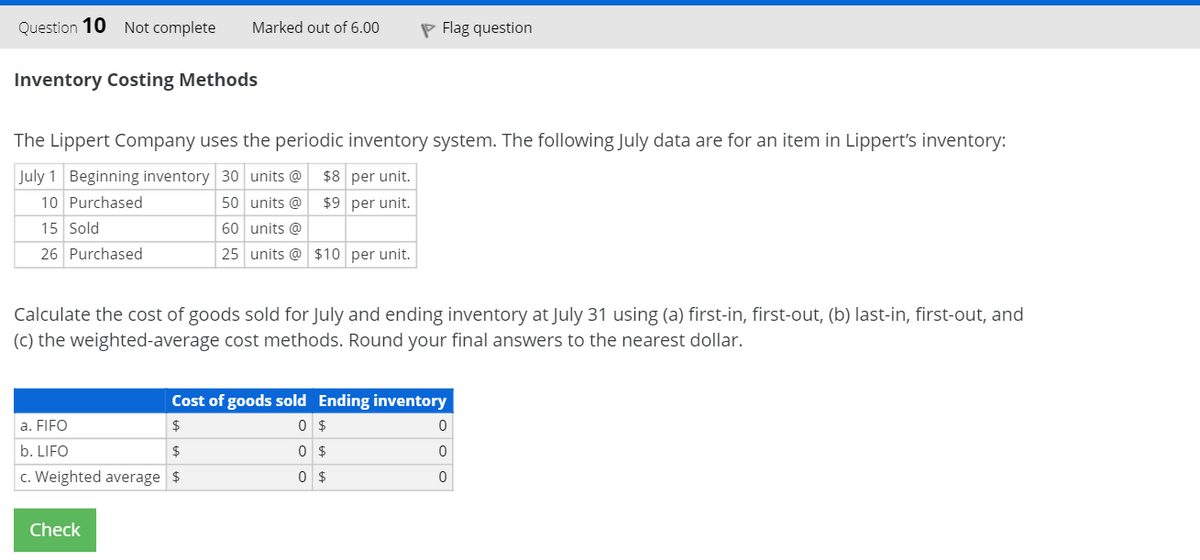

The Lippert Company uses the periodic inventory system. The following July data are for an item in Lippert's inventory: July 1 Beginning inventory 30 units @ $8 per unit. 10 Purchased 50 units @ $9 per unit. 15 Sold 60 units @ 26 Purchased 25 units @ $10 per unit. Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and (C) the weighted-average cost methods. Round your final answers to the nearest dollar. Cost of goods sold Ending inventory 0 $ a. FIFO b. LIFO 24 c. Weighted average $

The Lippert Company uses the periodic inventory system. The following July data are for an item in Lippert's inventory: July 1 Beginning inventory 30 units @ $8 per unit. 10 Purchased 50 units @ $9 per unit. 15 Sold 60 units @ 26 Purchased 25 units @ $10 per unit. Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and (C) the weighted-average cost methods. Round your final answers to the nearest dollar. Cost of goods sold Ending inventory 0 $ a. FIFO b. LIFO 24 c. Weighted average $

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 41BE: ( Appendix 6B) Inventory Costing Methods: Periodic Inventory Systems. Refer to the information for...

Related questions

Topic Video

Question

Transcribed Image Text:Question 10 Not complete

Marked out of 6.00

P Flag question

Inventory Costing Methods

The Lippert Company uses the periodic inventory system. The following July data are for an item in Lippert's inventory:

July 1 Beginning inventory 30 units @

$8 per unit.

10 Purchased

50 units @

$9 per unit.

15 Sold

60 units @

26 Purchased

25 units @ $10 per unit.

Calculate the cost of goods sold for July and ending inventory at July 31 using (a) first-in, first-out, (b) last-in, first-out, and

(c) the weighted-average cost methods. Round your final answers to the nearest dollar.

Cost of goods sold Ending inventory

a. FIFO

$

0 $

b. LIFO

2$

0 $

c. Weighted average $

Check

O o o

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,