al account balances of the partners in ABC Partnership on June 30, 20x1 before any necessary adjustments are as follows: Capital accounts A, Capital (20%) B, Capital (30%) C, Capital (50%)

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

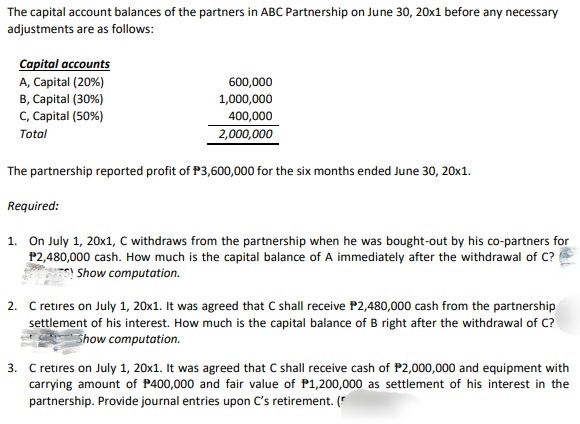

The capital account balances of the partners in ABC Partnership on June 30, 20x1 before any necessary

adjustments are as follows:

Capital accounts

A, Capital (20%)

B, Capital (30%)

C, Capital (50%)

Total

600,000

1,000,000

400,000

2,000,000

The partnership reported profit of P3,600,000 for the six months ended June 30, 20x1.

Required:

1. On July 1, 20x1, C withdraws from the partnership when he was bought-out by his co-partners for

P2,480,000 cash. How much is the capital balance of A immediately after the withdrawal of C? Show computation.

2. Cretires on July 1, 20x1. It was agreed that C shall receive P2,480,000 cash from the partnership in

settlement of his interest. How much is the capital balance of B right after the withdrawal of C? Show computation.

3. Cretires on July 1, 20x1. It was agreed that C shall receive cash of P2,000,000 and equipment with

carrying amount of P400,000 and fair value of P1,200,000 as settlement of his interest in the

partnership. Provide

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images