After recently receiving a bonus, you have decided to add some bonds to your investment portfolio. You have narrowed your choice down to the following bonds (assume semiannual payments): Which bond would you rather own if you expect market rates to fall by 2% across the maturity spectrum? What if rates will rise by 2%? Why?

After recently receiving a bonus, you have decided to add some bonds to your investment portfolio. You have narrowed your choice down to the following bonds (assume semiannual payments): Which bond would you rather own if you expect market rates to fall by 2% across the maturity spectrum? What if rates will rise by 2%? Why?

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 12P

Related questions

Question

100%

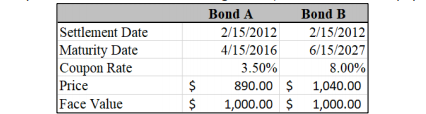

After recently receiving a bonus, you have decided to add some bonds to your investment portfolio. You have narrowed your choice down to the following bonds (assume semiannual payments):

Which bond would you rather own if you expect market rates to fall by 2% across the maturity spectrum? What if rates will rise by 2%? Why?

Transcribed Image Text:Bond A

Вond B

Settlement Date

Maturity Date

Coupon Rate

Price

Face Value

2/15/2012

6/15/2027

8.00%

890.00 $ 1,040.00

2/15/2012

4/15/2016

3.50%

$

1,000.00 $ 1,000.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning