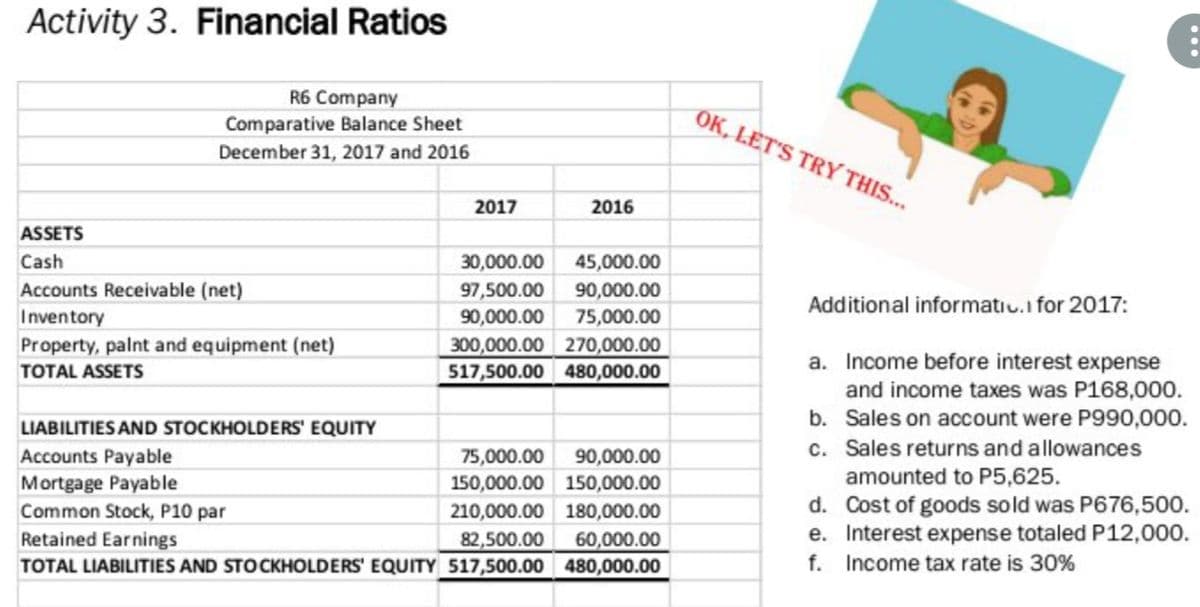

Activity 3. Financial Ratios R6 Company Comparative Balance Sheet OK, LET'S TRY THIS. December 31, 2017 and 2016 2017 2016 ASSETS Cash 30,000.00 45,000.00 Accounts Receivable (net) 97,500.00 90,000.00 Additional informatiu.i for 2017: 75,000.00 300,000.00 270,000.00 517,500.00 480,000.00 Inventory 90,000.00 Property, palnt and equipment (net) a. Income before interest expense and income taxes was P168,000. TOTAL ASSETS b. Sales on account were P990,000. LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable Mortgage Payable Common Stock, P10 par c. Sales returns and allowances amounted to P5,625. 75,000.00 90,000.00 150,000.00 150,000.00 d. Cost of goods sold was P676,500. e. Interest expense totaled P12,000. f. Income tax rate is 30% 210,000.00 180,000.00 60,000.00 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 517,500.00 480,000.00 Retained Earnings 82,500.00

Activity 3. Financial Ratios R6 Company Comparative Balance Sheet OK, LET'S TRY THIS. December 31, 2017 and 2016 2017 2016 ASSETS Cash 30,000.00 45,000.00 Accounts Receivable (net) 97,500.00 90,000.00 Additional informatiu.i for 2017: 75,000.00 300,000.00 270,000.00 517,500.00 480,000.00 Inventory 90,000.00 Property, palnt and equipment (net) a. Income before interest expense and income taxes was P168,000. TOTAL ASSETS b. Sales on account were P990,000. LIABILITIES AND STOCKHOLDERS' EQUITY Accounts Payable Mortgage Payable Common Stock, P10 par c. Sales returns and allowances amounted to P5,625. 75,000.00 90,000.00 150,000.00 150,000.00 d. Cost of goods sold was P676,500. e. Interest expense totaled P12,000. f. Income tax rate is 30% 210,000.00 180,000.00 60,000.00 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 517,500.00 480,000.00 Retained Earnings 82,500.00

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 89PSB

Related questions

Question

Compute and give the complete solution.

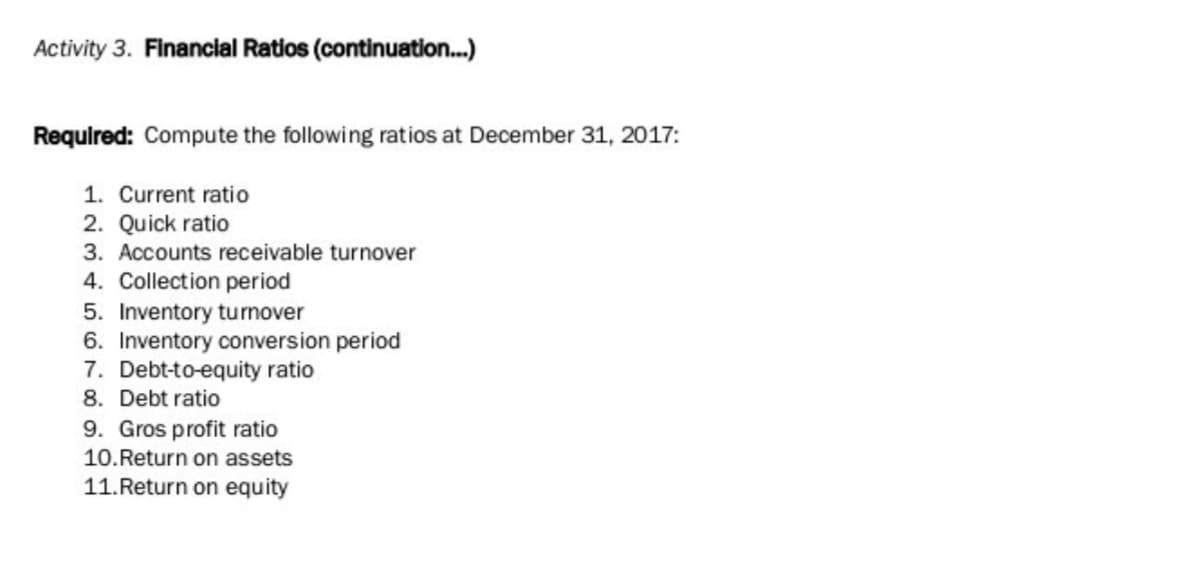

Transcribed Image Text:Activity 3. Financial Ratios (continuation.)

Required: Compute the following ratios at December 31, 2017:

1. Current ratio

2. Quick ratio

3. Accounts receivable turnover

4. Collection period

5. Inventory turnover

6. Inventory conversion period

7. Debt-to-equity ratio

8. Debt ratio

9. Gros profit ratio

10.Return on assets

11.Return on equity

Transcribed Image Text:Activity 3. Financial Ratios

R6 Company

Comparative Balance Sheet

OK, LET'S TRY THIS.

December 31, 2017 and 2016

2017

2016

ASSETS

Cash

30,000.00

45,000.00

Accounts Receivable (net)

97,500.00

90,000.00

90,000.00

Additional informatiu.i for 2017:

Inventory

75,000.00

300,000.00 270,000.00

517,500.00 480,000.00

Property, palnt and equipment (net)

a. Income before interest expense

TOTAL ASSETS

and income taxes was P168,000.

b. Sales on account were P990,000.

c. Sales returns and allowances

amounted to P5,625.

d. Cost of goods sold was P676,500.

e. Interest expense totaled P12,000.

LIABILITIES AND STOCKHOLDERS' EQUITY

75,000.00

150,000.00 150,000.00

210,000.00 180,000.00

Accounts Payable

90,000.00

Mortgage Payable

Common Stock, P10 par

Retained Earnings

82,500.00

60,000.00

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 517,500.00 480,000.00

f.

Income tax rate is 30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning