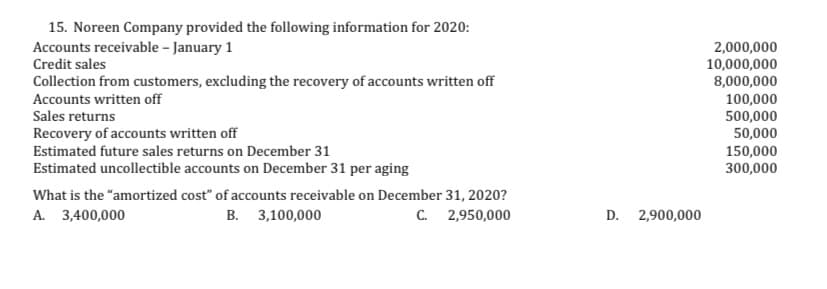

15. Noreen Company provided the following information for 2020: Accounts receivable - January 1 Credit sales 2,000,000 10,000,000 8,000,000 100,000 500,000 50,000 150,000 300,000 Collection from customers, excluding the recovery of accounts written off Accounts written off Sales returns Recovery of accounts written off Estimated future sales returns on December 31 Estimated uncollectible accounts on December 31 per aging What is the "amortized cost" of accounts receivable on December 31, 2020? A. 3,400,000 B. 3,100,000 C. 2,950,000 D. 2,900,000

15. Noreen Company provided the following information for 2020: Accounts receivable - January 1 Credit sales 2,000,000 10,000,000 8,000,000 100,000 500,000 50,000 150,000 300,000 Collection from customers, excluding the recovery of accounts written off Accounts written off Sales returns Recovery of accounts written off Estimated future sales returns on December 31 Estimated uncollectible accounts on December 31 per aging What is the "amortized cost" of accounts receivable on December 31, 2020? A. 3,400,000 B. 3,100,000 C. 2,950,000 D. 2,900,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Question

16. Int

Transcribed Image Text:15. Noreen Company provided the following information for 2020:

Accounts receivable – January 1

Credit sales

2,000,000

10,000,000

8,000,000

100,000

Collection from customers, excluding the recovery of accounts written off

Accounts written off

Sales returns

500,000

Recovery of accounts written off

Estimated future sales returns on December 31

50,000

150,000

300,000

Estimated uncollectible accounts on December 31 per aging

What is the "amortized cost" of accounts receivable on December 31, 2020?

А. 3,400,000

В. 3,100,000

C. 2,950,000

D. 2,900,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning