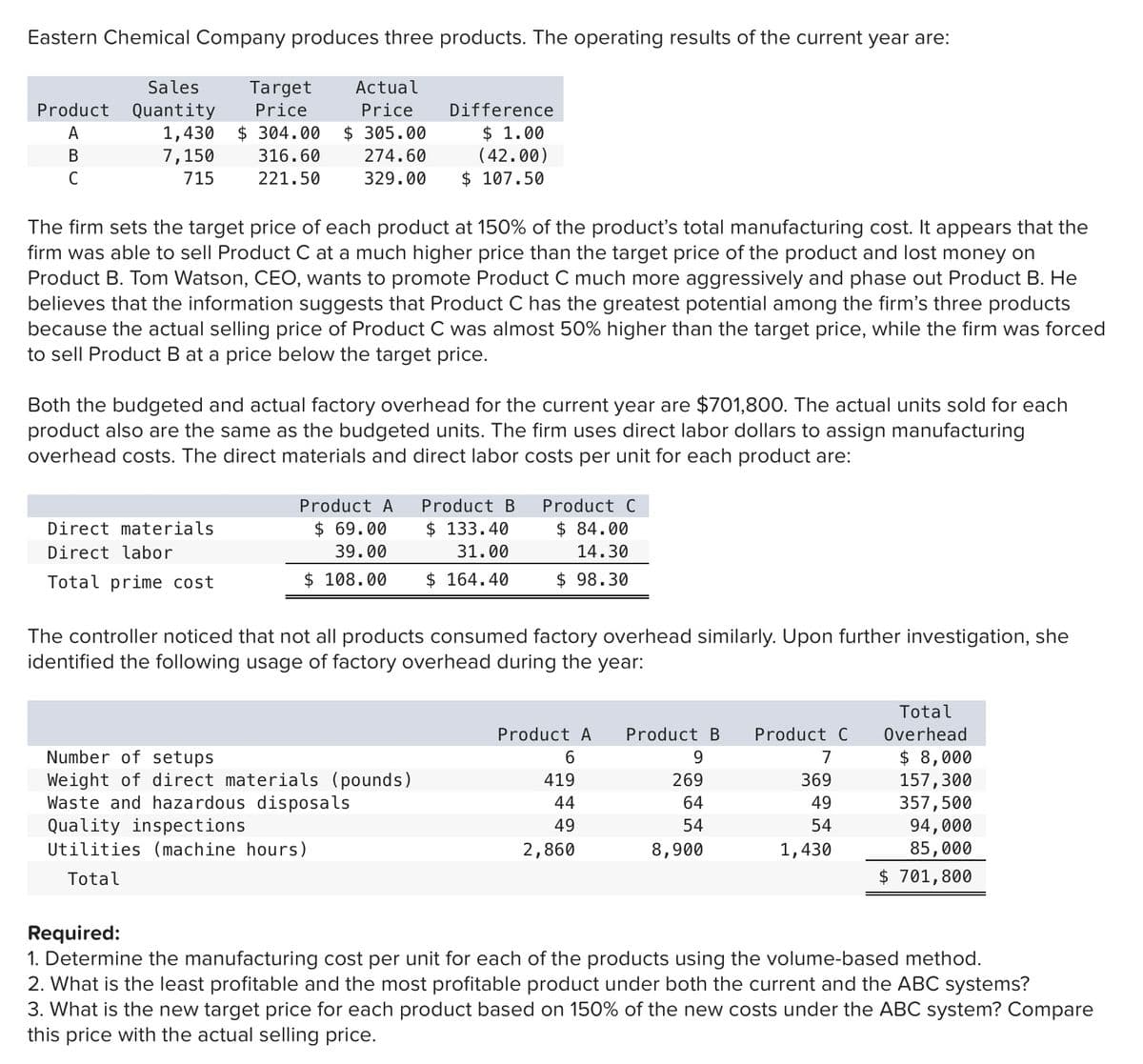

Eastern Chemical Company produces three products. The operating results of the current year are: Sales Target Price Actual Product Quantity 1,430 7,150 Price Difference $ 304.00 $ 305.00 $ 1.00 (42.00) $ 107.50 A В 316.60 274.60 715 221.50 329.00 The firm sets the target price of each product at 150% of the product's total manufacturing cost. It appears that the firm was able to sell Product C at a much higher price than the target price of the product and lost money on Product B. Tom Watson, CEO, wants to promote Product C much more aggressively and phase out Product B. He believes that the information suggests that Product C has the greatest potential among the firm's three products because the actual selling price of Product C was almost 50% higher than the target price, while the firm was forced to sell Product B at a price below the target price. Both the budgeted and actual factory overhead for the current year are $701,800. The actual units sold for each product also are the same as the budgeted units. The firm uses direct labor dollars to assign manufacturing overhead costs. The direct materials and direct labor costs per unit for each product are: Product A Product B Product C Direct materials $ 69.00 $ 133.40 $ 84.00 Direct labor 39.00 31.00 14.30 Total prime cost $ 108.00 $ 164.40 $ 98.30 The controller noticed that not all products consumed factory overhead similarly. Upon further investigation, she identified the following usage of factory overhead during the year: Total Product A Product B Product C Overhead Number of setups $ 8,000 157,300 357,500 94,000 85,000 6. 9. 7 Weight of direct materials (pounds) Waste and hazardous disposals Quality inspections Utilities (machine hours) 419 269 369 44 64 49 49 54 54 2,860 8,900 1,430 Total $ 701,800 Required: 1. Determine the manufacturing cost per unit for each of the products using the volume-based method. 2. What is the least profitable and the most profitable product under both the current and the ABC systems? 3. What is the new target price for each product based on 150% of the new costs under the ABC system? Compare this price with the actual selling price.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps