Bond A Bond B 2/15/2012 6/15/2027 8.00% 890.00 $ 1,040.00 1,000.00 Settlement Date 2/15/2012 Maturity Date Coupon Rate 4/15/2016 3.50% Price Face Value 1,000.00 $

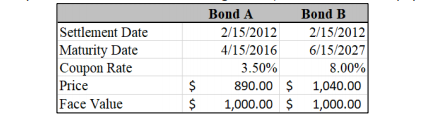

After recently receiving a bonus, you have decided to add some bonds to your investment portfolio. You have narrowed your choice down to the following bonds (assume semiannual payments):

a. Using the PRICE function, calculate the intrinsic value of each bond. Is either bond currently undervalued? How much accrued interest would you have to pay for each bond?

b. Using the YIELD function, calculate the yield to maturity of each bond using the current market prices.

c. Calculate the duration and modified duration of each bond.

d. Which bond would you rather own if you expect market rates to fall by 2% across the maturity spectrum? What if rates will rise by 2%? Why?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images