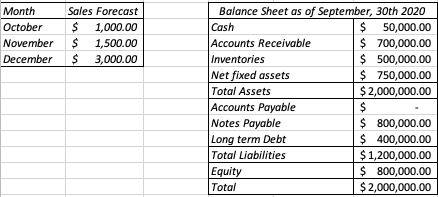

All sales are made on credit terms of net 30 days and are collected the following month and no bad debts are anticipated. The accounts receivable on the balance sheet at the end of September thus will be collected in October. The October sales will be collected in November, and so on. Inventory on hand represents a minimum operating level (or “safety” stock), which the company intends to maintain. Cost of goods sold average 80 percent of sales. Inventory is purchased in the month of sale and paid for in cash. Other cash expenses average 7 percent of sales. Depreciation is $10,000 per month. Assume taxes are paid monthly and the effective income tax rate is 40 percent for planning purposes. The annual interest rate on outstanding long-term debt and bank loans (notes payable) is 12%. There are no capital expenditures planned during the period, and no dividends will be paid. The company’s desired end-of-month cash balance is $80,000. The president hopes to meet any cash shortages during the period by increasing the firm’s notes payable to the bank. The interest rate on new loans will be 12 percent. Prepare monthly pro forma balance sheets at the end of October, November, and December, 2020

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

All sales are made on credit terms of net 30 days and are collected the following month and no

The annual interest rate on outstanding long-term debt and bank loans (notes payable) is 12%. There are no capital expenditures planned during the period, and no dividends will be paid. The company’s desired end-of-month cash balance is $80,000. The president hopes to meet any cash shortages during the period by increasing the firm’s notes payable to the bank. The interest rate on new loans will be 12 percent.

- Prepare monthly pro forma balance sheets at the end of October, November, and December, 2020.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images