How much is the amortization of patent for the year 2021?

Q: On Jan, 1, 20X1 ABC Corp sold equipment with a cost of P20,000,000 and accumulated depreciation of…

A: Gain (loss) on sale of the equipment = Cash received + Present value of the Note - Net book value of…

Q: bBramble Corporation builds in-home theater systems. Bramble’s business is growing quickly.…

A: A journal entry is being used to record a business transaction in an organization's accounting…

Q: Exercise 20.2 (Algo) High-Low Method of Cost Analysis (LO20-1, LO20-9) The following information is…

A: The high low method is prepared to separate the variable costs and fixed costs from the total cost…

Q: On Jan, 1, 20X1 ABC Corp sold equipment with a cost of P20,000,000 and accumulated depreciation of…

A: Gain (loss) on sale of the equipment = Cash received + Present value of the Note - Net book value of…

Q: The petty cash fund of Liwanag Company on December 31, 20XX is composed of the following:…

A: Petty cash or petty cash fund is the amount that is kept in hand by a company or individual for day…

Q: Define the terms assets and liabilities and give examples of each

A: Assets means anything which is owned by business and used in business. Liabilities means which the…

Q: the co-ownership?

A: The co-owners are the owners of the property, they own the property jointly. Co-owners enjoy the…

Q: Winston Company had two products code named X and Y. The firm had the following budget for August:…

A: Introduction:- The following formula used as follows under:- Budgeted units = Budgeted sales /…

Q: (f) Bought goods on credit $2200

A: An accounting equation refers to a mathematical representation of the transaction. It indicates that…

Q: how did you get these numbers ? Year 2022: Weighted-Average accumulated expenditure Date Amount…

A: Solution: Weighted average accumulated expenditure is determined by = Amount of expenditure * Period…

Q: Prepare a variable-costing income statement for Pattison Products, Inc., for the month of October.…

A: The variable costs includes direct materials, direct labor, variable overhead, variable selling and…

Q: Ben Merchandise presented the following accounts for 2019 and 2018: P1,238,550.00 (current assets…

A:

Q: 4. For the proposals accepted for further analysis in part (3), compute the net present value. Use…

A: Proposal B and proposal D are accepted in part 3.

Q: I: Common-size analysis all accounts are presented as percentage of total liabilities in Balance…

A: Financial statements are those statements and reports which are prepared at the end of the period…

Q: What does an Income statement tell about a business?

A: The income statement is a summary of a company's financial performance over a certain time period.…

Q: A consortium of international telecommunication companies contracted for the purchase and…

A: Depreciation: - Depreciation is the total reduction in the value of the asset by its regular use or…

Q: · An analysts wants to project the financial statements of a company in 2020. He has gathered the…

A: The current liabilities are the amount due to be paid within one year. The current liabilities can…

Q: What are some of the similarities and differences between evidence in a legal case and evidence…

A: Financial statements are descriptions of a company's monetary results, financial status, and cash…

Q: Prepare a depreciation schedule for a piece of machinery purchased Jan 10 for $8800. Transportation…

A: Straight line Method: The straight line basis technique is one approach that may be used by…

Q: 47.ABC Corp had a cash balance of P500,000 in its books at Dec 31. The following are additional…

A: The financial statement means those statements that keep the record of the business activities. All…

Q: Based on your answers and the decision criteria, determine whether you will accept or reject this…

A: Solution: Net present value is computed as = Present value of cash inflows - Initial investment

Q: Advanced Physics please answer this question on excel for a quick upvote 2.79 Find the present worth…

A: Present worth indicates the computation of the present value of the amount invested with respect to…

Q: each years accumulated depreciation.

A: Depreciation refers to the reduction in the value of an asset due to the wear and tear in the asset…

Q: Onix Manufacturing Company Inc uses direct labor hours in its predetermined overhead rate. At the…

A: Lets understand the basics. Overhead rate is calculated to applied on actual output using below…

Q: A promise to buy "all the oil I need to heat my shop this winter" recites valid consideration. True…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: The bill of exchange written by W states that BPI Family Savings Bank will get the reimbursement of…

A: A written order or promise by the maker of the document to pay a specified sum of money to some…

Q: The maximum amount of Work opportunity tax credit in 2021 is a) 24,000 b) 6,000 c) 2,400 d) None…

A: Work opportunity tax credit which is also written as WOTC, is a federal tax credit which is given to…

Q: Sako Company’s Audio Division produces a speaker that is used by manufacturers of various audio…

A: Solution 3a: If Audio Division can sell all of its speaker to outside customers for 88 per speaker,…

Q: calendar year and the Federal of 0.6% and the State Unemploy hhcld from her carnings was $1,4

A: Net pay is the amount of compensation that remains available for distribution to an employee after…

Q: Last day to appeal to the CTA is

A: Tax refund is the refund of the income tax which has been paid by the taxpayer during the year more…

Q: John and Mary had the following transactions for 2020. Calulate net capital gain/loss, how much to…

A: calculation of above requirement are as follows

Q: Q66. A, B and C were partners in a firm sharing profits in the ratio of 2:2:1. Cwas guaranteed to be…

A: Hi student Since there are multiple questions, we will answer only first question.

Q: What is the purpose of the major types of analytical procedures? At what point during the planning…

A: Analytical techniques are one type of evidence used in audits. These procedures can detect possible…

Q: he following are the records of a domestic corporation

A: As per the provisions of BIR in Phillipines ---…

Q: Why is it necessary to evaluate the attributes of audit evidence? Explain

A: Audit evidence is the evidence obtained by the auditor during the course of audit to enable him to…

Q: VINCENZO Inc. was formed towards the end of 2020. At the time of formation, the company spent…

A: An intangible asset is an asset that have without physical substance. Examples are patents,…

Q: A machinery costs of 1000,000 and its economic lite is 5 years. It charges depreciation at 20% per…

A: Depreciation is the steady decrease in the reported value of an item throughout its useful life by…

Q: Lab Company's targeted ending inventory is ₱250,000. Its forecasted sales is ₱980,000 and has a…

A: Budgeted purchase equal to cost of goods sold plus ending inventory minus beginning inventory…

Q: Instructions Journalize the selected transactions. Selected transactions completed by Equinox…

A: Common stock represents the ownership portion of the stockholder over the business and its resources…

Q: nership of Len, Gray has the ability to exercise significant influence over Len's financial and…

A: Disclaimer : “Since you have asked multiple question, we will solve the first question for you. If…

Q: and pay a $95 per month mai rmine the months of use nece.

A: All sorts of future cash flows in respect of adding interest on present value are known as future…

Q: Name three different methods of tracking and costing out inventory.

A: Introduction: The term inventory refers to both raw materials used in manufacturing and completed…

Q: issue of shares for cash

A: Solution: Cash receipt journal is used to record all type of cash receipts by a buisness.

Q: Data related to the inventories of Alpine Ski Equipment and Supplies is presented below: Skis…

A: Using lower of cost or net realizable value rule, the inventory is valued at lower value among cost…

Q: 9. Unless otherwise agreed, a partnership dissolves if___ Group of answer choices A. An event occurs…

A: A partnership is a legally enforceable agreement between two or more people to run a business and…

Q: Bramble Corporation builds in-home theater systems. Bramble’s business is growing quickly.…

A: Routine transactions, such as customer billings and supplier invoicing, should not be recorded using…

Q: okies at a cost of $1.08 per dozen the cookies remain unsold and v

A: Markup means the percentage margin either on cost or sales price.

Q: Genie Company has operating income after taxes of P50,000. It has P200,000 of equity capital, which…

A: Economic value added is value addition in something, It is a measure of the financial instruments of…

Q: Prepare adjusting entry for October 31. Show computation. A bank loan amounting to P100,000 was…

A: Formula: Interest amount = Bank loan amount x Interest rate x Time period.

Q: An analysis and aging of Serrano Company's accounts receivable at December 31, 20XX disclosed the…

A: Under Ageing of receivables method, Allowance for doubtful accounts is calculated on the basis of…

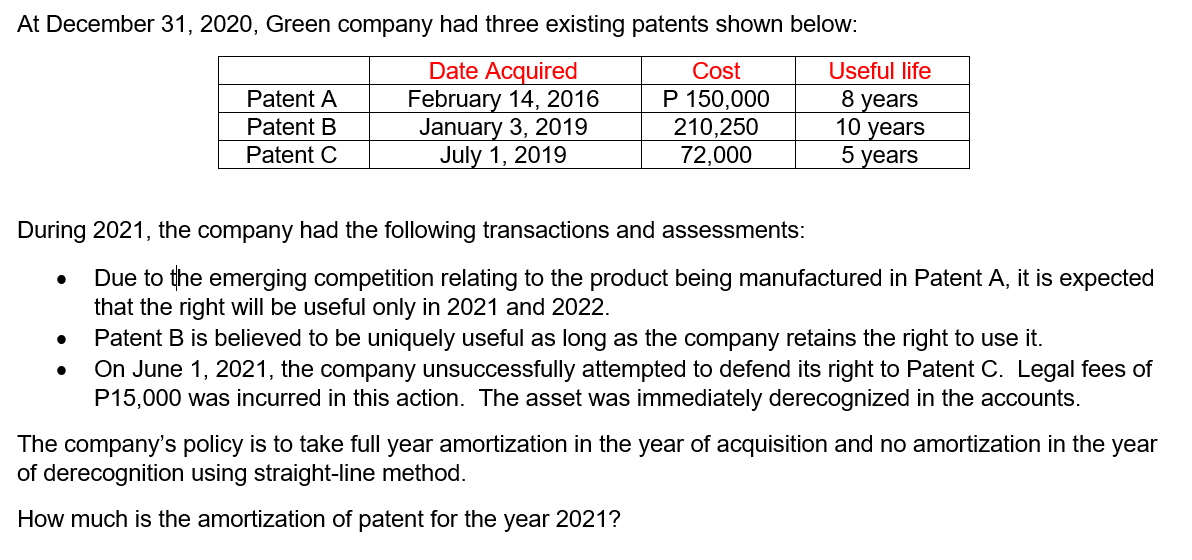

The answer is P28,125. The 1st bullet’s computation of amortization is only needed. The 2nd and 3rd bullet does not need to be amortized. Help me compute for the 1st bullet's amortization.

Step by step

Solved in 2 steps

- Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, for 72,000. The patent has a remaining legal life of 9 years. Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the straight-line method over the life of the asset.In examining Samson Manufacturing Companys books, you find on the December 31, 2019, balance sheet the item, Costs of patents, 308,440. Referring to the ledger accounts, you note the following items regarding one patent acquired in 2016; There are no credits in the account, and the company has not recorded any amortization for any of the patents. There are three other parents issued in 2013, 2015, and 2016; all were developed by the staff of Samson. The patented articles are presently very marketable, but are estimated to be in demand only for the next few years. Required: Discuss the accounting issues related to the items included in the Patent account.Lee Manufacturing Corporation was incorporated on January 3, 2018. The corporations financial statements for its first years operations were not examined by a CPA. You have been engaged to examine the financial statements for the year ended December 31, 2019, and your examination is substantially completed. Lees trial balance at December 31, 2019, appears as follows: The following information relates to accounts that may vet require adjustment: 1. Patents for Lees manufacturing process were acquired January 2, 2019, at a cost of 68,000. An additional 17,000 was spent in December 2019 to improve machinery covered by the patents and charged to the Patent account. Depreciation on fixed assets has been properly recorded for 2019 in accordance with Lees practice which provides a full years depreciation for property on hand June 30 and no depreciation otherwise. Lee uses the straight-line method fix all depreciation and amortization and amortizes its patents over their legal life. 2. On January 3. 2018, Lee purchased licensing Agreement No. 1, which was believed to have an indefinite useful life. The balance in the licensing Agreement No. 1 account includes its purchase price of 48,000 and costs of 2,000 related to the acquisition. On January 1, 2019, Lee purchased licensing Agreement No. 2, which has a life expectancy of 10 years. The balance in the Licensing Agreement No. 2 account includes its 48,000 purchase price and 2,000 in acquisition costs, but it has been reduced by a credit of 1,000 for the advance collection of 2020 revenue from the agreement. In late December 2018, an explosion caused a permanent 60% reduction in the expected revenue-producing value of licensing Agreement No. 1, and in January 2020 a flood caused additional damage that rendered the agreement worthless. 3. The balance in the Goodwill account includes (a) 8,000 paid December 30, 2018, for newspaper advertising for the next 4 years following the payment, and (b) legal costs of 16,000 incurred for Lees incorporation on January 3, 2018. 4. The Leasehold Improvements account includes (a) the 15,000 cost of improvements with a total estimated useful life of 12 years, which Lee, as tenant, made to leased premises in January 2018; (b) movable assembly line equipment costing 8,500 that was installed in the leased premises in December 2019; and (c) real estate taxes of 2,500 paid by Lee in 2019, which under the terms of the lease should have been paid by the land-lord. Lee paid its rent in full during 2019. A 10-year nonrenewable lease was signed January 3, 2018, fix the leased building that Lee used in manufacturing operations. 5. The balance in the Organization Costs account includes costs incurred during the organizational period. Required: Prepare a worksheet (spreadsheet) to adjust accounts that require adjustment and prepare financial statements. Formal adjusting journal entries and financial statements are not required. No intangible assets are impaired at the end of 2019. Ignore income taxes.

- Steel Magnolia Incorporated purchased a trademark 7 years ago for 275,000. Steel Magnolia believed the trade-mark would have an indefinite life. At the end of 2020, the corporation believes the fair value of the trademark is 189,000. Record the impairment loss for Steel Magnolia.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.

- At December 31, 2020, Green company had three existing patents shown below: Date Acquired Cost Useful life Patent A February 14, 2016 P 150,000 8 years Patent B January 3, 2019 210,250 10 years Patent C July 1, 2019 72,000 5 years During 2021, the company had the following transactions and assessments: Due to the emerging competition relating to the product being manufactured in Patent A, it is expected that the right will be useful only in 2021 and 2022. Patent B is believe to be uniquely useful as long as the company retains the right to use it. On June 1, 2021, the company unsuccessfully attempted to defend its right to Patent C. Legal fees of P15,000 was incurred in this action. The asset was immediately derecognized in the accounts. The company’s policy is to take full year amortization in the year of acquisition and no amortization in the year of derecognition using straight-line method. How…Tones Industries has the following patents on its December 31, 2019, balance sheet. Patent Item Initial Cost Date Acquired Useful Life at Date Acquired Patent A $30,600 3/1/16 17 years Patent B $15,000 7/1/17 10 years Patent C $14,400 9/1/18 4 years The following events occurred during the year ended December 31, 2020. 1. Research and development costs of $245,700 were incurred during the year. 2. Patent D was purchased on July 1 for $36,480. This patent has a useful life of 9½ years. 3. As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B's value may have occurred at December 31, 2020. The controller for Tones estimates the expected future cash flows from Patent B will be as follows. Year Expected Future Cash Flows 2021 $2,000 2022 2,000 2023 2,000 The proper discount rate to be used for these flows is 8%. (Assume that the cash flows occur at the end of the year.)…Sage Hill Industries has the following patents on its December 31, 2019, balance sheet. Patent Item Initial Cost Date Acquired Useful Life at Date Acquired Patent A $43,860 3/1/16 17 years Patent B $16,800 7/1/17 10 years Patent C $21,600 9/1/18 4 years The following events occurred during the year ended December 31, 2020. 1. Research and development costs of $245,000 were incurred during the year. 2. Patent D was purchased on July 1 for $40,470. This patent has a useful life of 91/2 years. 3. As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B’s value may have occurred at December 31, 2020. The controller for Sage Hill estimates the expected future cash flows from Patent B will be as follows. Year Expected Future Cash Flows 2021 $2,100 2022 2,100 2023 2,100 The proper discount rate to be used for these flows is 8%. (Assume…

- Sage Hill Industries has the following patents on its December 31, 2019, balance sheet. Patent Item Initial Cost Date Acquired Useful Life at Date Acquired Patent A $41,616 3/1/16 17 years Patent B $15,480 7/1/17 10 years Patent C $16,320 9/1/18 4 years The following events occurred during the year ended December 31, 2020. 1. Research and development costs of $234,000 were incurred during the year. 2. Patent D was purchased on July 1 for $47,196. This patent has a useful life of 91/2 years. 3. As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B’s value may have occurred at December 31, 2020. The controller for Sage Hill estimates the expected future cash flows from Patent B will be as follows. Year Expected Future Cash Flows 2021 $2,000 2022 2,000 2023 2,000 The proper discount rate to be used for these flows is 8%. (Assume…Skysong Industries has the following patents on its December 31, 2019, balance sheet. Patent Item Initial Cost Date Acquired Useful Life at Date Acquired Patent A $44,268 3/1/16 17 years Patent B $17,040 7/1/17 10 years Patent C $22,560 9/1/18 4 years The following events occurred during the year ended December 31, 2020. 1. Research and development costs of $247,000 were incurred during the year. 2. Patent D was purchased on July 1 for $37,848. This patent has a useful life of 91/2 years. 3. As a result of reduced demands for certain products protected by Patent B, a possible impairment of Patent B’s value may have occurred at December 31, 2020. The controller for Skysong estimates the expected future cash flows from Patent B will be as follows. Year Expected Future Cash Flows 2021 $2,200 2022 2,200 2023 2,200 The proper discount rate to be used for these flows is 8%. (Assume that the…The Western Company, a company that follows IFRS, provided you with the following information about a number of transactions that took place in 2020: On January 1, 2020 Western acquired a patent for $45,000 cash. The patent expires on January 1, 2028, but the company determined that it will generate future benefits for 6 years from the date of acquisition. During 2022, the total useful life of the patent was revised to 4 years. During March 2020, The Wester Company invested $120,000 in research costs about a new product that it aims to develop in 2021. The amount was paid in cash. The Western Company estimates that its internal goodwill is worth $980,000 in July 2020. Required- Prepare the journal entries related to the patent from January 1, 2020 to December 31, 2022. Prepare the journal entries for 2 and 3. If no journal entry is required, justify why.