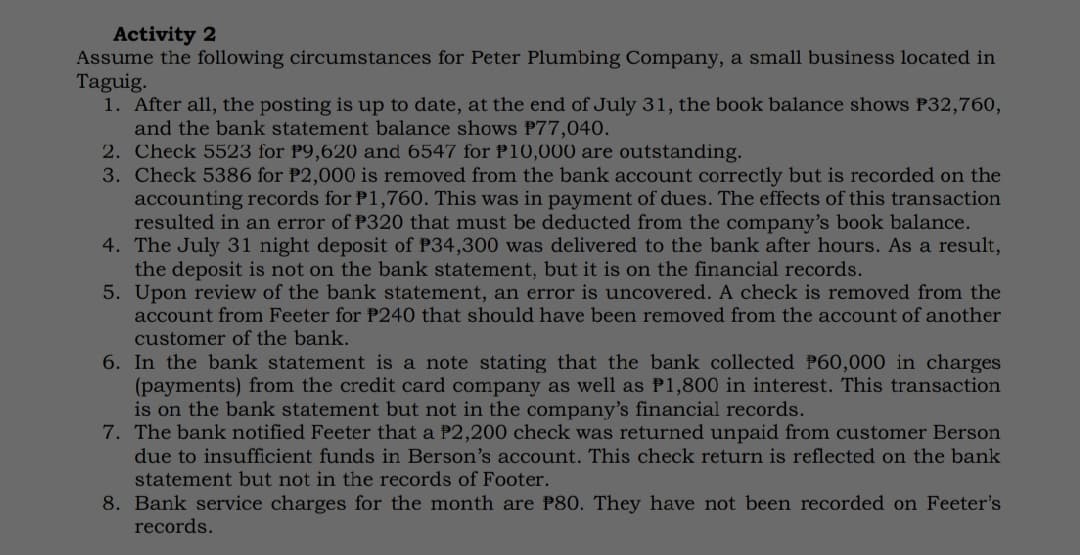

Activity 2 Assume the following circumstances for Peter Plumbing Company, a small business located in Taguig. 1. After all, the posting is up to date, at the end of July 31, the book balance shows P32,760, and the bank statement balance shows P77,040. 2. Check 5523 for P9,620 and 6547 for P10,000 are outstanding. 3. Check 5386 for P2,000 is removed from the bank account correctly but is recorded on the accounting records for P1,760. This was in payment of dues. The effects of this transaction resulted in an error of P320 that must be deducted from the company's book balance. 4. The July 31 night deposit of P34,300 was delivered to the bank after hours. As a result, the deposit is not on the bank statement, but it is on the financial records. 5. Upon review of the bank statement, an error is uncovered. A check is removed from the account from Feeter for P240 that should have been removed from the account of another customer of the bank. 6. In the bank statement is a note stating that the bank collected P60,000 in charges (payments) from the credit card company as well as P1,800 in interest. This transaction is on the bank statement but not in the company's financial records. 7. The bank notified Feeter that a P2,200 check was returned unpaid from customer Berson due to insufficient funds in Berson's account. This check return is reflected on the bank statement but not in the records of Footer. 8. Bank service charges for the month are P80. They have not been recorded on Feeter's records.

Activity 2 Assume the following circumstances for Peter Plumbing Company, a small business located in Taguig. 1. After all, the posting is up to date, at the end of July 31, the book balance shows P32,760, and the bank statement balance shows P77,040. 2. Check 5523 for P9,620 and 6547 for P10,000 are outstanding. 3. Check 5386 for P2,000 is removed from the bank account correctly but is recorded on the accounting records for P1,760. This was in payment of dues. The effects of this transaction resulted in an error of P320 that must be deducted from the company's book balance. 4. The July 31 night deposit of P34,300 was delivered to the bank after hours. As a result, the deposit is not on the bank statement, but it is on the financial records. 5. Upon review of the bank statement, an error is uncovered. A check is removed from the account from Feeter for P240 that should have been removed from the account of another customer of the bank. 6. In the bank statement is a note stating that the bank collected P60,000 in charges (payments) from the credit card company as well as P1,800 in interest. This transaction is on the bank statement but not in the company's financial records. 7. The bank notified Feeter that a P2,200 check was returned unpaid from customer Berson due to insufficient funds in Berson's account. This check return is reflected on the bank statement but not in the records of Footer. 8. Bank service charges for the month are P80. They have not been recorded on Feeter's records.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 27BE

Related questions

Question

Create a bank reconciliation statement

Transcribed Image Text:Activity 2

Assume the following circumstances for Peter Plumbing Company, a small business located in

Taguig.

1. After all, the posting is up to date, at the end of July 31, the book balance shows P32,760,

and the bank statement balance shows P77,040.

2. Check 5523 for P9,620 and 6547 for P10,000 are outstanding.

3. Check 5386 for P2,000 is removed from the bank account correctly but is recorded on the

accounting records for P1,760. This was in payment of dues. The effects of this transaction

resulted in an error of P320 that must be deducted from the company's book balance.

4. The July 31 night deposit of P34,300 was delivered to the bank after hours. As a result,

the deposit is not on the bank statement, but it is on the financial records.

5. Upon review of the bank statement, an error is uncovered. A check is removed from the

account from Feeter for P240 that should have been removed from the account of another

customer of the bank.

6. In the bank statement is a note stating that the bank collected P60,000 in charges

(payments) from the credit card company as well as P1,800 in interest. This transaction

is on the bank statement but not in the company's financial records.

7. The bank notified Feeter that a P2,200 check was returned unpaid from customer Berson

due to insufficient funds in Berson's account. This check return is reflected on the bank

statement but not in the records of Footer.

8. Bank service charges for the month are P80. They have not been recorded on Feeter's

records.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning