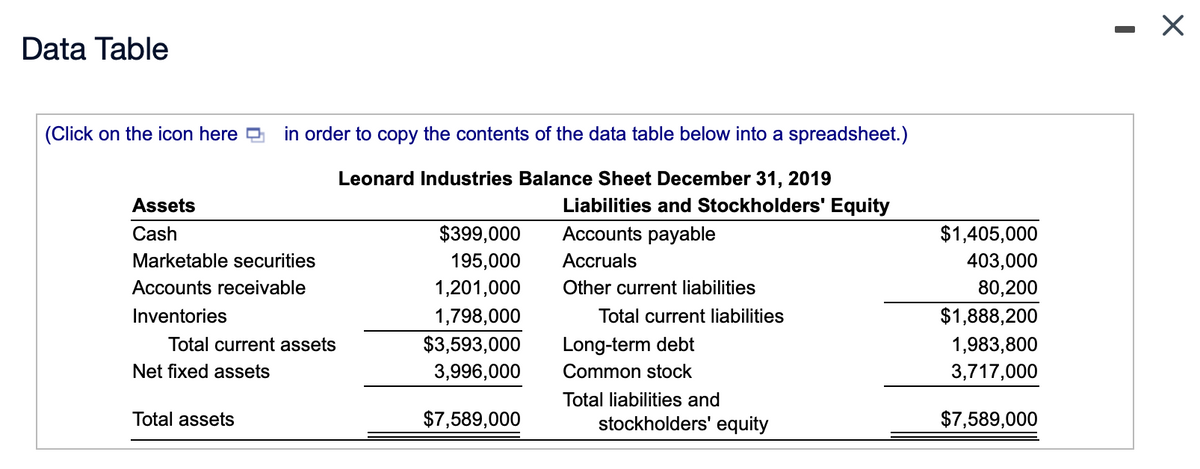

ro forma balance sheet Peabody & Peabody has 2019 sales of $10.5 million. It wishes to analyze expected performance and financing needs for 2021—2 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 11.9%, Inventory; 17.7%; Accounts payable, 13.6%; Net profit margin, 3.5%. (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $482,000 is desired. (4) A new machine costing $653,000 will be acquired in 2020, and equipment costing $848,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $288,000, and in 2021 $388,000 of depreciation will be taken. (5) Accruals are expected to rise to $504,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profits is expected to continue. (9) Sales are expected to be $11.6 million in 2020 and $11.7 million in 2021. (10) The December 31, 2019, balance sheet is here (PICTURE) a. Prepare a pro forma balance sheet dated December 31, 2021. b. Discuss the financing changes

ro forma balance sheet Peabody & Peabody has 2019 sales of $10.5 million. It wishes to analyze expected performance and financing needs for 2021—2 years ahead. Given the following information, respond to parts a. and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 11.9%, Inventory; 17.7%; Accounts payable, 13.6%; Net profit margin, 3.5%. (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $482,000 is desired. (4) A new machine costing $653,000 will be acquired in 2020, and equipment costing $848,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $288,000, and in 2021 $388,000 of depreciation will be taken. (5) Accruals are expected to rise to $504,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profits is expected to continue. (9) Sales are expected to be $11.6 million in 2020 and $11.7 million in 2021. (10) The December 31, 2019, balance sheet is here (PICTURE) a. Prepare a pro forma balance sheet dated December 31, 2021. b. Discuss the financing changes

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 3MC: Prince Corporations accounts provided the following information at December 31, 2019: What should be...

Related questions

Question

Pro forma balance sheet Peabody & Peabody has

2019

sales of

$10.5

million. It wishes to analyze expected performance and financing needs for

2021—2

years ahead. Given the following information, respond to parts a. and b.(1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable;

11.9%,

Inventory;

17.7%;

Accounts payable,

13.6%;

Net profit margin,

3.5%.

(2) Marketable securities and other current liabilities are expected to remain unchanged.

(3) A minimum cash balance of

$482,000

is desired.(4) A new machine costing

depreciation in

forecast as

$653,000

will be acquired in

2020,

and equipment costing

$848,000

will be purchased in

2021.

Total 2020

is $288,000,

and in

2021

$388,000

of depreciation will be taken.(5) Accruals are expected to rise to

$504,000

by the end of

2021.

(6) No sale or retirement of long-term debt is expected.

(7) No sale or repurchase of common stock is expected.

(8) The dividend payout of

50%

of net profits is expected to continue.(9) Sales are expected to be

$11.6

million in

2020

and

$11.7

million in

2021.

(10) The December 31,

2019,

balance sheet is here (PICTURE)

a. Prepare a pro forma balance sheet dated December 31,

2021.

b. Discuss the financing changes suggested by the statement prepared in part

(a).

Transcribed Image Text:Data Table

(Click on the icon here D

in order to copy the contents of the data table below into a spreadsheet.)

Leonard Industries Balance Sheet December 31, 2019

Assets

Liabilities and Stockholders' Equity

Cash

$399,000

Accounts payable

$1,405,000

Marketable securities

195,000

Accruals

403,000

Accounts receivable

1,201,000

Other current liabilities

80,200

Inventories

1,798,000

Total current liabilities

$1,888,200

Total current assets

$3,593,000

Long-term debt

1,983,800

Net fixed assets

3,996,000

Common stock

3,717,000

Total liabilities and

Total assets

$7,589,000

stockholders' equity

$7,589,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning