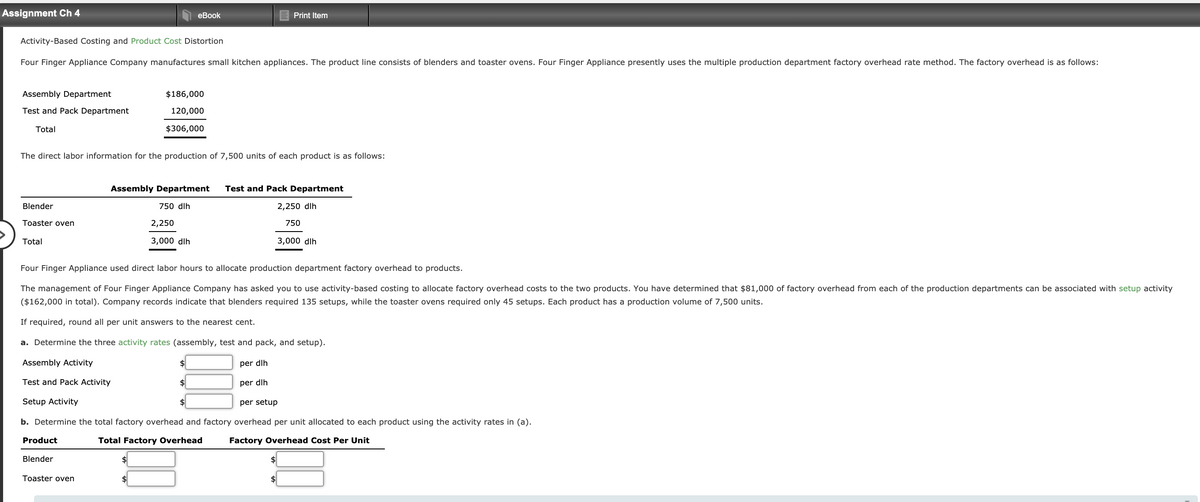

Activity-Based Costing and Product Cost Distortion Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as follows: Assembly Department $186,000 Test and Pack Department 120,000 Total $306,000 The direct labor information for the production of 7,500 units of each product is as follows: Assembly Department Test and Pack Department Blender 750 dih 2.250 dih Toaster oven 2,250 750 Total 3.000 dih 3,000 dih Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. The management of Four Finger Appliance Company has asked you to use activity-based costing to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from each of the production departments can be associated with setup activity ($162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units. If required, round all per unit answers to the nearest cent. a. Determine the three activity rates (assembly, test and pack, and setup). Assembly Activity per dih Test and Pack Activity per dih Setup Activity per setup b. Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (a). Product Total Factory Overhead Factory Overhead Cost Per Unit Blender Toaster oven

Activity-Based Costing and Product Cost Distortion Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as follows: Assembly Department $186,000 Test and Pack Department 120,000 Total $306,000 The direct labor information for the production of 7,500 units of each product is as follows: Assembly Department Test and Pack Department Blender 750 dih 2.250 dih Toaster oven 2,250 750 Total 3.000 dih 3,000 dih Four Finger Appliance used direct labor hours to allocate production department factory overhead to products. The management of Four Finger Appliance Company has asked you to use activity-based costing to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from each of the production departments can be associated with setup activity ($162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units. If required, round all per unit answers to the nearest cent. a. Determine the three activity rates (assembly, test and pack, and setup). Assembly Activity per dih Test and Pack Activity per dih Setup Activity per setup b. Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (a). Product Total Factory Overhead Factory Overhead Cost Per Unit Blender Toaster oven

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter18: Activity-Based Costing

Section: Chapter Questions

Problem 2ADM

Related questions

Question

Transcribed Image Text:Assignment Ch 4

еBook

Print Item

Activity-Based Costing and Product Cost Distortion

Four Finger Appliance Company manufactures small kitchen appliances. The product line consists of blenders and toaster ovens. Four Finger Appliance presently uses the multiple production department factory overhead rate method. The factory overhead is as follows:

Assembly Department

$186,000

Test and Pack Department

120,000

Total

$306,000

The direct labor information for the production of 7,500 units of each product is as follows:

Assembly Department

Test and Pack Department

Blender

750 dlh

2,250 dlh

Toaster oven

2,250

750

Total

3,000 dlh

3,000 dlh

Four Finger Appliance used direct labor hours to allocate production department factory overhead to products.

The management of Four Finger Appliance Company has asked you to use activity-based costing to allocate factory overhead costs to the two products. You have determined that $81,000 of factory overhead from each of the production departments can be associated with setup activity

($162,000 in total). Company records indicate that blenders required 135 setups, while the toaster ovens required only 45 setups. Each product has a production volume of 7,500 units.

If required, round all per unit answers to the nearest cent.

a. Determine the three activity rates (assembly, test and pack, and setup).

Assembly Activity

$

per dlh

Test and Pack Activity

2$

per dlh

Setup Activity

$

per setup

b. Determine the total factory overhead and factory overhead per unit allocated to each product using the activity rates in (a).

Product

Total Factory Overhead

Factory Overhead Cost Per Unit

Blender

Toaster oven

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning