(ALL OWNERSHIP GOES TO CENGAGE) The following graph gives the labor market for laboratory aides in the imaginary country of Sophos. The equilibrium hourly wage is $10, and the equilibrium number of laboratory aides is 150. Suppose the federal government of Sophos has decided to institute an hourly payroll tax of $4 on laboratory aides and wants to determine whether the tax should be levied on the workers, the employers, or both (in such a way that half the tax is collected from each party). Use the graph input tool to evaluate these three proposals. Entering a number into the Tax Levied on Employers field (initially set at zero dollars per hour) shifts the demand curve down by the amount you enter, and entering a number into the Tax Levied on Workers field (initially set at zero dollars per hour) shifts the supply curve up by the amount you enter. To determine the before-tax wage for each tax proposal, adjust the amount in the Wage field until the quantity of labor supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

(ALL OWNERSHIP GOES TO CENGAGE) The following graph gives the labor market for laboratory aides in the imaginary country of Sophos. The equilibrium hourly wage is $10, and the equilibrium number of laboratory aides is 150. Suppose the federal government of Sophos has decided to institute an hourly payroll tax of $4 on laboratory aides and wants to determine whether the tax should be levied on the workers, the employers, or both (in such a way that half the tax is collected from each party). Use the graph input tool to evaluate these three proposals. Entering a number into the Tax Levied on Employers field (initially set at zero dollars per hour) shifts the demand curve down by the amount you enter, and entering a number into the Tax Levied on Workers field (initially set at zero dollars per hour) shifts the supply curve up by the amount you enter. To determine the before-tax wage for each tax proposal, adjust the amount in the Wage field until the quantity of labor supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph. Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

Chapter11: Labor Markets

Section: Chapter Questions

Problem 1SQ

Related questions

Question

(ALL OWNERSHIP GOES TO CENGAGE)

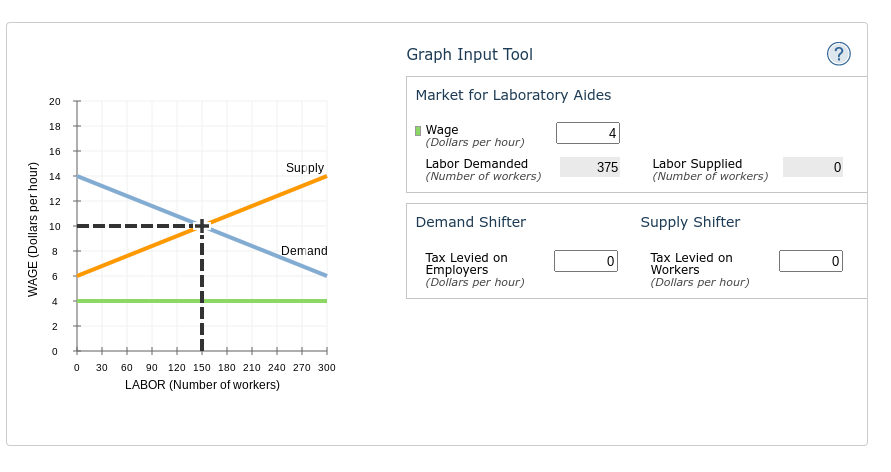

The following graph gives the labor market for laboratory aides in the imaginary country of Sophos. The equilibrium hourly wage is $10, and the equilibrium number of laboratory aides is 150.

Suppose the federal government of Sophos has decided to institute an hourly payroll tax of $4 on laboratory aides and wants to determine whether the tax should be levied on the workers, the employers, or both (in such a way that half the tax is collected from each party).

Use the graph input tool to evaluate these three proposals. Entering a number into the Tax Levied on Employers field (initially set at zero dollars per hour) shifts the demand curve down by the amount you enter, and entering a number into the Tax Levied on Workers field (initially set at zero dollars per hour) shifts the supply curve up by the amount you enter. To determine the before-tax wage for each tax proposal, adjust the amount in the Wage field until the quantity of labor supplied equals the quantity of labor demanded. You will not be graded on any changes you make to this graph.

Note: Once you enter a value in a white field, the graph and any corresponding amounts in each grey field will change accordingly.

(Images down below)

Transcribed Image Text:WAGE (Dollars per hour)

20

18

16

14

12

10

8

2

0

0

30

Supply

Demand

60 90 120 150 180 210 240 270 300

LABOR (Number of workers)

Graph Input Tool

Market for Laboratory Aides

Wage

(Dollars per hour)

Labor Demanded

(Number of workers)

Demand Shifter

Tax Levied on

Employers

(Dollars per hour)

375

0

Labor Supplied

(Number of workers)

Supply Shifter

Tax Levied on

Workers

(Dollars per hour)

(?)

0

0

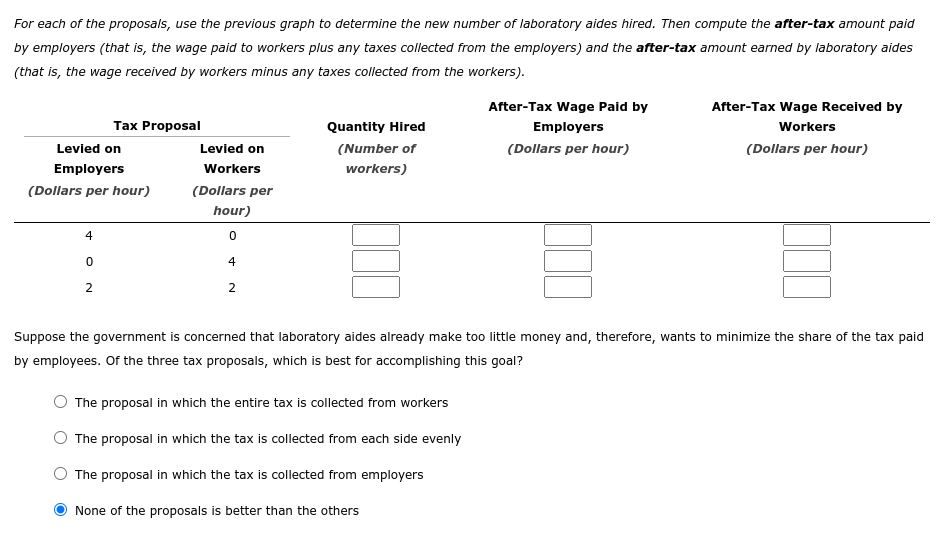

Transcribed Image Text:For each of the proposals, use the previous graph to determine the new number of laboratory aides hired. Then compute the after-tax amount paid

by employers (that is, the wage paid to workers plus any taxes collected from the employers) and the after-tax amount earned by laboratory aides

(that is, the wage received by workers minus any taxes collected from the workers).

Tax Proposal

Levied on

Employers

(Dollars per hour)

4

0

2

Levied on

Workers

(Dollars per

hour)

0

4

2

Quantity Hired

(Number of

workers)

After-Tax Wage Paid by

Employers

(Dollars per hour)

The proposal in which the entire tax is collected from workers

The proposal in which the tax is collected from each side evenly

The proposal in which the tax is collected from employers

None of the proposals is better than the others

After-Tax Wage Received by

Workers

(Dollars per hour)

Suppose the government is concerned that laboratory aides already make too little money and, therefore, wants to minimize the share of the tax paid

by employees. Of the three tax proposals, which is best for accomplishing this goal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you