Additional Information for MKH Co. in 20X1: 1. Net income for year 20X1 was $216,000. 2. The company declared and paid a cash dividend of $132,800. 3. The only posting to the net equipment account was for depreciation expense of $35,000 (i.e., no equipment was sold). 4. MKH sold land worth $19,200 for $8,000 cash. 5. The company retired $148,400 worth of bonds payable at the beginning of the year. 1. What was the loss on the sale of land recorded by MKH Company in 20X1? $11,200 $8,000 $0 $19,200 2. What were MKH Company's cash flows from (for) operating activities in 20X1? $268,200 ($180,300) $279,400 $233,100 3. What were MKH Company's cash flows from (for) investing activities in 20X1? $11,200 $0 $19,200 $8,000 4. What were MKH Company's cash flows from (for) financing activities in 20X1? ($47,500) ($97,100) ($180,300) ($116,500)

Additional Information for MKH Co. in 20X1: 1. Net income for year 20X1 was $216,000. 2. The company declared and paid a cash dividend of $132,800. 3. The only posting to the net equipment account was for depreciation expense of $35,000 (i.e., no equipment was sold). 4. MKH sold land worth $19,200 for $8,000 cash. 5. The company retired $148,400 worth of bonds payable at the beginning of the year. 1. What was the loss on the sale of land recorded by MKH Company in 20X1? $11,200 $8,000 $0 $19,200 2. What were MKH Company's cash flows from (for) operating activities in 20X1? $268,200 ($180,300) $279,400 $233,100 3. What were MKH Company's cash flows from (for) investing activities in 20X1? $11,200 $0 $19,200 $8,000 4. What were MKH Company's cash flows from (for) financing activities in 20X1? ($47,500) ($97,100) ($180,300) ($116,500)

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

100%

I need this explained in detail, I have tried to solve it multiple times but know I am adding or subtracting something incorrectly. You can use the cash flow statement with different colored pens for the questions and just put a + or - to tell me if you added or subtracted. As much detail as you can go in as I learn best by looking at questions and seeing how the answer was gotten.

Additional Information for MKH Co. in 20X1:

1. Net income for year 20X1 was $216,000.

2. The company declared and paid a cash dividend of $132,800.

3. The only posting to the net equipment account was for depreciation expense of $35,000 (i.e., no equipment was sold).

4. MKH sold land worth $19,200 for $8,000 cash.

5. The company retired $148,400 worth of bonds payable at the beginning of the year.

1. What was the loss on the sale of land recorded by MKH Company in 20X1?

$11,200

$8,000

$0

$19,200

2. What were MKH Company's cash flows from (for) operating activities in 20X1?

$268,200

($180,300)

$279,400

$233,100

3. What were MKH Company's cash flows from (for) investing activities in 20X1?

$11,200

$0

$19,200

$8,000

4. What were MKH Company's cash flows from (for) financing activities in 20X1?

($47,500)

($97,100)

($180,300)

($116,500)

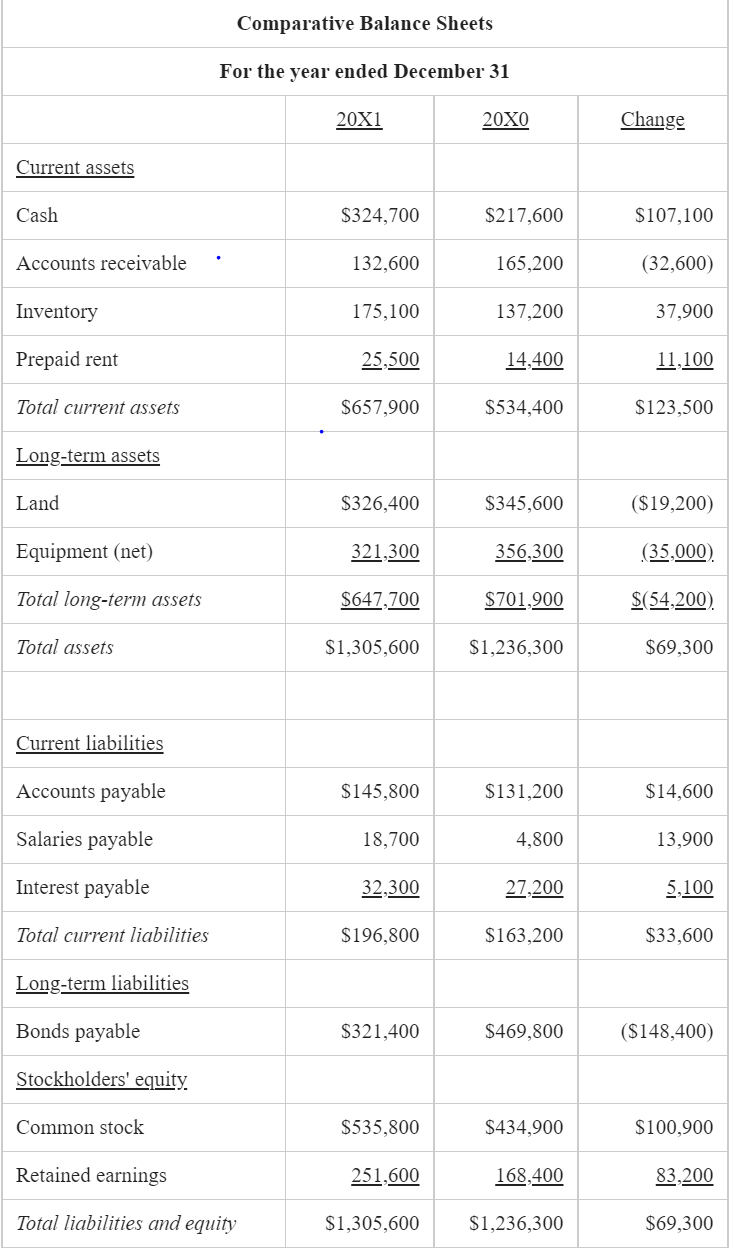

Transcribed Image Text:Comparative Balance Sheets

For the year ended December 31

20X1

20X0

Change

Current assets

Cash

$324,700

$217,600

$107,100

Accounts receivable

132,600

165,200

(32,600)

Inventory

175,100

137,200

37,900

Prepaid rent

25,500

14,400

11,100

Total current assets

$657,900

$534,400

$123,500

Long-term assets

Land

$326,400

$345,600

($19,200)

Equipment (net)

321,300

356.300

(35,000)

Total long-term assets

$647,700

$701,900

$(54,200).

Total assets

$1,305,600

$1,236,300

$69,300

Current liabilities

Accounts payable

$145,800

$131,200

$14,600

Salaries payable

18,700

4,800

13,900

Interest payable

32,300

27,200

5,100

Total current liabilities

$196,800

$163,200

$33,600

Long-term liabilities

Bonds payable

$321,400

$469,800

($148,400)

Stockholders' equity

Common stock

$535,800

$434,900

$100,900

Retained earnings

251,600

168,400

83,200

Total liabilities and equity

$1,305,600

$1,236,300

$69,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning