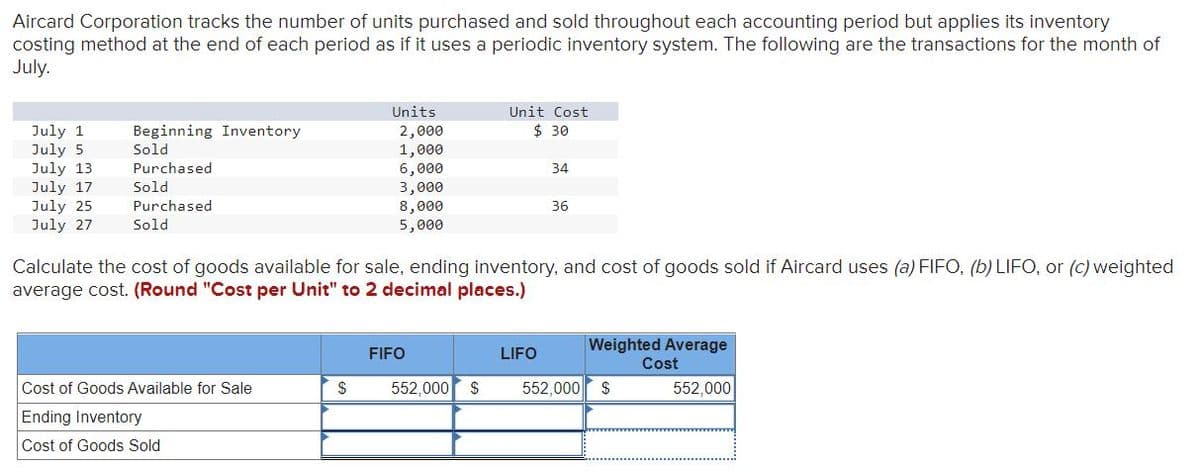

Aircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. The following are the transactions for the month of July. Units Unit Cost $ 30 July 1 July 5 July 13 July 17 July 25 July 27 Beginning Inventory Sold 2,000 1,000 6,000 3,000 8,000 5,000 Purchased 34 Sold Purchased 36 Sold Calculate the cost of goods available for sale, ending inventory, and cost of goods sold if Aircard uses (a) FIFO, (b) LIFO, or (c) weighted average cost. (Round "Cost per Unit" to 2 decimal places.) Weighted Average Cost FIFO LIFO Cost of Goods Available for Sale 552,000 2$ 552,000 S 552,000 Ending Inventory Cost of Goods Sold

Aircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. The following are the transactions for the month of July. Units Unit Cost $ 30 July 1 July 5 July 13 July 17 July 25 July 27 Beginning Inventory Sold 2,000 1,000 6,000 3,000 8,000 5,000 Purchased 34 Sold Purchased 36 Sold Calculate the cost of goods available for sale, ending inventory, and cost of goods sold if Aircard uses (a) FIFO, (b) LIFO, or (c) weighted average cost. (Round "Cost per Unit" to 2 decimal places.) Weighted Average Cost FIFO LIFO Cost of Goods Available for Sale 552,000 2$ 552,000 S 552,000 Ending Inventory Cost of Goods Sold

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 4PB: The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are...

Related questions

Question

Transcribed Image Text:Aircard Corporation tracks the number of units purchased and sold throughout each accounting period but applies its inventory

costing method at the end of each period as if it uses a periodic inventory system. The following are the transactions for the month of

July.

Units

Unit Cost

$ 30

July 1

July 5

July 13

July 17

July 25

July 27

Beginning Inventory

Sold

2,000

1,000

6,000

3,000

8,000

5,000

Purchased

34

Sold

Purchased

36

Sold

Calculate the cost of goods available for sale, ending inventory, and cost of goods sold if Aircard uses (a) FIFO, (b) LIFO, or (c) weighted

average cost. (Round "Cost per Unit" to 2 decimal places.)

Weighted Average

Cost

FIFO

LIFO

Cost of Goods Available for Sale

552,000

$

552,000

$

552,000

Ending Inventory

Cost of Goods Sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,