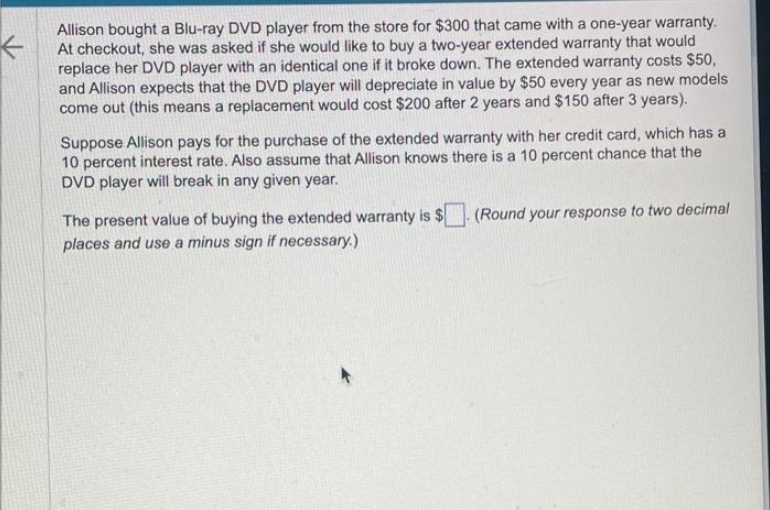

Allison bought a Blu-ray DVD player from the store for $300 that came with a one-year warranty. At checkout, she was asked if she would like to buy a two-year extended warranty that would replace her DVD player with an identical one if it broke down. The extended warranty costs $50, and Allison expects that the DVD player will depreciate in value by $50 every year as new models come out (this means a replacement would cost $200 after 2 years and $150 after 3 years). Suppose Allison pays for the purchase of the extended warranty with her credit card, which has a 10 percent interest rate. Also assume that Allison knows there is a 10 percent chance that the DVD player will break in any given year. The present value of buying the extended warranty is $ places and use a minus sign if necessary.) (Round your response to two decimal

Allison bought a Blu-ray DVD player from the store for $300 that came with a one-year warranty. At checkout, she was asked if she would like to buy a two-year extended warranty that would replace her DVD player with an identical one if it broke down. The extended warranty costs $50, and Allison expects that the DVD player will depreciate in value by $50 every year as new models come out (this means a replacement would cost $200 after 2 years and $150 after 3 years). Suppose Allison pays for the purchase of the extended warranty with her credit card, which has a 10 percent interest rate. Also assume that Allison knows there is a 10 percent chance that the DVD player will break in any given year. The present value of buying the extended warranty is $ places and use a minus sign if necessary.) (Round your response to two decimal

Chapter6: Business Expenses

Section: Chapter Questions

Problem 89TPC

Related questions

Question

Hw.145.

Transcribed Image Text:←

Allison bought a Blu-ray DVD player from the store for $300 that came with a one-year warranty.

At checkout, she was asked if she would like to buy a two-year extended warranty that would

replace her DVD player with an identical one if it broke down. The extended warranty costs $50,

and Allison expects that the DVD player will depreciate in value by $50 every year as new models

come out (this means a replacement would cost $200 after 2 years and $150 after 3 years).

Suppose Allison pays for the purchase of the extended warranty with her credit card, which has a

10 percent interest rate. Also assume that Allison knows there is a 10 percent chance that the

DVD player will break in any given year.

The present value of buying the extended warranty is $

places and use a minus sign if necessary.)

(Round your response to two decimal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you