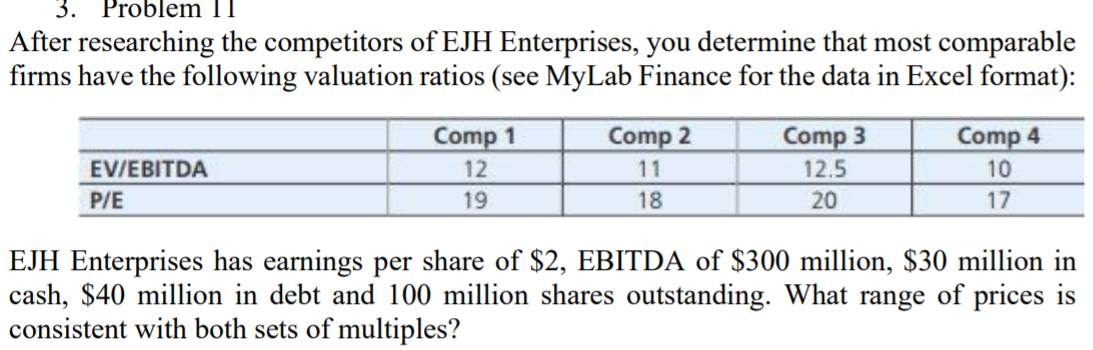

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios (see MyLab Finance for the data in Excel format): Comp 1 Comp 2 Comp 3 Comp 4 EV/EBITDA 12 11 12.5 10 P/E 19 18 20 17 EJH Enterprises has earnings per share of $2, EBITDA of $300 million, $30 million in cash, $40 million in debt and 100 million shares outstanding. What range of prices is consistent with both sets of multiples?

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios (see MyLab Finance for the data in Excel format): Comp 1 Comp 2 Comp 3 Comp 4 EV/EBITDA 12 11 12.5 10 P/E 19 18 20 17 EJH Enterprises has earnings per share of $2, EBITDA of $300 million, $30 million in cash, $40 million in debt and 100 million shares outstanding. What range of prices is consistent with both sets of multiples?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 5RP

Related questions

Question

After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios (see MyLab Finance for the data in Excel format): EJH Enterprises has earnings per share of $2, EBITDA of $300 million, $30 million in cash, $40 million in debt and 100 million shares outstanding. What range of prices is consistent with both sets of multiples?

Transcribed Image Text:3. Problem 11

After researching the competitors of EJH Enterprises, you determine that most comparable

firms have the following valuation ratios (see MyLab Finance for the data in Excel format):

Comp 1

Comp 2

Comp 3

Comp 4

EV/EBITDA

12

11

12.5

10

P/E

19

18

20

17

EJH Enterprises has earnings per share of $2, EBITDA of $300 million, $30 million in

cash, $40 million in debt and 100 million shares outstanding. What range of prices is

consistent with both sets of multiples?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning