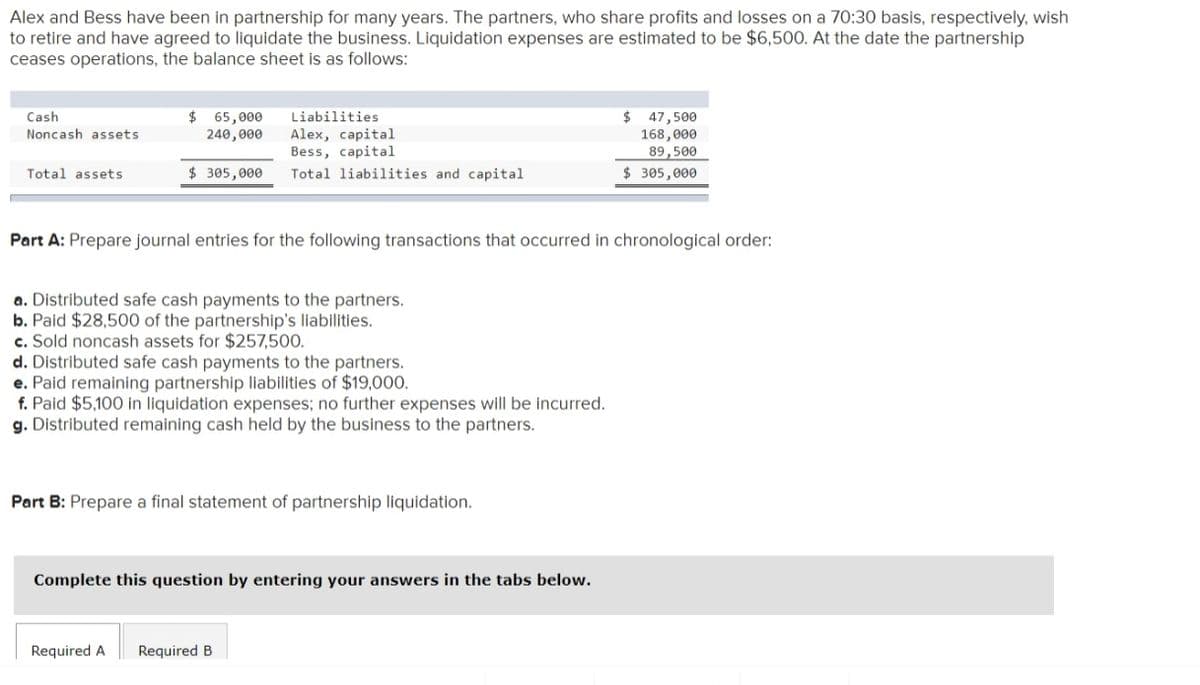

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: $ 47,500 168,000 89,500 $ 305,000 Cash Noncash assets $ 65,000 240,000 Liabilities Alex, capital Bess, capital Total assets $ 305,000 Total liabilities and capital Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final statement of partnership liquidation.

Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership ceases operations, the balance sheet is as follows: $ 47,500 168,000 89,500 $ 305,000 Cash Noncash assets $ 65,000 240,000 Liabilities Alex, capital Bess, capital Total assets $ 305,000 Total liabilities and capital Part A: Prepare journal entries for the following transactions that occurred in chronological order: a. Distributed safe cash payments to the partners. b. Paid $28,500 of the partnership's liabilities. c. Sold noncash assets for $257,500. d. Distributed safe cash payments to the partners. e. Paid remaining partnership liabilities of $19,000. f. Paid $5,100 in liquidation expenses; no further expenses will be incurred. g. Distributed remaining cash held by the business to the partners. Part B: Prepare a final statement of partnership liquidation.

Chapter21: Partnerships

Section: Chapter Questions

Problem 11BCRQ

Related questions

Question

Transcribed Image Text:Alex and Bess have been in partnership for many years. The partners, who share profits and losses on a 70:30 basis, respectively, wish

to retire and have agreed to liquidate the business. Liquidation expenses are estimated to be $6,500. At the date the partnership

ceases operations, the balance sheet is as follows:

$ 65,000

240,000

$ 47,500

168,000

89,500

Cash

Liabilities

Noncash assets

Alex, capital

Bess, capital

Total liabilities and capital

Total assets

$ 305,000

$ 305,000

Part A: Prepare journal entries for the following transactions that occurred in chronological order:

a. Distributed safe cash payments to the partners.

b. Paid $28,500 of the partnership's liabilities.

c. Sold noncash assets for $257,500.

d. Distributed safe cash payments to the partners.

e. Paid remaining partnership liabilities of $19,000.

f. Paid $5,100 in liquidation expenses; no further expenses will be incurred.

g. Distributed remaining cash held by the business to the partners.

Part B: Prepare a final statement of partnership liquidation.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning