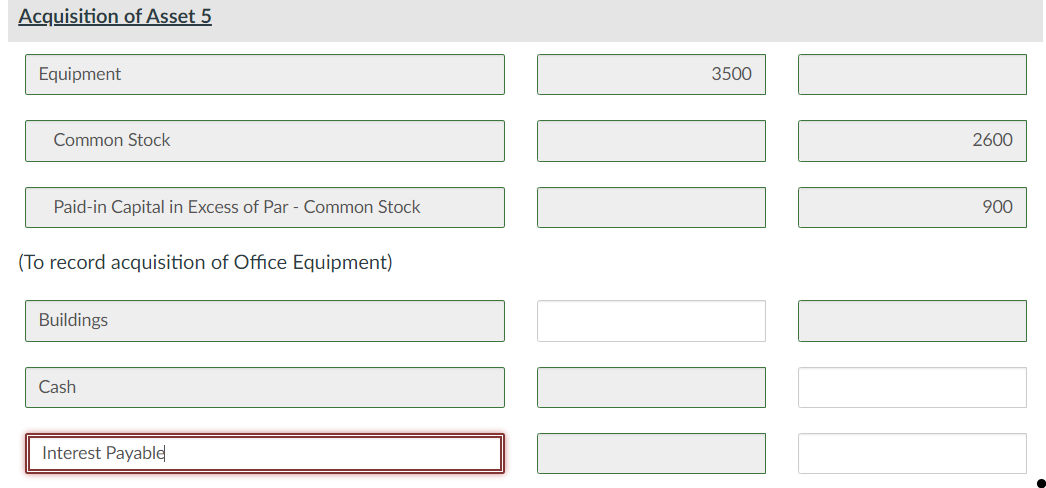

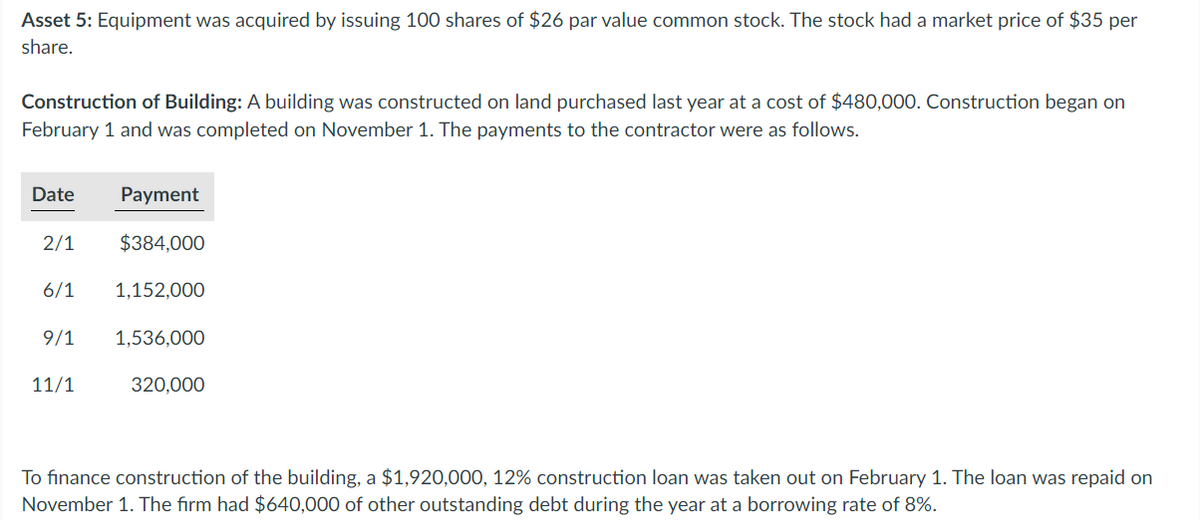

Acquisition of Asset 5 Equipment Common Stock Paid-in Capital in Excess of Par - Common Stock (To record acquisition of Office Equipment) Buildings Cash Interest Payable 3500 [II 2600 900

Q: A man expects to receive P20,000.00 in 8 years. How much is that money worth now considering…

A: Answer - Present Value is a formula used to calculate the present-day value of a certain amount…

Q: 1. Using the accounts below, prepare a basic Balance Sheet. All accounts will be used once; refer to…

A: Balance Sheet :— It is one of the financial statement that shows list of final balances of assets,…

Q: Equivalent Units of Production The following information concerns production in the Baking…

A: Equivalent unit means the total number of units that are supposed to be produced using the same…

Q: Can you show me how to figure the charitable contribution amount of $12,540?

A: Charitable contribution refers to the amount of money which is donated including the securities or…

Q: Question Carlos is a resident citizen. He maintains a savings account deposit with the BPI-Baguio…

A: Solution Tax is the amount that you pay to the government and by using this government provide…

Q: Dillon Products manufactures various machined parts to customer specifications. The company uses a…

A: Journal Entry :— It is an act of recording transaction in books of account when it is occured.…

Q: a3. Prepare the May journal entry for the Casting Department for the completed production…

A: *FIFO method is being followed for the calculation of equivalent units and cost per equivalent unit.…

Q: ANSWER THE FOLLOWING Problem 2 You are currently started expansion of your existing store which…

A: Advertising costs refer to the expenses involved in the process of creating marketing and promoting…

Q: On 8/1/2023 We issue 60 million of 8% 20 years bonds for 90 give the first Journal entries

A: This is issue of bonds at discount. The rate of interest on bonds is…

Q: Selected income statement data follow for Harper, Inc., for the year ended December 31 (in…

A: Times interest earned ratio is the measure that helps in determining the ability of an entity in…

Q: a job-order costing system with a sin rate based on machine-hours. The co. ad rate for the current…

A: Plant wide overhead rate uses a single overhead rate to allocate total manufacturing cost to units .

Q: Olivia's Apple Orchard had the following transactions during the month of September, the first month…

A: Revenue :— Revenue Means What You earn During the Prescribed Period from The principal Business…

Q: 5) The following information for Cooper Enterprises is given below: Assets and obligations Plan…

A: Amortization is an accounting practice that is used to reduce the book value of a loan or an…

Q: The amounts of the assets and liabilities of Excalibur Travel Agency at December 31, 20Y5, the end…

A: The financial statements of the business include the income statement and balance sheet. The…

Q: Can free cash flow continue to grow, even if ROIC falls? Explain.

A: If the working capital of the company can be managed free cash flow can grow at a better rate even…

Q: White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat…

A: There are two methods of process costing used , weighted average and FIFO method . When FIFO method…

Q: Prepare the necessary elimination entries in general journal form.

A: the stock is undervalued by 5000 dollars Bonds are also overvalued by an amount of 5000 dollars land…

Q: Worthington Chandler Company’s fiscal year end is December 31. On January 1, 2016, Worthington…

A: At the time of acquisition of fixed assets, all costs that are necessary to be incurred for making…

Q: Cull Corporation uses a job-order costing system with a single plantwide predetermined overhead rate…

A: The total cost is the combination of material cost, labor cost and overhead cost. Overhead cost…

Q: lamarisk, Inc., changed from the LIFO cost flow assumption to the FIFO cost flow assumption in 2020.…

A: Every organization does a lot of financial transactions and these transactions should be recorded in…

Q: sits and foreign currency deposit act of the philip

A: Bank deposits refer to the concept when a bank account holder submits his or her money into his…

Q: Using the compound interest formula, verify the impact of the 2% commission rate identified in this…

A: The question emphasizes the impact of compounding over different horizons. It's a simple time value…

Q: Anwar and Arif are in partnership. The following figures are extracted from their accounts for the…

A: A partnership appears to be a sort of business in which at least two persons run the company and…

Q: Explain the items of gross income and how to tax them: whether at gross or at net, further…

A: •Gross income means all the income earned by an individual from all thhe sources but before tax…

Q: [The following information applies to the questions displayed below.] The following data is provided…

A: Direct material Used :— It is the cost of materials that is directly incurred in manufacturing…

Q: The following cost data relate to the manufacturing activities of Chang Company during the just…

A: Over Applied and Under Applied of Manufacturing OH :— Under applied overhead is the opposite of…

Q: A Month in the Life of a Faculty from cash vs. accrual accounting perspective The Faculty provides…

A: Income statement: The income statement is the most important part of the financial statement. this…

Q: (Amounts Expressed in Millions) For the Fiscal Years Ended September 26 and September 28,…

A: Net Working Capital :— It is the difference of current assets and current liabilities. Current…

Q: Your examination of the records of a company that follows the cash basis of accounting tells you…

A: Net income is the amount of income earned by an entity by deducting the expenses from the revenues.…

Q: 2. If you could relate materiality, disclosure, and conservatism to types of measure- ments…

A: You may find out how accurately variables are recorded using levels of measurement, also known as…

Q: 15:58 0.00 N KB/S go.room.sh/?room=3ec0b922-e618- Question F Polk, after being in Bakery business…

A: Journal entries recording is to be treated as first step of accounting cycle process, under which…

Q: Hugh has the choice between investing in a City of Heflin bond at 5.70 percent or investing in a…

A: Bonds Bonds are fixed-income securities that reflect loans from investors to borrowers (typically…

Q: $30,000 nonfarm NOL in 2020. In which carryback or carryforward year would the NOL deduction be…

A: Net operating losses refer to the sum value of money in terms of loss arising when the business…

Q: Equivalent Units of Production Kellogg Company (K) manufactures cold cereal products, such as…

A: Answer - Equivalent Unit of Production - An equivalent unit of production term applied to the…

Q: ligan's pays its employees weekly. Use the wage-bracket tables

A: As per Internal Revenue Service [IRS] rules for the year 2022 [assumed…

Q: In an NOL carryback year, the NOL is combined with the AGI from the return as originally filed or…

A: NOL stands for Net operating loss and refers to the situation when the deductions in the company…

Q: Saira works for an accounting firm. Her annual salary is $70,000. She also earned income from rental…

A: Ordinary income is defined as any sort of income generated by a company or person that is taxed at…

Q: Which of the following statements are true? 1. In a job-order costing system, indirect labor is…

A: The expense of manufacturing each product is calculated using the job order technique of pricing.…

Q: Problem Compute for the equivalent units of production in each of the following cases: Case A In…

A: FIFO :— It is one of the method of inventory valuation in which it is assumed that first beginning…

Q: The following were taken from the books of Amihan Company: Long-term Payable P 500,000 Notes Payable…

A: (Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: D. Hepare the entry to assign factory labor to production. E15.2 (LO 1, 2, 3, 4), AP Stine Company…

A: JOB Costing :— Job costing is an accounting method designed to help you to track the cost of…

Q: Question#01: 06 The following information pertains to TNT Company for July 2017: 1. Cash balance per…

A: Bank Capital - Bank capital is the balance of a bank's net worth left over after subtracting its…

Q: Which of the following statements are true? 1. The fact that one department may be labor intensive…

A: Overhead refers to the expenses that are indirectly associated with the product manufactured and…

Q: Problem 1 (Adapted) The shareholders’ equity of Yelan Company showed the following account balances…

A: Share capital is one of the important source of finance for the business. It includes common share…

Q: i did ask for a certain question to be resolved question 2b

A: High low method is used to segregate the semi variable or mixed cost into two separate costs i.e.…

Q: Moe, Edita, and Hunter have been operating a business together as partners without a partnership…

A: Partnership refers to operating a business by two or more people together. Under the partnership,…

Q: Rubber Corporation acquired all of the common stock of Plastic Company for $450,000 on January 1,…

A: As per IAS 36 i.e Impairment of Asset, An asset is to impaired if the carrying amount is more than…

Q: Youngston Company (a Massachusetts employer) wants to give a holiday bonus check of $750 to each…

A: Employers frequently prefer to pay their employees a defined amount as a yearly or holiday bonus;…

Q: Estimated total machine-hours used Estimated total fixed manufacturing overhead Estimated variable…

A: manufacturing cost included sum total of all cost included to make a product calculation of…

Q: What is the correct balance of each account below and it the balance a debit or a credit? -The…

A: Adjusted trial balance is prepared after including all the additional adjustments. In the trial…

F 4

Please explain in detail......

Step by step

Solved in 2 steps with 3 images

- Balance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the worksheet approach. Use the indirect method to prepare the statement.Balance sheets for Brierwold Corporation follow: Additional transactions were as follows: a. Purchased equipment costing 50,000. b. Sold equipment costing 60,000, with a book value of 25,000, for 40,000. c. Retired preferred stock at a cost of 110,000. (The premium is debited to Retained Earnings.) d. Issued 10,000 shares of common stock (par value, 4) for 10 per share. e. Reported a loss of 15,000 for the year. f. Purchased land for 50,000. Required: Prepare a statement of cash flows using the indirect method.A comapny started its operations with $25,700 in cash with the issue of common stock dated Jan 1, Year 1. The proceeds was used to purchase equipment for $25,700 and had a salvage value of $4,500 with 4 years life. In the beginning of 5th year, equipment was being sold for $4,980 for cash (SLM depreciation) Revenue: ($) Year1=7,480 Year2=7,980 Year3=8,180 Year4=6,980 Year5=0 A.Income Statement B.Statement of changes in Stockholder’s equity for each of the five years

- Legan Inc. started its operations with $25,700 in cash with the issue of common stock dated Jan 1, Year 1. The proceeds was used to purchase equipment for $25,700 and had a salvage value of $4,500 with 4 years life. In the beginning of 5th year, equipment was being sold for $4,980 for cash (SLM depreciation) Revenue: ($) Year1=7,480 Year2=7,980 Year3=8,180 Year4=6,980 Year5=0 Required. Income Statement for each of the five years.Company charter authorizes 1,000,000 shares of common stock. They purchased a piece of land and in payment fo the land, issues 400,000 shares of common stock with a $1.00 par value. The land has been appraised at a market value of $1,480,000. Journalize the entryKY Jewellers purchased a piece of land from the original owner. In payment for the land, KY Jewellers issues 300,000 shares of common stock with $1.00 par value. The land has been appraised at a market value of 1200,000 1.The company sold 120,000 shares of common stock with $1 par value. 2. Issued 25,500shares of $20 par value preferred stock. Shares were issued at par. 3. Earned net income of $764,000 4. Dividend declared and paid - $0.15 per share on common stock 5. Dividend declared and paid - $5 per share on preferred stock Question Prepare the closingj journal entries for the following tracnsactions listed above

- A company issued 14,000 ordinary shares ( $50 par) with a market value of $60 per share (based on a recent sale of 100 shares ) for the land. The land was recently appraised at $800,000 by independent and competent appraisers. How much is the cost of land acquired?Assume the following independent cases: (a) At the beginning of the year, a check was issued for P400,000 as payment for a piece of land and the buyer assumed the liability for unpaid taxes in arrears for the previous year, P10,000 and those assessed for the current year, P9,000.(b) A company issued 14,000 ordinary shares (P50 par) with a market value of P60 per share (based upon a recent sale of 100 shares) for the land. The land was recently appraised at P800,000 by independent and professional appraisers.(c) A company rejected an offer to purchase the land for P8,000,000 cash two years ago. Instead, the company issued 100,000 ordinary shares for the land (market value of the ordinary share, P78 each based on several recent large transactions and normal weekly stock trading volume).How much is the cost of land acquired in (a), (b), and (c), respectively? a. 419,000; 800,000; 7,800,000 b. 410,000; 800,000; 7,800,000 c. 410,000; 840,000; 7,800,000 d. 419,000; 840,000;…Assume the following independent cases:A. At the beginning of the year, a check was issued for P400,000 as payment for a piece of land, and the buyer assumed the liability for the unpaid taxes at the end of the year, P10,000 and those assessed for the current year at P9,000.B. A company issued 14,000 ordinary shares (P10 par) with a market value of P60 per share (based upon a recent sale of 100 shares) for the land. The land was recently appraised at P800,000 by independent and competent appraisers.C. A company rejected an offer to purchase the land for P8,000,000 cash two years ago. Instead, the company issued 100,000 ordinary shares for the land (market value of the ordinary share, P78 each based on several recent large transactions and normal weekly stock trading volume).D. A company purchased land by signing a note with the seller, requiring P100,000 down payment, payment of P120,000 one year from purchase, and P80,000 three years from purchase. The note is non-interest bearing,…

- Presented below is information related to Tamarisk Company.1. On July 6, Tamarisk Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $300,000 Buildings 900,000 Equipment 600,000 Total $1,800,000 Tamarisk Company gave 12,300 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property.2. Tamarisk Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $178,500 Construction of bases for equipment to be installed later 229,500 Driveways and parking lots 207,400 Remodeling of office space in building, including new partitions and walls 273,700 Special assessment by city on land 30,600 3. On December 20, the company paid cash…Presented below is information related to Cullumber Company.1. On July 6, Cullumber Company acquired the plant assets of Doonesbury Company, which had discontinued operations. The appraised value of the property is: Land $200,000 Buildings 600,000 Equipment 400,000 Total $1,200,000 Cullumber Company gave 12,000 shares of its $100 par value common stock in exchange. The stock had a market price of $168 per share on the date of the purchase of the property.2. Cullumber Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building. (Prepare consolidated entry for all transactions below.) Repairs to building $168,000 Construction of bases for equipment to be installed later 216,000 Driveways and parking lots 195,200 Remodeling of office space in building, including new partitions and walls 257,600 Special assessment by city on land 28,800 3. On December 20, the company paid cash…The company's chater authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock and the following are the transactions for consideration: 1) KY Jewelers purchased a piece of land from the original owner. In payment for the land, KY Jewelers issues 300,000 shares of common stock with $1.00 par value. The land has been appraised at a marked value of $1,200,000. 2) The company sold 120,000 shares of common stock with $1 par value. 3) Issued 25,500 shares of $20 par value preferred stock. Shares were issued at par 4) Earned net income of $764,000 5) Dividend declared and paid -$0.15 per share on common stock 6) Dividend declared and paid -$5 per share on preferred stock A) Prepare Journal entries for the above B) Prepare closing entries for the above