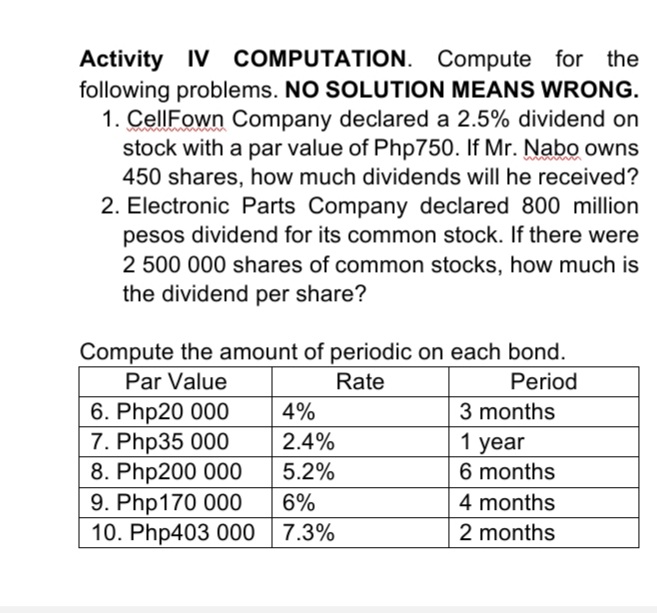

Activity IV COMPUTATION. Compute for the following problems. NO SOLUTION MEANS WRONG. 1. CellFown Company declared a 2.5% dividend on stock with a par value of Php750. If Mr. Nabo owns 450 shares, how much dividends will he received? 2. Electronic Parts Company declared 800 million pesos dividend for its common stock. If there were 2 500 000 shares of common stocks, how much is the dividend per share? Compute the amount of periodic on each bond. Par Value Rate Period 6. Php20 000 4% 3 months 7. Php35 000 2.4% 1 year 8. Php200 000 5.2% 6 months 9. Php170 000 6% 4 months 10. Php403 000 7.3% 2 months

Activity IV COMPUTATION. Compute for the following problems. NO SOLUTION MEANS WRONG. 1. CellFown Company declared a 2.5% dividend on stock with a par value of Php750. If Mr. Nabo owns 450 shares, how much dividends will he received? 2. Electronic Parts Company declared 800 million pesos dividend for its common stock. If there were 2 500 000 shares of common stocks, how much is the dividend per share? Compute the amount of periodic on each bond. Par Value Rate Period 6. Php20 000 4% 3 months 7. Php35 000 2.4% 1 year 8. Php200 000 5.2% 6 months 9. Php170 000 6% 4 months 10. Php403 000 7.3% 2 months

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Activity IV COMPUTATION. Compute for the

following problems. NO SOLUTION MEANS WRONG.

1. CellFown Company declared a 2.5% dividend on

stock with a par value of Php750. If Mr. Nabo owns

450 shares, how much dividends will he received?

2. Electronic Parts Company declared 800 million

pesos dividend for its common stock. If there were

2 500 000 shares of common stocks, how much is

the dividend per share?

Compute the amount of periodic on each bond.

Par Value

Rate

Period

6. Php20 000

7. Php35 000

8. Php200 000

9. Php170 000

10. Php403 000

4%

3 months

2.4%

1 year

5.2%

6 months

6%

4 months

7.3%

2 months

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning