Akron, Inc., owns all outstanding stock of Toledo Corporation. Amortization expense of $15,000 per year for patented technology resulted from the original acquisition. For 2021, the companies had the following account balances: Akron Toledo Sales $ 1,100,000 $ 600,000 Cost of goods sold 500,000 400,000 Operating expenses 400,000 220,000 Investment income Not given 0 Dividends declared 80,000 30,000 Intra-entity sales of $320,000 occurred during 2020 and again in 2021. This merchandise cost $240,000 each year. Of the total transfers, $70,000 was still held on December 31, 2020, with $50,000 unsold on December 31, 2021. Prepare a consolidated income statement for the year ending December 31, 2021.

Akron, Inc., owns all outstanding stock of Toledo Corporation. Amortization expense of $15,000 per year for patented technology resulted from the original acquisition. For 2021, the companies had the following account balances: Akron Toledo Sales $ 1,100,000 $ 600,000 Cost of goods sold 500,000 400,000 Operating expenses 400,000 220,000 Investment income Not given 0 Dividends declared 80,000 30,000 Intra-entity sales of $320,000 occurred during 2020 and again in 2021. This merchandise cost $240,000 each year. Of the total transfers, $70,000 was still held on December 31, 2020, with $50,000 unsold on December 31, 2021. Prepare a consolidated income statement for the year ending December 31, 2021.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 98.3C

Related questions

Question

Akron, Inc., owns all outstanding stock of Toledo Corporation. Amortization expense of $15,000 per year for patented technology resulted from the original acquisition. For 2021, the companies had the following account balances:

| Akron | Toledo | |||||

| Sales | $ | 1,100,000 | $ | 600,000 | ||

| Cost of goods sold | 500,000 | 400,000 | ||||

| Operating expenses | 400,000 | 220,000 | ||||

| Investment income | Not given | 0 | ||||

| Dividends declared | 80,000 | 30,000 | ||||

Intra-entity sales of $320,000 occurred during 2020 and again in 2021. This merchandise cost $240,000 each year. Of the total transfers, $70,000 was still held on December 31, 2020, with $50,000 unsold on December 31, 2021.

- Prepare a consolidated income statement for the year ending December 31, 2021.

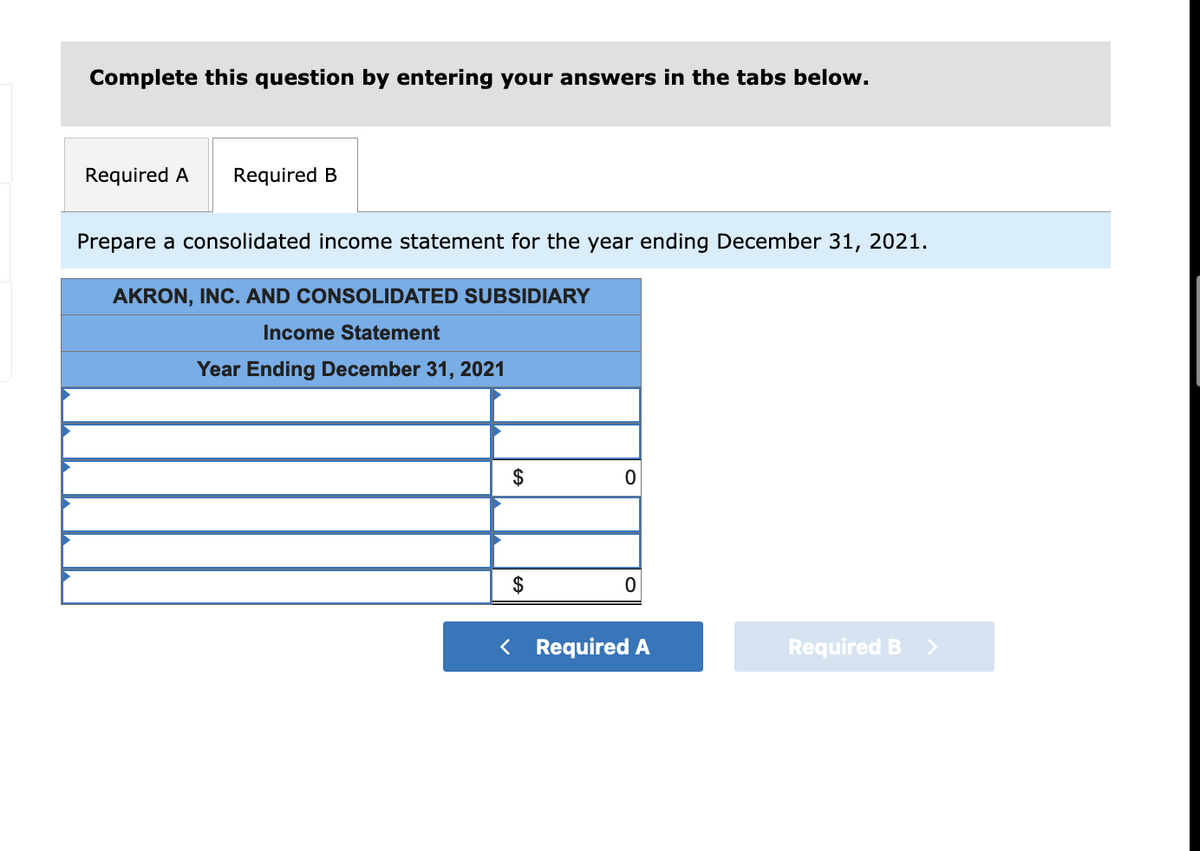

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare a consolidated income statement for the year ending December 31, 2021.

AKRON, INC. AND CONSOLIDATED SUBSIDIARY

Income Statement

Year Ending December 31, 2021

2$

$

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning