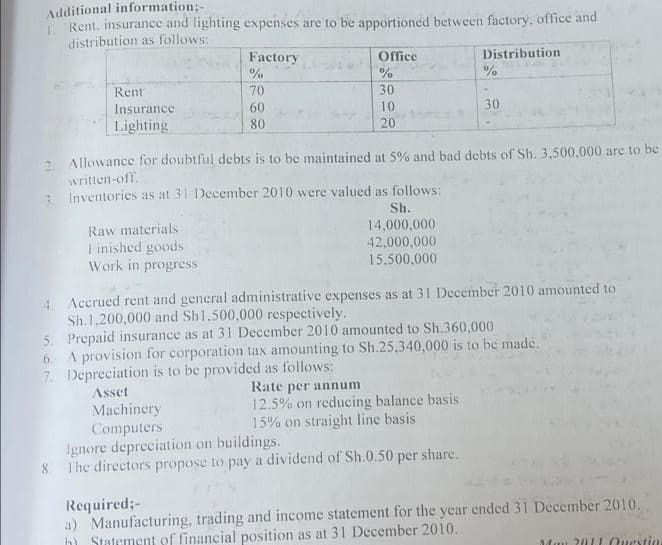

Additional informátion: Rent, insurance and lighting expenses are to be apportioned between factory, office and distribution as follows: Factory Office Distribution % Rent 70 30 Insurance 60 10 20 30 Lighting 80 2 Allowance for doubtful debts is to be maintained at 5% and bad debts of Sh. 3,500,000 are to be written-off. Inventories as at 31 December 2010 were valued as follows: Sh. Raw materials I inished goods Work in progress 14,000,000 42,000,000 15,500,000 4. Accrued rent and general administrative expenses as at 31 December 2010 amounted to Sh.1.200,000 and Sh1.500,000 respectively. 5. Prepaid insurance as at 31 December 2010 amounted to Sh.360,000 6. A provision for corporation tax amounting to Sh.25,340,000 is to be made, 7. Depreciation is to be provided as follows: Rate per annum 12.5% on reducing balance basis 15% on straight line basis Asset Machinery Computers Ignore depreciation on buildings. 8. The directors propose to pay a dividend of Sh.0.50 per share. Required;- a) Manufacturing, trading and income statement for the year ended 31 December 2010. of financial position as at 31 December 2010.

Additional informátion: Rent, insurance and lighting expenses are to be apportioned between factory, office and distribution as follows: Factory Office Distribution % Rent 70 30 Insurance 60 10 20 30 Lighting 80 2 Allowance for doubtful debts is to be maintained at 5% and bad debts of Sh. 3,500,000 are to be written-off. Inventories as at 31 December 2010 were valued as follows: Sh. Raw materials I inished goods Work in progress 14,000,000 42,000,000 15,500,000 4. Accrued rent and general administrative expenses as at 31 December 2010 amounted to Sh.1.200,000 and Sh1.500,000 respectively. 5. Prepaid insurance as at 31 December 2010 amounted to Sh.360,000 6. A provision for corporation tax amounting to Sh.25,340,000 is to be made, 7. Depreciation is to be provided as follows: Rate per annum 12.5% on reducing balance basis 15% on straight line basis Asset Machinery Computers Ignore depreciation on buildings. 8. The directors propose to pay a dividend of Sh.0.50 per share. Required;- a) Manufacturing, trading and income statement for the year ended 31 December 2010. of financial position as at 31 December 2010.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

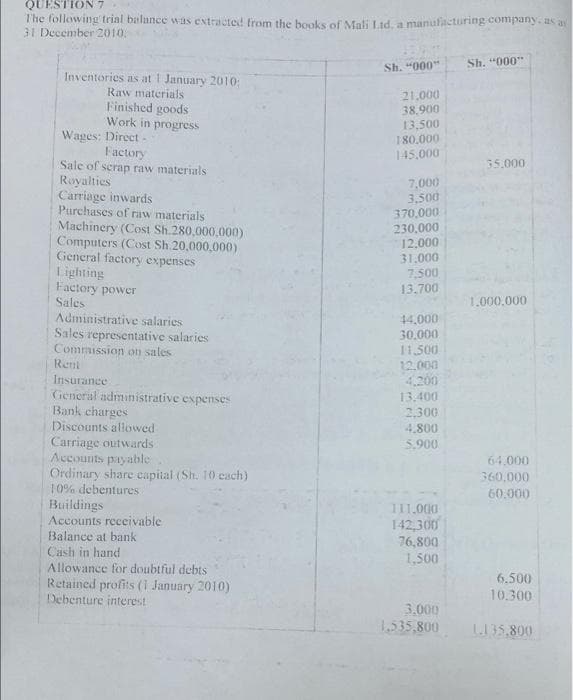

Transcribed Image Text:QUESTION 7

The followingtrial balunce was extracted from the books of Mati Lid, a manufacturing company, as a

31 December 2010,

Sh. "000"

Sh. "000"

Inventories as at 1 January 2010:

Raw materials

Finished goods

Work in progress

21,000

38.900

13,500

180.000

145.000

Wages: Direct-

Factory

Sale of scrap raw materials

Royalties

Carriage inwards

Purchases of raw materials

Machinery (Cost Sh.280,000,000)

Computers (Cost Sh 20,000,000)

General factory expenses

Lighting

Factory power

Sales

35.000

7,000

3,500

370,000

230,000

12,000

31,000

7,500

13.700

1.000,000

Administrative salaries

Sales representative salaries

Commission on sales

Reni

4,000

30,000

11.500

12.000

4,200

13,400

Insurance

General administrative expenses

Bank charges

2,300

Discounts allowed

4,800

Carriage outwards

Accounts payable

Ordinary share capital (Sh. 10 each)

10% debentures

5,900

64,000

360,000

60.000

Buildings

Accounts receivable

III.000

142,300

76,800

1,500

Balance at bank

Cash in hand

Allowance for doubtful debts

Retained profits (1 January 2010)

Debenture interest

6.500

10.300

3.000

1,535,800

LI35,800

Transcribed Image Text:Additional information:-

Rent, insurance and lighting expenses are to be apportioned between factory, office and

distribution as follows:

Factory

%

Office

Distribution

Rent

70

30

Insurance

60

80

10

20

30

Lighting

2 Allowance for doubtful debts is to be maintained at 5% and bad debts of Sh. 3,500,000 arc to be

written-off.

Inventories as at 31 December 2010 were valued as follows:

Sh.

14,000,000

Raw materials

I inished goods

Work in progress

42,000,000

15.500,000

4 Accrued rent and general administrative expenses as at 31 December 2010 amounted to

Sh.1.200,000 and Sh1.500,000 respectively.

5. Prepaid insurance as at 31 December 2010 amounted to Sh.360,000

6. A provision for corporation tax amounting to Sh.25,340,000 is to be made,

7. Depreciation is to be provided as follows:

Rate per annum

12.5% on reducing balance basis

15% on straight line basis

Asset

Machinery

Computers

Ignore depreciation on buildings.

8. The directors propose to pay a dividend of Sh.0.50 per share.

Required;-

a) Manufacturing, trading and income statement for the year ended 31 December 2010.

Statement of financial position as at 31 December 2010.

h)

Man 2011 Questin

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education