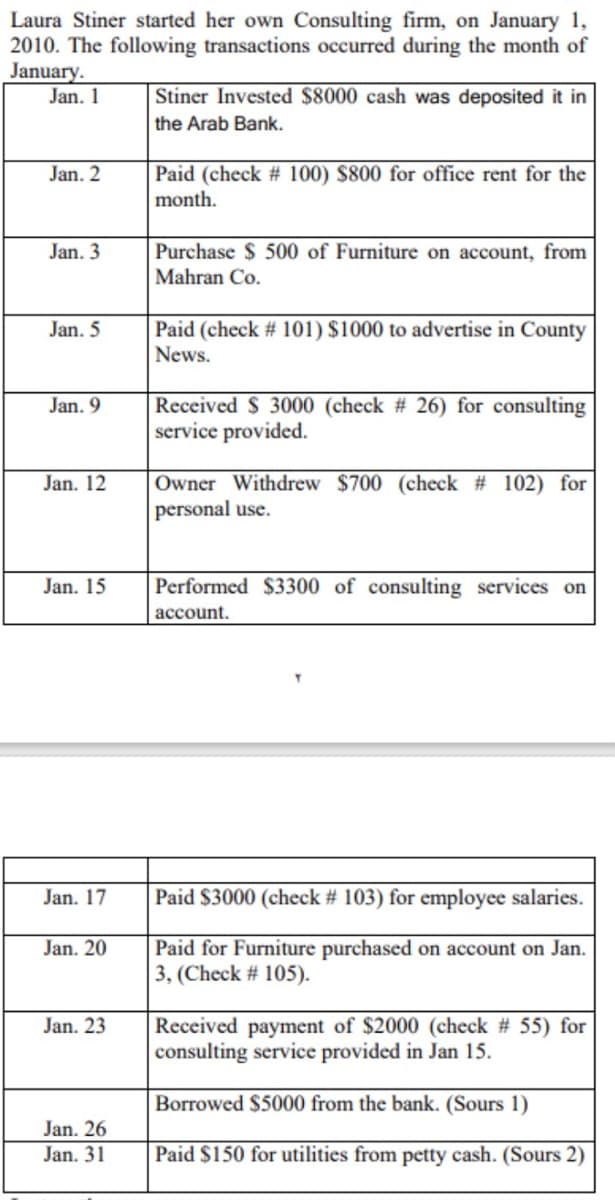

A)Journalize these transactions B)Journalize the adjusting entries. C)Balance sheet. D)Income Statement. F)Trial Balance.

Q: Adjusting entries affect at least one a.revenue and the dividends account b.income statement…

A: Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to…

Q: e adjusted trial balance is prepared a.to determine the net income or loss. b.to verify the…

A: Solution: Trial balance is a supporting statement to financial statements which summarizes the…

Q: Among these, which item is used as the base for preparing unadjusted trial balance? a. General…

A: The correct option is a. General Ledger

Q: Once the adjusting entries are posted, the adjusted trial balance is prepared to verify the correct…

A: Adjusting entries are reported at the year-end to make the necessary adjustment to the required…

Q: 1. What is the Supplies Expense in the adjusted trial balance columns of worksheet? A. Income…

A: Lets understand the meaning of the how adjustment is made for supplies expense for adjusted trail…

Q: what four different types of adjustments are frequently necessary before financial statements are…

A: Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to…

Q: Requirements: 1. Prepare Journal Entries of each transaction. (With explanations) 2. Prepare…

A: Here asked for multi sub part question we will solve first three sub part question. If you need…

Q: 1) A - Describe the nature of the Adjustment process.

A: 1) A) The analysing and evaluating of account at the end of each accounting period. The adjustment…

Q: What is the Unearned service revenue in the adjusted trial balance columns of worksheet?

A: Balance sheet represents the financial position of the company that involve the assets, liabilities,…

Q: A. Analyze business transactions. B. Journalize the transactions. C. Post to ledger accounts. D.…

A: Introduction: Accounting: Accounting is an art of recording , classifying , summarizing and…

Q: he recording of adjusting entries is supported by the a.accuracy concept. b.matching principle.…

A: Solution: Adjusting entries are those entries which are made to match the revenues and expenses to…

Q: Adjusting entries are made to ensure that:

A: Adjusting entries are made inorder to comply with accrual basis of accounting Under Accrual basis…

Q: Which is the correct order of the following steps in the accounting cycle? Group of answer choices…

A: The accounting cycle start with journal entry , ledger , unadjusted trial balance, adjusting entries…

Q: When preparing a worksheet, real accounts in the a trial balance are extended to the a. Balance…

A: Solution: Real accounts are those accounts which are related to the material assets and liabilities…

Q: What is the difference between the Trial balance and the post-closing trial balance? 2-What is…

A: Post-closing trial balance: A post-closing trial balance is a listing of all balance sheet accounts…

Q: What is the Income statement, statement of owners oquityAdjusted Trial Balance

A: Income Statement is a profit or loss account to the entity, it is one of financial statements that…

Q: A. Analyze business transactions. B. Journalize the transactions. C. Post to ledger accounts. D.…

A: SOLUTION ACCOUNTING CYCLE IS A COLLECTIVE PROCESS IDENTIFYING ,ANALYSING AND RECORDING THE…

Q: If the effect of the credit portion of an adjusting entry is to increase the balance of a revenue…

A: Adjusting entries are those entries which are passed to reflect the given adjustments.

Q: The adjusting entry for accrued revenues includes O a. debit to an asset account. O b. credit to an…

A: Introduction: A general ledger entry made at the end of an accounting period to record any…

Q: Fill in the blank associated with each adjusting entry: a. Prepaid expense: Debit Supplies Expense;…

A: a. Prepaid expense: Debit Supplies Expense; credit Suppliesb. Deferred revenue: Debit deferred…

Q: The following contains the various steps of the financial reporting process. Place these steps in…

A:

Q: An adjusted trial balance a. Lists all accounts and their balances at a particular date after…

A: Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their…

Q: The adjusting entry for accrued expenses includes O a. a debit to an expense account.

A: First of all we have to understand the concept of accrued expenses, Accrued expenses are the…

Q: Number in their proper order the following steps in the accounting cycle. a. Prepare a trial…

A: Answer The accounting cycle is a process which begins with analyzing the documents, after analyzing…

Q: Which is a logical order in the accounting cycle? A. Posting, financial statements and unadjusted…

A: Accounting is primarily concerned with identifying, recording, measuring, summarizing transactions…

Q: Directions: Give the account to be credited to complete the uncompleted adjusting entries: Accounts…

A: The adjusting journal entries are prepared by the corporation at the end of each accounting period.…

Q: Of the following steps of the accounting cycle, which step should be completed last? a.Transactions…

A: Steps in the accounting cycle: Accounting cycle is the series of steps of accounting process which…

Q: Income statement presents a) The revenues generated ,and the expenses paid during an accounting…

A: The income statement represents the net income or loss of the company that is calculated by…

Q: 1. The adjusting entry to recognize an expense that has been incurred but not yet paid involves a…

A: Since you have asked multiple questions, we will solve the first question for you . If you want any…

Q: The primary source used in the preparation of the financial statements is the: a. Adjusted trial…

A: Answer Adjusted trial balance is The primary source used in the preparation of the financial…

Q: Adjusting entries always include A. Only income statement account B. B At least one income statement…

A: Income statement: It is one of the financial statements prepared by an organization. This statement…

Q: Explain What is an adjusting entry? Write different (four) adjusting entries Converting assets to…

A: Accounting is a system in which all the financial transactions of a business is recorded. The…

Q: Which of the following is true of an adjusting entry? a.It consists of an income statement account…

A: Adjusting entries are made in order to adjust the adjustment to the accounts. Adjusting entries are…

Q: Typically an adjusting entry will include * ?which of the following Two Balance Sheet Accounts O Two…

A: Adjusting entries are entries to changes the journal entry which were already recorded.

Q: Which of the statements below is not true? O An adjusted trial balance can be used to prepare…

A: An adjusted trial balance is an internal document that summarizes the ending balances in all…

Q: Which of the following accounts are debited to record increases? A. assets and liabilities…

A: T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this…

Q: Which of the following statements is true of a trial balance? O A. A trial balance is the first step…

A: Trial balance means the statement prepared from ledger account where all debit and credit balance…

Q: The spreadsheet is O a. used to aid in preparing financial statements. O b. used to determine net…

A: Spreadsheet is generally used to prepare the financial statements. it is done after recording…

Q: After transaction information has been recorded in the journal, it is transferred to the Select…

A: The accounting cycle is often defined as a collective process consisting of determining, analyzing,…

Q: If the effect of the credit portion of an adjusting entry is to increase the balance of a liability…

A: Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to…

Q: The trial balance of Beowulfwhich may require adjustment. Company includes the following balance…

A: Adjusting entries are those entries which are passed at the end of the period in order to accurately…

Q: The individual accounts find a place in a summarised manner which is called a. Financial statements…

A: Answers

Q: Which of the following comes first in worksheet preparation? A. Compute profit or loss as the…

A: Worksheet helpful in evaluating weather the accounting entries are posted correctly in their…

Q: The adjusted trial balance is prepared

A: The adjusted trial balance are prepared after all the adjusting entries are posted. This in turn…

Q: Use the following to describe the order of the steps in the Accounting Cycle. Prompts Submitted…

A: Answer:- Accounting cycle meaning:- Accounting cycle is basically a process which is designed to…

Q: "How does adjusting entries affect the six main categories of accounting? Think about what accruals…

A: Adjusting entries: An adjusting entry is a journal entry prepared by an organization at the end…

Q: Which among the following is considered as the book of original entry? a. Trial Balance b. Balance…

A: Book of original entry means where the transaction is recorded at first at the time of it happened.…

Q: A trial balance can best be explained as a list of a. The income statement accounts used to…

A: Trial Balance:- It is a statement that consists of debit and credit sides and closing balances of…

Q: Which of the following statements about an adjusted trial balance is correct? A. It is used to…

A: Adjusted trial balance is a list of ledgers after passing adjustment entries such as depreciation,…

Step by step

Solved in 4 steps with 2 images

- B. Kelso established Computer Wizards during November of this year. The accountant prepared the following chart of accounts: The following transactions occurred during the month: a. Kelso deposited 45,000 in a bank account in the name of the business. b. Paid the rent for the current month, 1,800, Ck. No. 2001. c. Bought office desks and filing cabinets for cash, 790, Ck. No. 2002. d. Bought a computer and printer from Cyber Center for use in the business, 2,700, paying 1,700 in cash and placing the balance on account, Ck. No. 2003. e. Bought a neon sign on account from Signage Co., 1,350. f. Kelso invested her personal computer software with a fair market value of 600 in the business. g. Received a bill from Country News for newspaper advertising, 365. h. Sold services for cash, 1,245. i. Received and paid the electric bill, 345, Ck. No. 2004. j. Paid on account to Country News, a creditor, 285, Ck. No. 2005. k. Sold services for cash, 1,450. l. Paid wages to an employee, 925, Ck. No. 2006. m. Received and paid the bill for the city business license, 75, Ck. No. 2007. n. Kelso withdrew cash for personal use, 850, Ck. No. 2008. o. Kelso withdrew cash for personal use, 850, Ck. No. 2008. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance, with a three-line heading, dated November 30, 20--.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On July 1, K. Resser opened Ressers Business Services. Ressers accountant listed the following chart of accounts: The following transactions were completed during July: a. Resser deposited 25,000 in a bank account in the name of the business. b. Bought tables and chairs for cash, 725, Ck. No. 1200. c. Paid the rent for the current month, 1,750, Ck. No. 1201. d. Bought computers and copy machines from Ferber Equipment, 15,700, paying 4,000 in cash and placing the balance on account, Ck. No. 1202. e. Bought supplies on account from Wigginss Distributors, 535. f. Sold services for cash, 1,742. g. Bought insurance for one year, 1,375, Ck. No. 1203. h. Paid on account to Ferber Equipment, 700, Ck. No. 1204. i. Received and paid the electric bill, 438, Ck. No. 1205. j. Paid on account to Wigginss Distributors, 315, Ck. No. 1206. k. Sold services to customers for cash for the second half of the month, 820. l. Received and paid the bill for the business license, 75, Ck. No. 1207. m. Paid wages to an employee, 1,200, Ck. No. 1208. n. Resser withdrew cash for personal use, 700, Ck. No. 1209. Required 1. Record the owners name in the Capital and Drawing T accounts. 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts. 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 4. Foot the T accounts and show the balances. 5. Prepare a trial balance as of July 31, 20--. 6. Prepare an income statement for July 31, 20--. 7. Prepare a statement of owners equity for July 31, 20--. 8. Prepare a balance sheet as of July 31, 20--. LO 1, 2, 3, 4, 5, 6In October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015. c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account e. Bought Insurance for the truck for the yean 1,400, Ck. No. 2016. f. Sold services on account 5,000. g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050. i. Received and paid the bill for utilities, 150, Ck. No. 2017. j. Received a bill for gas and oil for the truck. 80. k. Paid wages to the employees, 1,400, Ck Nos. 20182020. l. Sold services for cash for the remainder of the month, 4,200. m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction.

- P. Schwartz, Attorney at Law, opened his office on October 1. The account headings are presented below. Transactions completed during the month follow. a. Schwartz deposited 25,000 in a bank account in the name of the business. b. Bought office equipment on account from QuipCo, 9,670. c. Schwartz invested his personal law library, which cost 2,800. d. Paid the office rent for the month, 1,700, Ck. No. 2000. e. Bought office supplies for cash, 418, Ck. No. 2001. f. Bought insurance for two years, 944, Ck. No. 2002. g. Sold legal services for cash, 8,518. h. Paid the salary of the part-time receptionist, 1,820, Ck. No. 2003. i. Received and paid the telephone bill, 388, Ck. No. 2004. j. Received and paid the bill for utilities, 368, Ck. No. 2005. k. Sold legal services for cash, 9,260. l. Paid on account to QuipCo, 2,670, Ck. No. 2006. m. Schwartz withdrew cash for personal use, 2,500, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.During December of this year, G. Elden established Ginnys Gym. The following asset, liability, and owners equity accounts are included in the chart of accounts: During December, the following transactions occurred: a. Elden deposited 35,000 in a bank account in the name of the business. b. Bought exercise equipment for cash, 8,150, Ck. No. 1001. c. Bought advertising on account from Hazel Company, 105. d. Bought a display rack on account from Cyber Core, 790. e. Bought office equipment on account from Office Aids, 185. f. Elden invested her exercise equipment with a fair market value of 1,200 in the business. g. Made a payment to Cyber Core, 200, Ck. No. 1002. h. Sold services for the month of December for cash, 800. Required 1. Write the account classifications (Assets, Liabilities, Capital, Drawing, Revenue, Expense) in the fundamental accounting equation, as well as the plus and minus signs and Debit and Credit. 2. Write the account names on the T accounts under the classifications, place the plus and minus signs for each T account, and label the debit and credit sides of the T accounts 3. Record the amounts in the proper positions in the T accounts. Write the letter next to each entry to identify the transaction. 4. Foot and balance the accounts.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001. c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. f. Sold professional services for cash, 3,482. g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005. i. Paid the salary of the assistant, 1,050, Ck. No. 1006. j. Sold professional services for cash, 3,295. k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On June 1 of this year, J. Larkin, Optometrist, established the Larkin Eye Clinic. The clinics account names are presented below. Transactions completed during the month follow. a. Larkin deposited 25,000 in a bank account in the name of the business. b. Paid the office rent for the month, 950, Ck. No. 1001 (Rent Expense). c. Bought supplies for cash, 357, Ck. No. 1002. d. Bought office equipment on account from NYC Office Equipment Store, 8,956. e. Bought a computer from Wardens Office Outfitters, 1,636, paying 750 in cash and placing the balance on account, Ck. No. 1003. f. Sold professional services for cash, 3,482 (Professional Fees). g. Paid on account to Wardens Office Outfitters, 886, Ck. No. 1004. h. Received and paid the bill for utilities, 382, Ck. No. 1005 (Utilities Expense). i. Paid the salary of the assistant, 1,050, Ck. No. 1006 (Salary Expense). j. Sold professional services for cash, 3,295 (Professional Fees). k. Larkin withdrew cash for personal use, 1,250, Ck. No. 1007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001. c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600. g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005. i. Paid the salary of the assistant, 1,150, Ck. No. 2006. j. Sold professional services for cash, 3,868. k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.