alance at beginning of year let income (loss) eductions: Stock dividend (34,900 shares) Common shares retired (110,000 shares) Common stock cash dividends alance at end of year 2021 2020 2019 $ 6,794,292 $5,464,052 $ 5,624,552 3,308,700 2,240,900 (160, 500) 242,000 212,660 889,950 698,000 $ 8,971,042 $ 6,794,292 $ 5,464,052 December 31, 2018, common shares consisted of the following: Common stock, 1,855,000 shares at $1 par aid-in capital-excess of par $1,855,000 7,420,000 0

alance at beginning of year let income (loss) eductions: Stock dividend (34,900 shares) Common shares retired (110,000 shares) Common stock cash dividends alance at end of year 2021 2020 2019 $ 6,794,292 $5,464,052 $ 5,624,552 3,308,700 2,240,900 (160, 500) 242,000 212,660 889,950 698,000 $ 8,971,042 $ 6,794,292 $ 5,464,052 December 31, 2018, common shares consisted of the following: Common stock, 1,855,000 shares at $1 par aid-in capital-excess of par $1,855,000 7,420,000 0

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 19E: Lyon Company shows the following condensed income statement information for the year ended December...

Related questions

Question

I need help with these please.

A. Record transfer of net loss to

B. Record transfer of net income to retained earnings.

C. Record repurchase of shares for retirement.

D. Record declaration of cash dividend.

E. Record payment of cash dividend.

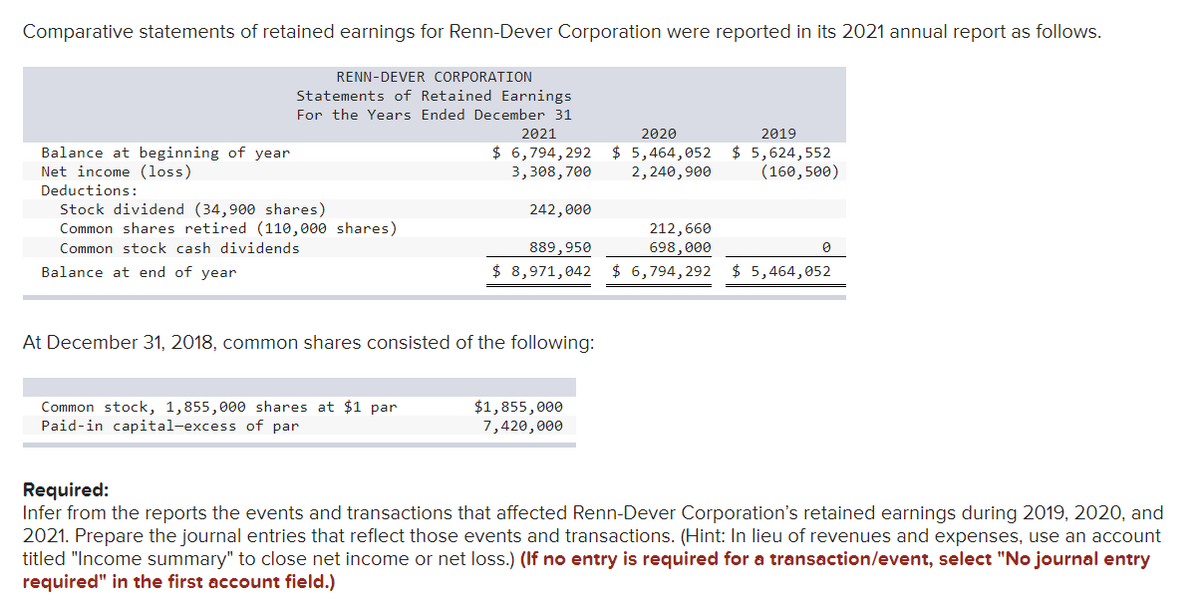

Transcribed Image Text:Comparative statements of retained earnings for Renn-Dever Corporation were reported in its 2021 annual report as follows.

RENN-DEVER CORPORATION

Statements of Retained Earnings

For the Years Ended December 31

2021

$ 6,794,292

3,308, 700

Balance at beginning of year

Net income (loss)

Deductions:

Stock dividend (34,900 shares)

Common shares retired (110,000 shares)

Common stock cash dividends

Balance at end of year

At December 31, 2018, common shares consisted of the following:

Common stock, 1,855,000 shares at $1 par

Paid-in capital-excess of par

2020

$5,464,052

2,240,900

242,000

212,660

698,000

889,950

$ 8,971,042 $ 6,794,292 $ 5,464,052

$1,855,000

7,420,000

2019

$ 5,624,552

(160,500)

0

Required:

Infer from the reports the events and transactions that affected Renn-Dever Corporation's retained earnings during 2019, 2020, and

2021. Prepare the journal entries that reflect those events and transactions. (Hint: In lieu of revenues and expenses, use an account

titled "Income summary" to close net income or net loss.) (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,