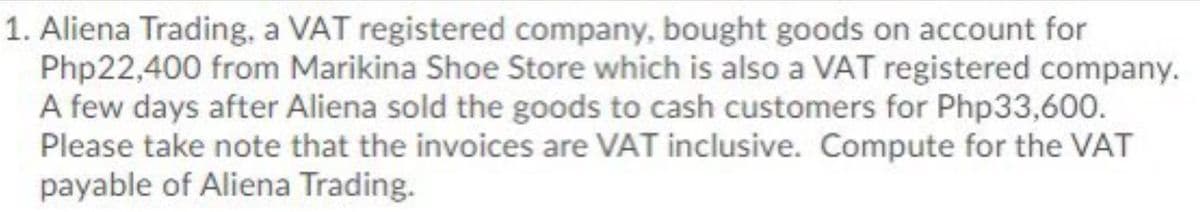

Aliena Trading, a VAT registered company, bought goods on account for Php22,400 from Marikina Shoe Store which is also a VAT registered company. A few days after Aliena sold the goods to cash customers for Php33,600. Please take note that the invoices are VAT inclusive. Compute for the VAT payable of Aliena Trading.

Q: Chocolairs Food Enterprise is a cookie manufacturer in Selangor. The following information was…

A: Trade discount do not appears in books. Amount is recorded after deducting trade discount. May 2:…

Q: The following were selected from among the transactions completed by Caldemeyer Co. during the…

A: Note: As the Chart of Account is not provided, the generally used account titles are used for…

Q: Lynne’s Furniture Store had $350,000 in receivables and factored them to Marvin’s Finance Co. on…

A: Total amount received = Accounts receivable x % paid = $350,000 x 90% = $315,000

Q: On June 1, Compassion Company sold merchandise with a list price of P 1,000,000 to a customer. The…

A: Trade discount:- A trade discount is referred as the discount amount through which the manufacturer…

Q: Presented below is the following information related to GOYGOY D. Co. On April 5, purchased…

A: Journal is the recording of financial transactions using the dual entity concept in chronological…

Q: Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account, $55,000, terms…

A: Journal: It is the systematic record of a financial transactions of a business recorded in a…

Q: JKL Co. Operates a number of branches in Baguio. On June 30, 2021. its XYZ branch showed a Home…

A: Net Income:- Net Income is defined as those income which shows the net earnings of a particular…

Q: The following transactions were selected from among those completed by Hailey Retailers in the…

A: Journal entries are entries recorded in the books of accounts. Journal entries are recorded from the…

Q: The company is a registered VAT Vendor and use a periodic system The following transactions took…

A: Under the Periodic inventory system of accounting, the inventories are not calculated on daily basis…

Q: JKL Co. Operates a number of branches in Baguio. On June 30, 2021. its XYZ branch showed a Home…

A: Given: A Corporation, operates a number of branches in Metro Manila. On June 30, 2018, its branch…

Q: Joyce's Company received an invoice for $211,250 dated November 4, 2011 with payment terms 7/3,…

A: Invoice amount is $211,250 dated November 4, 2011 payment terms 7/3, 2/20, n/45 which means if…

Q: On February 13, a jewelry store sells an engagement ring with a sales price of $10,000 to a nervous…

A: Solution: Journal entry to record revenue is as under:

Q: On March 1, Showcase Co., a furniture wholesaler, sells merchandise to Balboa Co. on account,…

A: Net Payment made = Inventory Purchased - Inventory returned = $252,510 - $30,380 = $222,130

Q: During the months of January and February, Solitare Corporation sold goods to three customers. The…

A: Discount on Jan. 6 on paymentb received from Wizard Inc. = Amount receivables x rate of discount =…

Q: 2. Below are the transactions for the month of October 2020 of Mrs Rose, a sole trader: Oct 2 Bought…

A: Journal entry: It is also called as book of original entry. It is used to record a financial…

Q: Clayco Company completes the following transactions during the year. July 14 Writes off a $750…

A: 1.

Q: Quarantino Covidap decided to established his own Coviduvidup Hardware Store by investing cash of…

A: Ending inventory = Purchase - purchase return - cost of goods sold =…

Q: a. Furniture & fixtures was purchased on credit for Php50,000. b. Merchandise costing Php202,560 was…

A: Adjusting entries are defined as the changes that are made to the journal entries that have been…

Q: On July 15, Piper Co. sold $10,000 of merchandise (costing $5,000) for cash. The sales tax rate is…

A: Sales Tax Payable: Sales Tax is levied on the sales made. It is collected by the seller from the…

Q: The Liccorish Pizza bought $5,000 worth of merchandise from TechCom and signed a 90-day, 10%…

A: Journal entry is the way of recording transactions whether economic or non economic with their debit…

Q: Record them in the Pats journal and ledger accounts and compile a trail balance.

A: Accounting is the process of recording financial transactions that are material to the business. It…

Q: In performing accounting services for small businesses, you encounter the following situations…

A: Introduction: Journal: Recording of a business transactions in a chronological order. First step in…

Q: On November 3, FN Trading sold merchandise for P200,000 less 10-5 on terms 3/10 2/20 n/30. Two days…

A: Discount - A discount is an amount or percentage that is reduced or subtracted from the actual…

Q: The following transactions were selected from among those completed by Hailey Retailers in the…

A: 1.Credit card fees charged from customer B: $600 *2% = $12 Customer D balance: Sale value of 12…

Q: Huhu Company and Hihi Company engaged in the following transactions during the month of July 2021.…

A: The question is related to the goos sold om credit. The credit policy os 2/10, net 30. It means that…

Q: Paid for advertising for the month of February, P6,000. Sold merchandise for cash, P250,000. Paid…

A: Ledgers - After recording transactions in the journal next step is to transfer them into ledgers.…

Q: Supreme Hardware Store completed the following merchandising transactions in the month of May. At…

A: The process of recording business transactions in the books of accounts for the first time is…

Q: The following transactions relate to Pat’s business for the month of December 2019. 1.12.19 Started…

A: Following are the requisite Journal entries, ledger accounts and Trial balance

Q: On December 1, Macy Company sold merchandise with a selling price of $8,000 on account to Mrs…

A: Account receivable means the debtor from whom we have to collect the payment for sale of the product…

Q: The following transactions were selected from among those completed by Bennett Retailers in November…

A: In the above table, the net sales for the month of november and december has been calculated by…

Q: On May 11, Sharjah Co. accepts delivery of $40,000 of merchandise it purchases for resale from…

A: As the question provides that both the company follow the perpetual inventory system. The following…

Q: Mr. Alejandro Sison is marketing goods and he is subject to the 1% Percentage Tax. He registered his…

A: Trial balance is the balance which checks whether the balance of ledgers has been posted correctly…

Q: On Nov 3, Ali Mercadejas sold merchandise for $180,000 less 15-10 on terms 3/10 2/20 n/30. Two days…

A: Gross sales = sales x (1- trade discount rate) x (1 - trade discount rate) = 180000*(1-0.15)…

Q: Journalize the entries to record the transactions.

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: The company "Z" displays in its accounting records the following costs for the goods purchased to…

A: IAS 2: Inventories: The costs of purchase of inventories comprise the purchase price, import duties…

Q: What is the ending balance of Allowance for Doubtful Accounts at December 31, 2018, after all…

A: Accounts Receivable: An accounts receivable is the money owed by the customers to the business for…

Q: During the month of October 20--, The Pink Petal flower shop engaged in the following transactions:…

A: Journal Entries - Journal Entries are the four column format for recording debit and credit of the…

Q: In August 1, 2012, Mr. Al Fabet put up a trading business, ABC Design Enterprises, with an initial…

A: The journal entries are prepared to record daily transactions of the business.

Q: The following were selected from among the transactions completed by Caldemeyer Co. during the…

A: Journal entry: This is the first step to record accounts. It is written in the same order in which…

Q: DCM Clocks received the following two invoices from its supplier: $25,000 on August 29, 2014 and…

A: 2/10 net 30 means 2% discount will be there if payment is made with in 10 days and no discount after…

Q: ABC Company, located in La Trinidad, Benguet, sold merchandise to Minda, a customer located in La…

A: A cash discount is the fixed percentage of the selling price of goods and services. It is provided…

Q: On May 12, Wilcox Company accepted delivery of $20,000 of merchandise and received an invoice dated…

A: Following are the Journal entries recorded

Q: liwat Company purchases goods for OMR 18,000 from the supplier and makes payment along with VAT, The…

A: VAT is a value added tax lived on goods and services for value added at every stage of production or…

Q: A customer purchased P5,000 of goods on credit

A: The sale revenue is recognized when right to receive payment in respect of the sale is established.

Q: Wildhorse Company sells goods to Danone Inc. by accepting a note receivable on January 2, 2017. The…

A: Transaction on 02.01.17. The credit salees made for $ 569900 with the passt histiry of allowing…

Q: JKL Co. Operates a number of branches in Baguio. On June 30, 2021. its XYZ branch showed a Home…

A: The branch account in the books of the home office shows a debit balance representing the investment…

Q: On 6th August, Tasha purchased goods on credit from Nisha Ltd, with a list price of $3,360, less…

A: The cash balance due to suppliers is calculated after adjustment for purchase returns, and purchase…

VAT = 12%, Philippines is the country

Step by step

Solved in 2 steps

- On January 1, Incredible Infants sold goods to Babies Inc. for $1,540, terms 30 days, and received payment on January 18. Which journal would the company use to record this transaction on the 18th? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalReview the following transactions and prepare any necessary journal entries for Tolbert Enterprises. A. On April 7, Tolbert Enterprises contracts with a supplier to purchase 300 water bottles for their merchandise inventory, on credit, for $10 each. Credit terms are 2/10, n/60 from the invoice date of April 7. B. On April 15, Tolbert pays the amount due in cash to the supplier.Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions take place during the current year: A. On April 5, the company purchases 400 parts for $8.30 per part, on credit. Terms of the purchase are 4/ 10, n/30, invoice dated April 5. B. On May 5, Air Compressors does not pay the amount due and renegotiates with the supplier. The supplier agrees to $400 cash immediately as partial payment on note payable due, converting the debt owed into a short-term note, with a 7% annual interest rate, payable in three months from May 5. C. On August 5, Air Compressors pays its account in full. Record the journal entries to recognize the initial purchase, the conversion plus cash, and the payment.

- The following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.Toby Company had the following sales transactions for March: Mar. 6Sold merchandise on account to Osbourne, Inc., invoice no. 1128, 563.17. 14Sold merchandise on account to Ortiz Company, invoice no. 1129, 823.50. 20Sold merchandise on account to Bailey Corporation, invoice no. 1130, 2,350.98. 24Sold merchandise on account to Shannon Corporation, invoice no. 1131, 1,547.07. Assume that Toby Company had beginning balances on March 1 of 3,569.80 (Sales 411) and 2,450.39 (Accounts Receivable 113). Record the sales of merchandise on account in the sales journal (page 24) and then post to the general ledger.The following transactions were completed by Nelsons Boutique, a retailer, during July. Terms of sales on account are 2/10, n/30, FOB shipping point. July 3Received cash from J. Smith in payment of June 29 invoice of 350, less cash discount. 6Issued Ck. No. 1718, 742.50, to Designer, Inc., for invoice. no. 2256, recorded previously for 750, less cash discount of 7.50. July 9Sold merchandise in the amount of 250 on a credit card. Sales tax on this sale is 6%. The credit card fee the bank deducted for this transaction is 5. 10Issued Ck. No. 1719, 764.40, to Smart Style, Inc., for invoice no. 1825, recorded previously on account for 780. A trade discount of 25% was applied at the time of purchase, and Smart Style, Inc.s credit terms are 2/10, n/30. 12Received 180 cash in payment of June 20 invoice from R. Matthews. No cash discount applied. 18Received 1,575 cash in payment of a 1,500 note receivable and interest of 75. 21Voided Ck. No. 1720 due to error. 25Received and paid utility bill, 152; Ck. No. 1721, payable to City Utilities Company. 31Paid wages recorded previously for the month, 2,586, Ck. No. 1722. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.

- Your company paid rent of $1,000 for the month with check number 1245. Which journal would the company use to record this? A. sales journal B. purchases journal C. cash receipts journal D. cash disbursements journal E. general journalThe following transactions relate to Hawkins, Inc., an office store wholesaler, during June of this year. Terms of sale are 2/10, n/30. The company is located in Los Angeles, California. June 1Sold merchandise on account to Hendrix Office Store, invoice no. 1001, 451.20. The cost of the merchandise was 397.06. 3Bought merchandise on account from Krueger, Inc., invoice no. 845A, 485.15; terms 1/10, n/30; dated June 1; FOB San Diego, freight prepaid and added to the invoice, 15 (total 500.15). 10Sold merchandise on account to Ballard Stores, invoice no. 1002, 2,483.65. The cost of the merchandise was 2,235.29. 13Bought merchandise on account from Kennedy, Inc., invoice no. 4833, 2,450.13; terms 2/10, n/30; dated June 11; FOB San Francisco, freight prepaid and added to the invoice, 123 (total 2,573.13). 18Sold merchandise on account to Lawson Office Store, invoice no. 1003, 754.99. The cost of the merchandise was 671.94. 20Issued credit memo no. 33 to Lawson Office Store for merchandise returned, 103.25. The cost of the merchandise was 91.89. 25Bought merchandise on account from Villarreal, Inc., invoice no. 4R32, 1,552.30; terms net 30; dated June 18; FOB Santa Rosa, freight prepaid and added to the invoice, 84 (total 1,636.30). 30Received credit memo no. 44 for merchandise returned to Villarreal, Inc., for 224.50. Required Record the transaction in the general journal using the perpetual inventory system. If using Working Papers, use pages 25 and 26.Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.

- Review the following transactions and prepare any necessary journal entries. A. On January 5, Bunnet Co. purchases 350 aprons (Supplies) at $25 per apron from a supplier, on credit. Terms of the purchase are 3/10, n/30 from the invoice date of January 5. B. On February 18, Melon Construction receives advance cash payment from a client for construction services in the amount of $20,000. Melon had yet to provide construction services as of February 18. C. On March 21, Noonan Smoothies sells 875 smoothies for $4 cash per smoothie. The sales tax rate is 6.5%. D. On June 7, Organic Methods paid a portion of their noncurrent note in the amount of $9,340 cash.The following transactions relate to Khan, Inc., a sporting goods wholesaler, during November of this year. Terms of sale are 2/10, n/30. The company is located in Denver, Colorado. Nov. 3Sold merchandise on account to Spence Tennis Shop, invoice no. 5420, 2,482.51. The cost of the merchandise was 1,961.18. 5Issued credit memo no. 38 to Spence Tennis Shop for merchandise returned, 287.45. The cost of the merchandise was 227.09. 7Bought merchandise on account from Maldonado Manufacturing, Inc., invoice no. 1548, 3,854.16; terms n/45; dated November 4; FOB Memphis, freight prepaid and added to the invoice, 135 (total 3,989.16). 9Bought merchandise on account from Lozano, Inc., invoice no. 8755, 426.65; terms 1/15, n/30; dated November 5; FOB New York City, freight prepaid and added to the invoice, 67 (total 493.65). 12Received credit memo no. 542 to Lozano, Inc., for merchandise returned, 102.20. 17Sold merchandise on account to Jacks Golfing Shop, invoice no. 5421, 486.35. The cost of the merchandise was 432.85. 23Sold merchandise on account to Yates Sporting Goods, invoice no. 5422, 2,465.99. The cost of the merchandise was 1,972.79. 28Bought merchandise on account from Fields, Inc., invoice no. 4599, 441.29; terms 2/10, n/30; dated November 25; FOB Austin, freight prepaid and added to the invoice, 102 (total 543.29). Required Record the transaction in the general journal using the perpetual inventory system. If using Working Papers, use pages 84 and 85.Bhakti Games is a chain of board game stores. Record entries for the following transactions related to Bhaktis purchase of inventory. A. On October 5, Bhakti purchases and receives inventory from XYZ Entertainment for $5,000 with credit terms of 2/10 net 30. B. On October 7, Bhakti returns $1,000 worth of the inventory purchased from XYZ. C. Bhakti makes payment in full on its purchase from XYZ on October 14.