Aggressive Corporation approaches Matt Taylor, a loan officer for Oklahoma State Bank, seeking to increase the company’s borrowings with the bank from $100,000 to $150,000. Matt has an uneasy feeling as he examines the loan application from Aggressive Corporation, which just completed its first year of operations. The application included the following financial statements. The income statement submitted with the application shows net income of $30,000 in the first year of operations. Referring to the balance sheet, this net income represents a more-thanacceptable 15% rate of return on assets of $200,000. Matt’s concern stems from his recollection that the $100,000 note payable reported on the balance sheet is a three-year loan from his bank, approved earlier this year. He recalls another promising new company that, just recently, defaulted on its loan due to its inability to generate sufficient cash flows to meet its loan obligations. Seeing Matt’s hesitation, Larry Bling, the CEO of Aggressive Corporation, closes the door to the conference room and shares with Matt that he owns several other businesses. He says he will be looking for a new CFO in another year to run Aggressive Corporation along with his other businesses and Matt is just the kind of guy he is looking for. Larry mentions that as CFO, Matt would receive a significant salary. Matt is flattered and says he will look over the loan application and get back to Larry concerning the $50,000 loan increase by the end of the week. Required: 1. Prepare a statement of cash flows for Aggressive Corporation. 2. Explain how Aggressive Corporation can have positive net income but negative operating cash flows. How does the finding of negative operating cash flows affect your confidence in the reliability of the net income amount? 3. Why do you think Larry mentioned the potential employment position? Should the potential employment position with Aggressive Corporation have any influence on the loan decision?

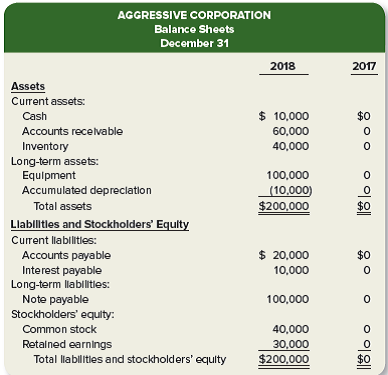

Aggressive Corporation approaches Matt Taylor, a loan officer for Oklahoma State Bank, seeking to increase the company’s borrowings with the bank from $100,000 to $150,000. Matt has an uneasy feeling as he examines the loan application from Aggressive Corporation, which just completed its first year of operations. The application included the following financial statements.

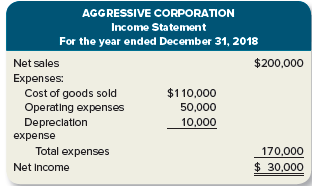

The income statement submitted with the application shows net income of $30,000 in the first year of operations. Referring to the balance sheet, this net income represents a more-thanacceptable 15%

Matt’s concern stems from his recollection that the $100,000 note payable reported on the balance sheet is a three-year loan from his bank, approved earlier this year. He recalls another promising new company that, just recently, defaulted on its loan due to its inability to generate sufficient cash flows to meet its loan obligations.

Seeing Matt’s hesitation, Larry Bling, the CEO of Aggressive Corporation, closes the door to the conference room and shares with Matt that he owns several other businesses. He says he will be looking for a new CFO in another year to run Aggressive Corporation along with his other businesses and Matt is just the kind of guy he is looking for. Larry mentions that as CFO, Matt would receive a significant salary. Matt is flattered and says he will look over the loan application and get back to Larry concerning the $50,000 loan increase by the end of the week.

Required:

1. Prepare a statement of cash flows for Aggressive Corporation.

2. Explain how Aggressive Corporation can have positive net income but negative operating cash flows. How does the finding of negative operating cash flows affect your confidence in the reliability of the net income amount?

3. Why do you think Larry mentioned the potential employment position? Should the potential employment position with Aggressive Corporation have any influence on the loan decision?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images