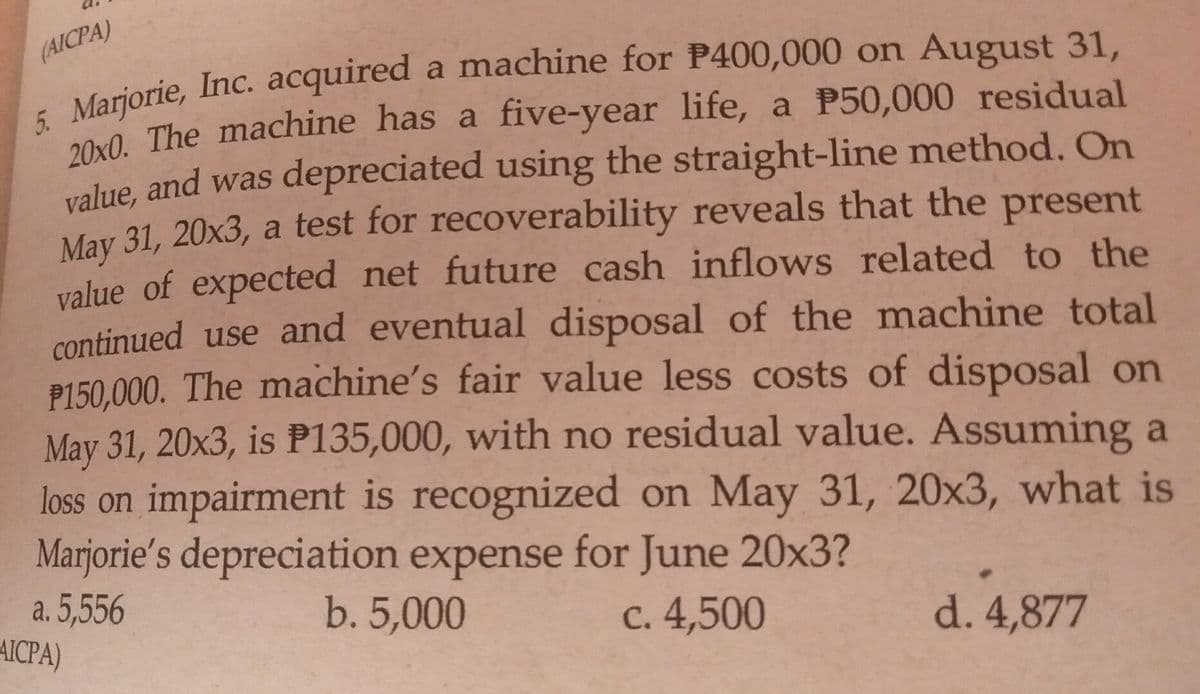

(AICPA) 5. Marjorie, Inc. acquired a machine for P400,000 on August 31, 20x0. The machine has a five-year life, a P50,000 residual value, and was depreciated using the straight-line method. On May 31, 20x3, a test for recoverability reveals that the present value of expected net future cash inflows related to the continued use and eventual disposal of the machine total P150,000. The machine's fair value less costs of disposal on May 31, 20x3, is P135,000, with no residual value. Assuming a loss on impairment is recognized on May 31, 20x3, what is Marjorie's depreciation expense for June 20x3? a. 5,556 AICPA) b. 5,000 C. 4,500 d. 4,877

(AICPA) 5. Marjorie, Inc. acquired a machine for P400,000 on August 31, 20x0. The machine has a five-year life, a P50,000 residual value, and was depreciated using the straight-line method. On May 31, 20x3, a test for recoverability reveals that the present value of expected net future cash inflows related to the continued use and eventual disposal of the machine total P150,000. The machine's fair value less costs of disposal on May 31, 20x3, is P135,000, with no residual value. Assuming a loss on impairment is recognized on May 31, 20x3, what is Marjorie's depreciation expense for June 20x3? a. 5,556 AICPA) b. 5,000 C. 4,500 d. 4,877

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE

Related questions

Question

Transcribed Image Text:(AICPA)

200 The machine has a five-year life, a P50,000 residual

value, and was depreciated using the straight-line method. On

May 31, 20x3, a test for recoverability reveals that the present

value of expected net future cash inflows related to the

continued use and eventual disposal of the machine total

P150,000. The machine's fair value less costs of disposal on

May 31, 20x3, is P135,000, with no residual value. Assuming a

loss on impairment is recognized on May 31, 20x3, what is

Marjorie's depreciation expense for June 20x3?

a. 5,556

AICPA)

b. 5,000

C. 4,500

d. 4,877

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT