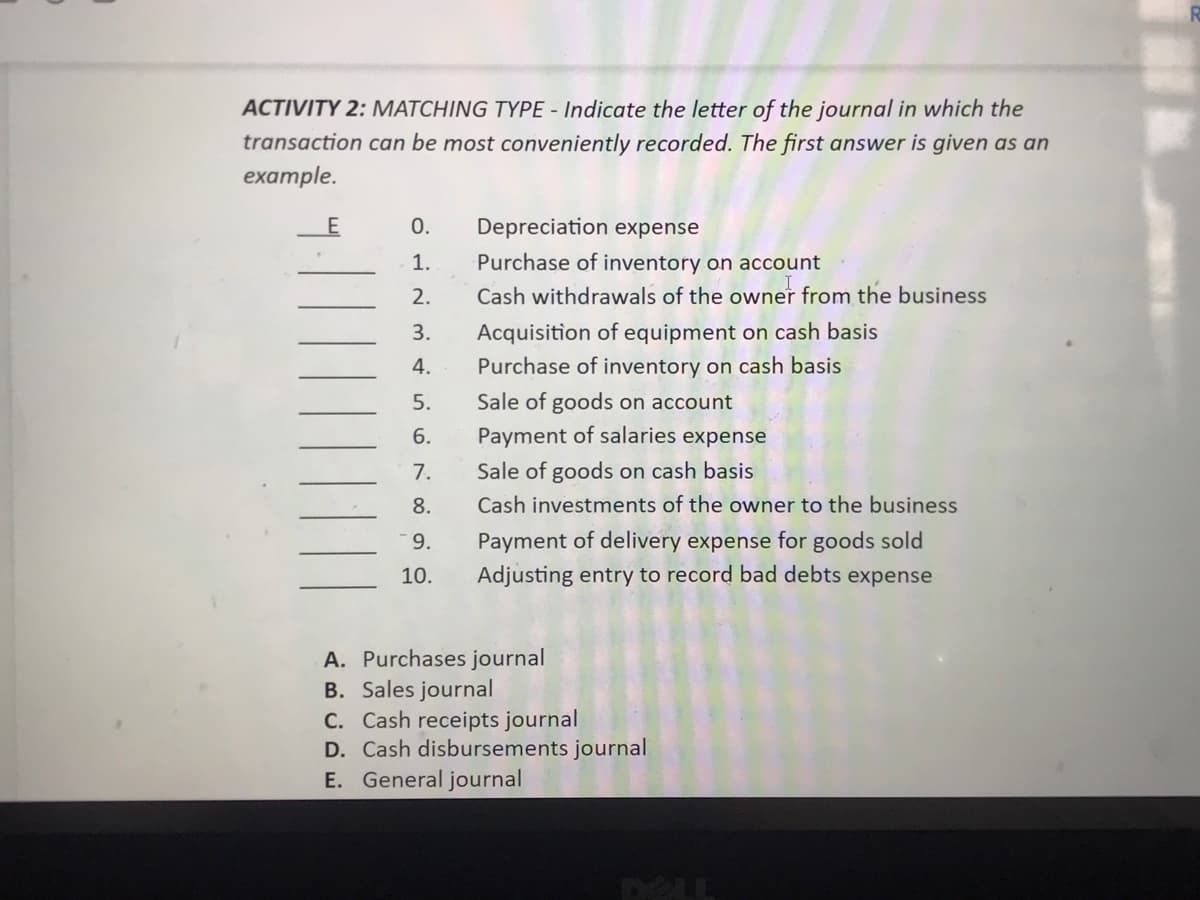

ACTIVITY 2: MATCHING TYPE - Indicate the letter of the journal in which the transaction can be most conveniently recorded. The first answer is given as an example. 0. Depreciation expense Purchase of inventory on account Cash withdrawals of the owner from the business 1. 2. Acquisition of equipment on cash basis Purchase of inventory on cash basis 3. 4. 5. Sale of goods on account 6. Payment of salaries expense 7. Sale of goods on cash basis 8. Cash investments of the owner to the business Payment of delivery expense for goods sold Adjusting entry to record bad debts expense 9. 10. A. Purchases journal B. Sales journal C. Cash receipts journal D. Cash disbursements journal E. General journal

ACTIVITY 2: MATCHING TYPE - Indicate the letter of the journal in which the transaction can be most conveniently recorded. The first answer is given as an example. 0. Depreciation expense Purchase of inventory on account Cash withdrawals of the owner from the business 1. 2. Acquisition of equipment on cash basis Purchase of inventory on cash basis 3. 4. 5. Sale of goods on account 6. Payment of salaries expense 7. Sale of goods on cash basis 8. Cash investments of the owner to the business Payment of delivery expense for goods sold Adjusting entry to record bad debts expense 9. 10. A. Purchases journal B. Sales journal C. Cash receipts journal D. Cash disbursements journal E. General journal

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 15MC: Sold goods for $650 cash. Which journal would the company use to record this transaction? A. sales...

Related questions

Question

Transcribed Image Text:ACTIVITY 2: MATCHING TYPE - Indicate the letter of the journal in which the

transaction can be most conveniently recorded. The first answer is given as an

example.

0.

Depreciation expense

1.

Purchase of inventory on account

2.

Cash withdrawals of the owner from the business

Acquisition of equipment on cash basis

Purchase of inventory on cash basis

3.

4.

5.

Sale of goods on account

6.

Payment of salaries expense

7.

Sale of goods on cash basis

8.

Cash investments of the owner to the business

9.

Payment of delivery expense for goods sold

10.

Adjusting entry to record bad debts expense

A. Purchases journal

B. Sales journal

C. Cash receipts journal

D. Cash disbursements journal

E. General journal

DELL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning