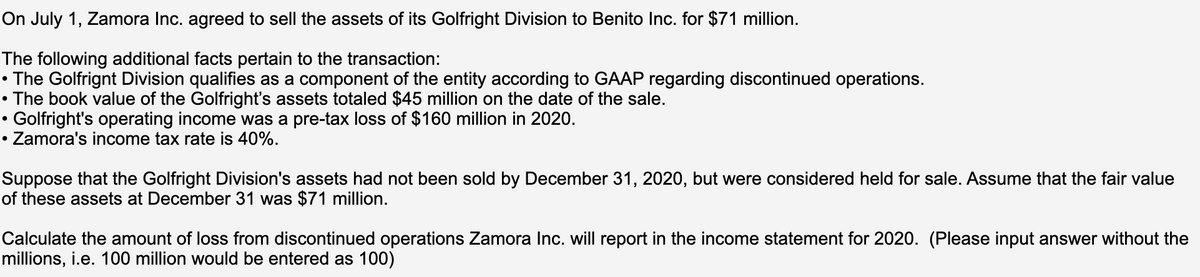

On July 1, Zamora Inc. agreed to sell the assets of its Golfright Division to Benito Inc. for $71 million. The following additional facts pertain to the transaction: • The Golfrignt Division qualifies as a component of the entity according to GAAP regarding discontinued operations. • The book value of the Golfright's assets totaled $45 million on the date of the sale. • Golfright's operating income was a pre-tax loss of $160 million in 2020. • Zamora's income tax rate is 40%. Suppose that the Golfright Division's assets had not been sold by December 31, 2020, but were considered held for sale. Assume that the fair value of these assets at December 31 was $71 million. Calculate the amount of loss from discontinued operations Zamora Inc. will report in the income statement for 2020. (Please input answer without the millions, i.e. 100 million would be entered as 100)

On July 1, Zamora Inc. agreed to sell the assets of its Golfright Division to Benito Inc. for $71 million. The following additional facts pertain to the transaction: • The Golfrignt Division qualifies as a component of the entity according to GAAP regarding discontinued operations. • The book value of the Golfright's assets totaled $45 million on the date of the sale. • Golfright's operating income was a pre-tax loss of $160 million in 2020. • Zamora's income tax rate is 40%. Suppose that the Golfright Division's assets had not been sold by December 31, 2020, but were considered held for sale. Assume that the fair value of these assets at December 31 was $71 million. Calculate the amount of loss from discontinued operations Zamora Inc. will report in the income statement for 2020. (Please input answer without the millions, i.e. 100 million would be entered as 100)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:On July 1, Zamora Inc. agreed to sell the assets of its Golfright Division to Benito Inc. for $71 million.

The following additional facts pertain to the transaction:

• The Golfrignt Division qualifies as a component of the entity according to GAAP regarding discontinued operations.

• The book value of the Golfright's assets totaled $45 million on the date of the sale.

Golfright's operating income was a pre-tax loss of $160 million in 2020.

• Zamora's income tax rate is 40%.

Suppose that the Golfright Division's assets had not been sold by December 31, 2020, but were considered held for sale. Assume that the fair value

of these assets at December 31 was $71 million.

Calculate the amount of loss from discontinued operations Zamora Inc. will report in the income statement for 2020. (Please input answer without the

millions, i.e. 100 million would be entered as 100)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning