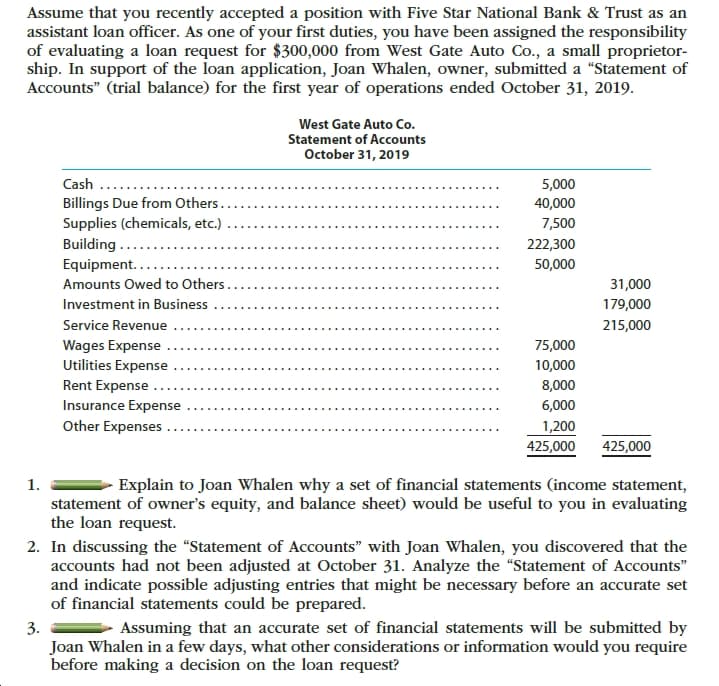

Assume that you recently accepted a position with Five Star National Bank & Trust as an assistant loan officer. As one of your first duties, you have been assigned the responsibility of evaluating a loan request for $300,000 from West Gate Auto Co., a small proprietor- ship. In support of the loan application, Joan Whalen, owner, submitted a "Statement of Accounts" (trial balance) for the first year of operations ended October 31, 2019. West Gate Auto Co. Statement of Accounts October 31, 2019 Cash 5,000 Billings Due from Others. Supplies (chemicals, etc.) Building... 40,000 7,500 222,300 Equipment.. 50,000 Amounts Owed to Others.. 31,000 Investment in Business 179,000 Service Revenue 215,000 Wages Expense 75,000 Utilities Expense 10,000 8,000 Rent Expense . Insurance Expense Other Expenses 6,000 1,200 425,000 425,000 Explain to Joan Whalen why a set of financial statements (income statement, 1. statement of owner's equity, and balance sheet) would be useful to you in evaluating the loan request. 2. In discussing the "Statement of Accounts" with Joan Whalen, you discovered that the accounts had not been adjusted at October 31. Analyze the "Statement of Accounts" and indicate possible adjusting entries that might be necessary before an accurate set of financial statements could be prepared. Assuming that an accurate set of financial statements will be submitted by 3. Joan Whalen in a few days, what other considerations or information would you require before making a decision on the loan request?

Assume that you recently accepted a position with Five Star National Bank & Trust as an assistant loan officer. As one of your first duties, you have been assigned the responsibility of evaluating a loan request for $300,000 from West Gate Auto Co., a small proprietor- ship. In support of the loan application, Joan Whalen, owner, submitted a "Statement of Accounts" (trial balance) for the first year of operations ended October 31, 2019. West Gate Auto Co. Statement of Accounts October 31, 2019 Cash 5,000 Billings Due from Others. Supplies (chemicals, etc.) Building... 40,000 7,500 222,300 Equipment.. 50,000 Amounts Owed to Others.. 31,000 Investment in Business 179,000 Service Revenue 215,000 Wages Expense 75,000 Utilities Expense 10,000 8,000 Rent Expense . Insurance Expense Other Expenses 6,000 1,200 425,000 425,000 Explain to Joan Whalen why a set of financial statements (income statement, 1. statement of owner's equity, and balance sheet) would be useful to you in evaluating the loan request. 2. In discussing the "Statement of Accounts" with Joan Whalen, you discovered that the accounts had not been adjusted at October 31. Analyze the "Statement of Accounts" and indicate possible adjusting entries that might be necessary before an accurate set of financial statements could be prepared. Assuming that an accurate set of financial statements will be submitted by 3. Joan Whalen in a few days, what other considerations or information would you require before making a decision on the loan request?

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 3CP

Related questions

Question

Transcribed Image Text:Assume that you recently accepted a position with Five Star National Bank & Trust as an

assistant loan officer. As one of your first duties, you have been assigned the responsibility

of evaluating a loan request for $300,000 from West Gate Auto Co., a small proprietor-

ship. In support of the loan application, Joan Whalen, owner, submitted a "Statement of

Accounts" (trial balance) for the first year of operations ended October 31, 2019.

West Gate Auto Co.

Statement of Accounts

October 31, 2019

Cash

5,000

Billings Due from Others.

Supplies (chemicals, etc.)

Building...

40,000

7,500

222,300

Equipment..

50,000

Amounts Owed to Others..

31,000

Investment in Business

179,000

Service Revenue

215,000

Wages Expense

75,000

Utilities Expense

10,000

8,000

Rent Expense .

Insurance Expense

Other Expenses

6,000

1,200

425,000

425,000

Explain to Joan Whalen why a set of financial statements (income statement,

1.

statement of owner's equity, and balance sheet) would be useful to you in evaluating

the loan request.

2. In discussing the "Statement of Accounts" with Joan Whalen, you discovered that the

accounts had not been adjusted at October 31. Analyze the "Statement of Accounts"

and indicate possible adjusting entries that might be necessary before an accurate set

of financial statements could be prepared.

Assuming that an accurate set of financial statements will be submitted by

3.

Joan Whalen in a few days, what other considerations or information would you require

before making a decision on the loan request?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT