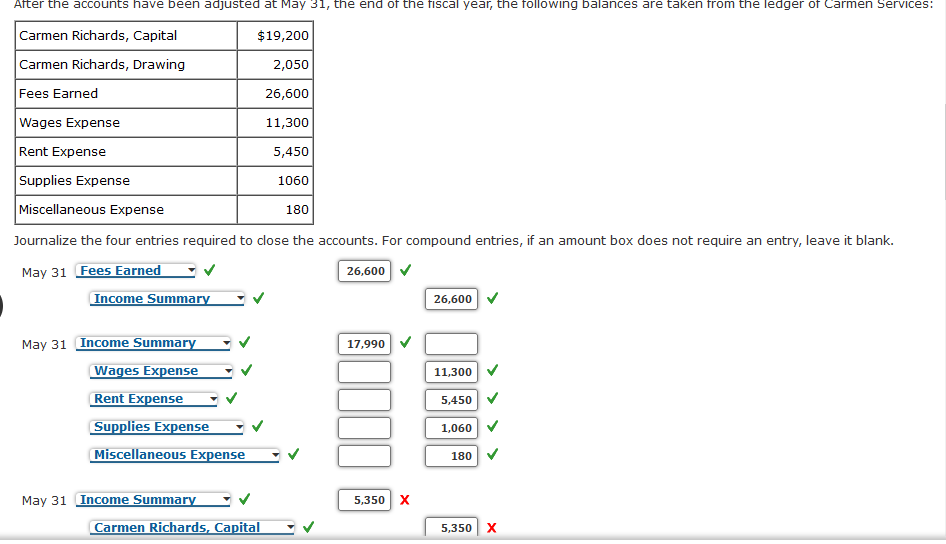

fter the accounts have been adjusted at May 31, the end of the fiscal year, the following balances are taken from the ledger of Carmen Services Carmen Richards, Capital $19,200 Carmen Richards, Drawing 2,050 Fees Earned 26,600 Wages Expense 11,300 Rent Expense 5,450 Supplies Expense 1060 Miscellaneous Expense 180 burnalize the four entries required to close the accounts. For compound entries, if an amount box does not require an entry, leave it blank. May 31 Fees Earned Income Summary 26,600 26,600 v May 31 Income Summary 17,990 Wages Expense 11,300 Rent Expense 5,450 Supplies Expense 1,060 V Miscellaneous Expense 180 May 31 Income Summary 5,350 X Carmen Richards, Capital 5,350 X

fter the accounts have been adjusted at May 31, the end of the fiscal year, the following balances are taken from the ledger of Carmen Services Carmen Richards, Capital $19,200 Carmen Richards, Drawing 2,050 Fees Earned 26,600 Wages Expense 11,300 Rent Expense 5,450 Supplies Expense 1060 Miscellaneous Expense 180 burnalize the four entries required to close the accounts. For compound entries, if an amount box does not require an entry, leave it blank. May 31 Fees Earned Income Summary 26,600 26,600 v May 31 Income Summary 17,990 Wages Expense 11,300 Rent Expense 5,450 Supplies Expense 1,060 V Miscellaneous Expense 180 May 31 Income Summary 5,350 X Carmen Richards, Capital 5,350 X

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter4: Income Measurement And Accrual Accounting

Section: Chapter Questions

Problem 4.28E

Related questions

Question

100%

Need help with the incorrect ones, thank you

Transcribed Image Text:After the accounts have been adjusted at May 31, the end of the fiscal year, the following balances are taken from the ledger of Carmen Services:

Carmen Richards, Capital

$19,200

Carmen Richards, Drawing

2,050

Fees Earned

26,600

Wages Expense

11,300

Rent Expense

5,450

Supplies Expense

1060

Miscellaneous Expense

180

Journalize the four entries required to close the accounts. For compound entries, if an amount box does not require an entry, leave it blank.

May 31 Fees Earned

Income Summary

26,600

26,600

May 31 Income Summary

17,990

Wages Expense

11,300

Rent Expense

5,450

Supplies Expense - v

1,060

Miscellaneous Expense

180

May 31 Income Summary

5,350 X

Carmen Richards, Capital

5,350 X

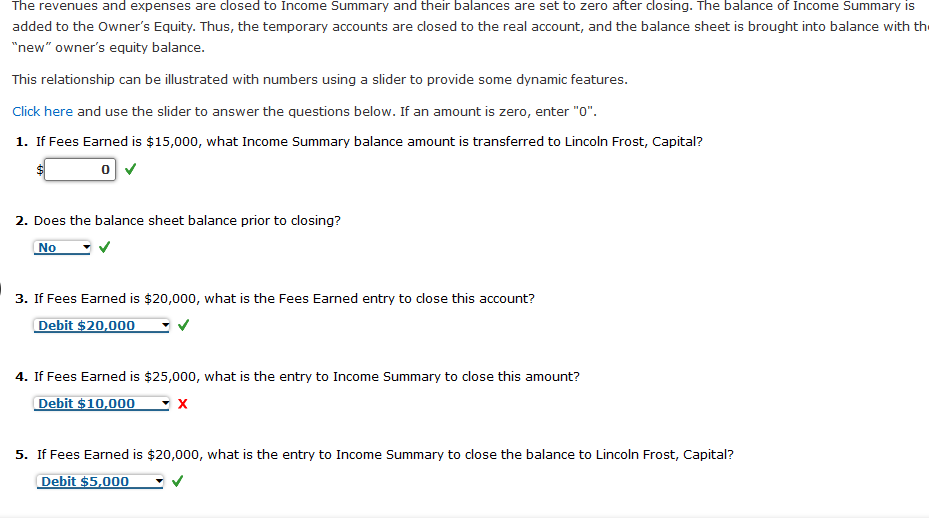

Transcribed Image Text:The revenues and expenses are closed to Income Summary and their balances are set to zero after closing. The balance of Income Summary is

added to the Owner's Equity. Thus, the temporary accounts are closed to the real account, and the balance sheet is brought into balance with the

"new" owner's equity balance.

This relationship can be illustrated with numbers using a slider to provide some dynamic features.

Click here and use the slider to answer the questions below. If an amount is zero, enter "0".

1. If Fees Earned is $15,000, what Income Summary balance amount is transferred to Lincoln Frost, Capital?

2. Does the balance sheet balance prior to closing?

No

3. If Fees Earned is $20,000, what is the Fees Earned entry to close this account?

Debit $20,000

4. If Fees Earned is $25,000, what is the entry to Income Summary to close this amount?

Debit $10,000

5. If Fees Earned is $20,000, what is the entry to Income Summary to close the balance to Lincoln Frost, Capital?

Debit $5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage