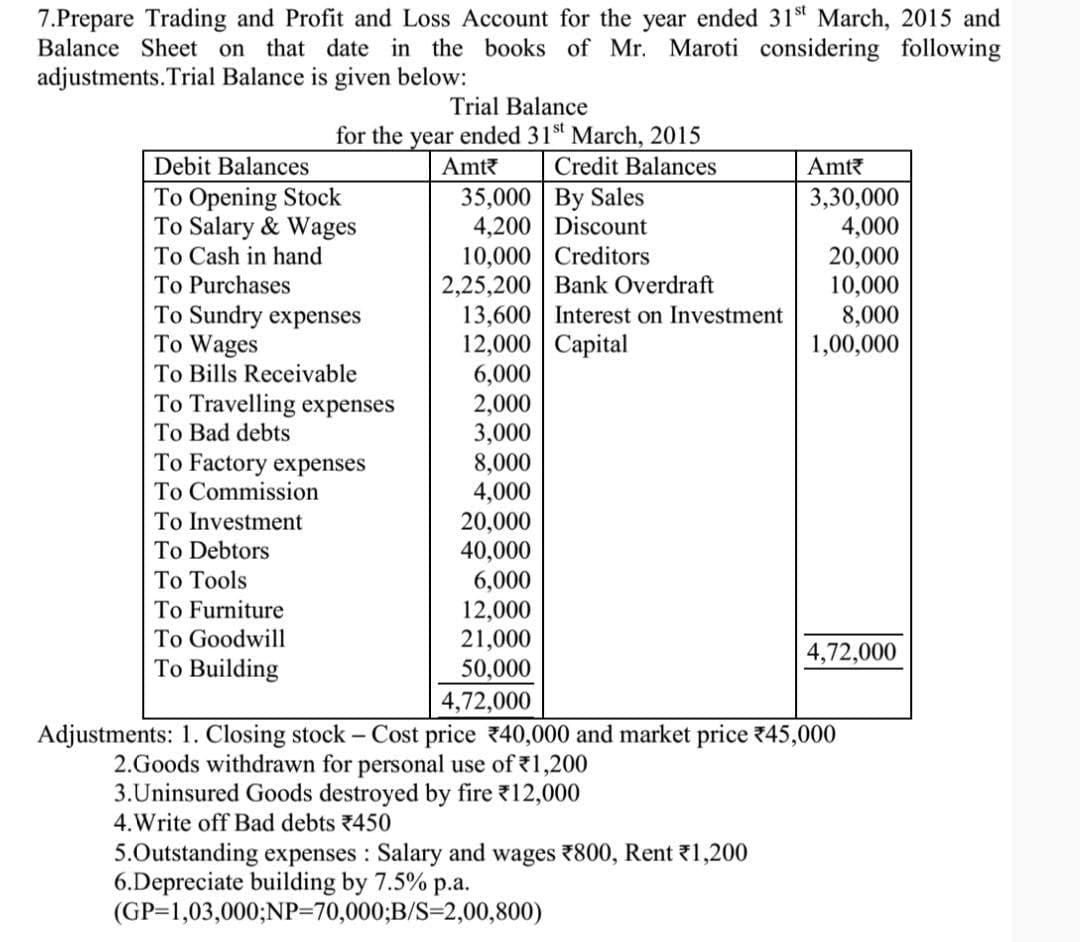

7.Prepare Trading and Profit and Loss Account for the year ended 31st March, 2015 and Balance Sheet on that date in the books of Mr. Maroti considering following adjustments.Trial Balance is given below: Trial Balance for the year ended 31Sst March, 2015 Credit Balances Debit Balances Amt Amt 35,000 By Sales 4,200 Discount 10,000 Creditors 2,25,200 Bank Overdraft 13,600 Interest on Investment 12,000 Capital 6,000 2,000 3,000 8,000 4,000 20,000 40,000 6,000 12,000 21,000 50,000 To Opening Stock To Salary & Wages To Cash in hand 3,30,000 4,000 20,000 10,000 8,000 1,00,000 To Purchases To Sundry expenses To Wages To Bills Receivable To Travelling expenses To Bad debts To Factory expenses To Commission To Investment To Debtors To Tools To Furniture To Goodwill 4,72,000 To Building 4,72,000 Adjustments: 1. Closing stock - Cost price 40,000 and market price 745,000 2.Goods withdrawn for personal use of 1,200 3.Uninsured Goods destroyed by fire 12,000 4. Write off Bad debts 7450 5.Outstanding expenses : Salary and wages T800, Rent 1,200 6.Depreciate building by 7.5% p.a. (GP=1,03,000;NP=70,000;B/S=2,00,800)

7.Prepare Trading and Profit and Loss Account for the year ended 31st March, 2015 and Balance Sheet on that date in the books of Mr. Maroti considering following adjustments.Trial Balance is given below: Trial Balance for the year ended 31Sst March, 2015 Credit Balances Debit Balances Amt Amt 35,000 By Sales 4,200 Discount 10,000 Creditors 2,25,200 Bank Overdraft 13,600 Interest on Investment 12,000 Capital 6,000 2,000 3,000 8,000 4,000 20,000 40,000 6,000 12,000 21,000 50,000 To Opening Stock To Salary & Wages To Cash in hand 3,30,000 4,000 20,000 10,000 8,000 1,00,000 To Purchases To Sundry expenses To Wages To Bills Receivable To Travelling expenses To Bad debts To Factory expenses To Commission To Investment To Debtors To Tools To Furniture To Goodwill 4,72,000 To Building 4,72,000 Adjustments: 1. Closing stock - Cost price 40,000 and market price 745,000 2.Goods withdrawn for personal use of 1,200 3.Uninsured Goods destroyed by fire 12,000 4. Write off Bad debts 7450 5.Outstanding expenses : Salary and wages T800, Rent 1,200 6.Depreciate building by 7.5% p.a. (GP=1,03,000;NP=70,000;B/S=2,00,800)

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 13EA: Dortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000...

Related questions

Question

please help

Transcribed Image Text:7.Prepare Trading and Profit and Loss Account for the year ended 31st March, 2015 and

Balance Sheet on that date in the books of Mr. Maroti considering following

adjustments.Trial Balance is given below:

Trial Balance

for the year ended 31St March, 2015

Credit Balances

Debit Balances

Amt?

Amt?

35,000 By Sales

4,200 Discount

10,000 Creditors

2,25,200 Bank Overdraft

13,600 Interest on Investment

12,000 Capital

6,000

2,000

3,000

8,000

4,000

To Opening Stock

To Salary & Wages

3,30,000

4,000

20,000

10,000

8,000

1,00,000

To Cash in hand

To Purchases

To Sundry expenses

To Wages

To Bills Receivable

To Travelling expenses

To Bad debts

To Factory expenses

To Commission

To Investment

20,000

40,000

6,000

12,000

21,000

To Debtors

To Tools

To Furniture

To Goodwill

4,72,000

To Building

50,000

4,72,000

Adjustments: 1. Closing stock – Cost price 40,000 and market price 745,000

2.Goods withdrawn for personal use of 1,200

3.Uninsured Goods destroyed by fire 12,000

4. Write off Bad debts 7450

5.Outstanding expenses : Salary and wages 7800, Rent 1,200

6.Depreciate building by 7.5% p.a.

(GP=1,03,000;NP=70,000;B/S=2,00,800)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub