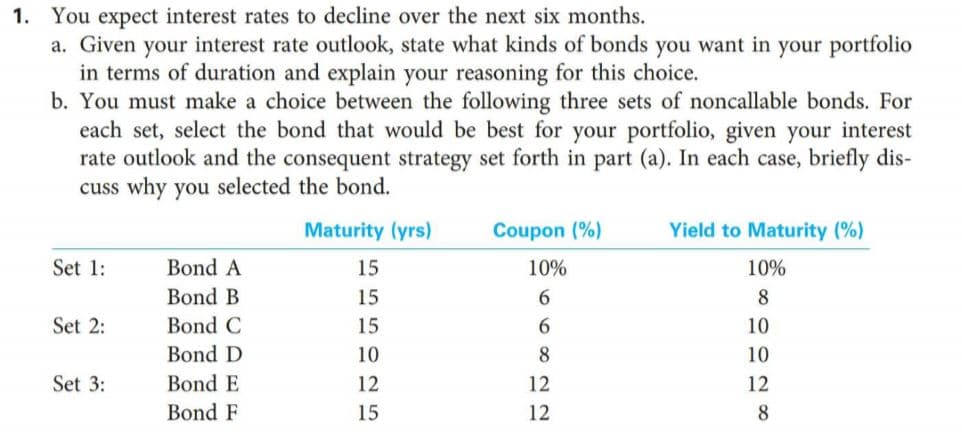

1. You expect interest rates to decline over the next six months. a. Given your interest rate outlook, state what kinds of bonds you want in your portfolio in terms of duration and explain your reasoning for this choice. b. You must make a choice between the following three sets of noncallable bonds. For each set, select the bond that would be best for your portfolio, given your interest rate outlook and the consequent strategy set forth in part (a). In each case, briefly dis- cuss why you selected the bond. Yield to Maturity (%) Maturity (yrs) Coupon (%) Bond A Set 1: 15 10% 10% Bond B 15 Bond C Set 2: 15 6. 10 Bond D 8. 10 10 Bond E Set 3: 12 12 12 Bond F 15 12

1. You expect interest rates to decline over the next six months. a. Given your interest rate outlook, state what kinds of bonds you want in your portfolio in terms of duration and explain your reasoning for this choice. b. You must make a choice between the following three sets of noncallable bonds. For each set, select the bond that would be best for your portfolio, given your interest rate outlook and the consequent strategy set forth in part (a). In each case, briefly dis- cuss why you selected the bond. Yield to Maturity (%) Maturity (yrs) Coupon (%) Bond A Set 1: 15 10% 10% Bond B 15 Bond C Set 2: 15 6. 10 Bond D 8. 10 10 Bond E Set 3: 12 12 12 Bond F 15 12

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter6: Risk And Return

Section: Chapter Questions

Problem 4MC: What is the stand-alone risk? Use the scenario data to calculate the standard deviation of the bonds...

Related questions

Question

Transcribed Image Text:1. You expect interest rates to decline over the next six months.

a. Given your interest rate outlook, state what kinds of bonds you want in your portfolio

in terms of duration and explain your reasoning for this choice.

b. You must make a choice between the following three sets of noncallable bonds. For

each set, select the bond that would be best for your portfolio, given your interest

rate outlook and the consequent strategy set forth in part (a). In each case, briefly dis-

cuss why you selected the bond.

Yield to Maturity (%)

Maturity (yrs)

Coupon (%)

Bond A

Set 1:

15

10%

10%

Bond B

15

Bond C

Set 2:

15

6.

10

Bond D

8.

10

10

Bond E

Set 3:

12

12

12

Bond F

15

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning