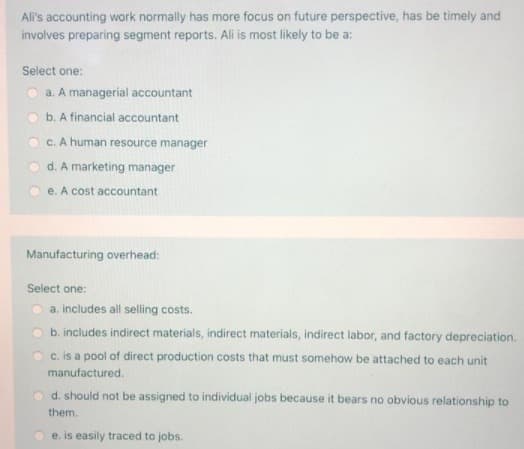

All's accounting work normally has more focus on future perspective, has be timely and involves preparing segment reports. Ali is most likely to be a: Select one: O a. A managerial accountant O b. A financial accountant c. A human resource manager d. A marketing manager e. A cost accountant Manufacturing overhead: Select one: a. includes all selling costs. b. includes indirect materials, indirect materials, indirect labor, and factory depreciation c. is a pool of direct production costs that must somehow be attached to each unit manufactured. d. should not be assigned to individual jobs because it bears no obvious relationship to them. O e. is easily traced to jobs.

All's accounting work normally has more focus on future perspective, has be timely and involves preparing segment reports. Ali is most likely to be a: Select one: O a. A managerial accountant O b. A financial accountant c. A human resource manager d. A marketing manager e. A cost accountant Manufacturing overhead: Select one: a. includes all selling costs. b. includes indirect materials, indirect materials, indirect labor, and factory depreciation c. is a pool of direct production costs that must somehow be attached to each unit manufactured. d. should not be assigned to individual jobs because it bears no obvious relationship to them. O e. is easily traced to jobs.

Chapter1: Accounting As A Tool For Managers

Section: Chapter Questions

Problem 1EB: Indicate whether the statement describes reporting by the financial accounting function or the...

Related questions

Question

Transcribed Image Text:Ali's accounting work normally has more focus on future perspective, has be timely and

involves preparing segment reports. Ali is most likely to be a:

Select one:

O a. A managerial accountant

O b. A financial accountant

O C. A human resource manager

O d. A marketing manager

O e. A cost accountant

Manufacturing overhead:

Select one:

O a. includes all selling costs.

b. includes indirect materials, indirect materials, indirect labor, and factory depreciation.

O c.is a pool of direct production costs that must somehow be attached to each unit

manufactured.

O d. should not be assigned to individual jobs because it bears no obvious relationship to

them.

O e. is easily traced to jobs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:

9781133935940

Author:

Ulric J. Gelinas

Publisher:

CENGAGE L