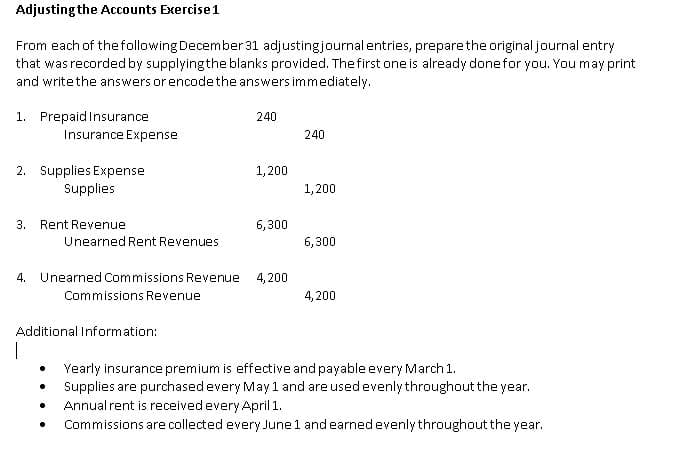

Adjusting the Accounts Exercise 1 From each of the following December 31 adjustingjournalentries, prepare the original journal entry that was recorded by supplyingthe blanks provided. The first one is already donefor you. You may print and write the answers or encode the answers immediately. 1. Prepaid Insurance Insurance Expense 240 240 2. Supplies Expense Supplies 1,200 1,200 3. Rent Revenue 6,300 Unearned Rent Revenues 6,300 4. Unearned Commissions Revenue 4,200 Commissions Revenue 4, 200 Additional Information: Yearly insurance premium is effective and payable every March 1. Supplies are purchased every May 1 and are used evenly throughout the year. Annual rent is receivedevery April 1. • Commissions are collected every June 1 and earned evenly throughout the year.

Adjusting the Accounts Exercise 1 From each of the following December 31 adjustingjournalentries, prepare the original journal entry that was recorded by supplyingthe blanks provided. The first one is already donefor you. You may print and write the answers or encode the answers immediately. 1. Prepaid Insurance Insurance Expense 240 240 2. Supplies Expense Supplies 1,200 1,200 3. Rent Revenue 6,300 Unearned Rent Revenues 6,300 4. Unearned Commissions Revenue 4,200 Commissions Revenue 4, 200 Additional Information: Yearly insurance premium is effective and payable every March 1. Supplies are purchased every May 1 and are used evenly throughout the year. Annual rent is receivedevery April 1. • Commissions are collected every June 1 and earned evenly throughout the year.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 1QY: Determine the balance of the following T account:

94,100 debit

54,900 debit

133,300 credit

54,900...

Related questions

Question

Answer what are the input for original entry (debit and credit)

Transcribed Image Text:Adjusting the Accounts Exercise1

From each of the following December 31 adjustingjournal entries, prepare the original journal entry

that was recorded by supplyingthe blanks provided. The first one is already donefor you. You may print

and writethe answers or encode the answers immediately.

1. Prepaid Insurance

240

Insurance Expense

240

2. Supplies Expense

Supplies

1,200

1,200

3.

Rent Revenue

6,300

Unearned Rent Revenues

6,300

4. Unearned Commissions Revenue

4, 200

Commissions Revenue

4,200

Additional Information:

Yearly insurance premium is effective and payable every March 1.

Supplies are purchasedevery May 1 and are usedevenly throughout the year.

Annual rent is received every April 1.

Commissions are collected every June1 andearned evenlythroughout the year.

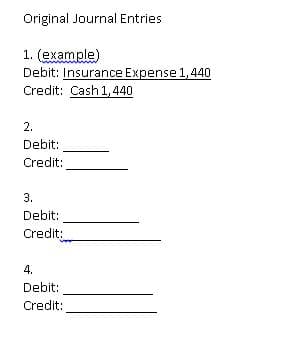

Transcribed Image Text:Original Journal Entries

1. (example)

Debit: Insurance Expense1,440

Credit: Cash 1,440

2.

Debit:

Credit:

3.

Debit:

Credit:

4.

Debit:

Credit:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub