Instruction: Write "T" if the statement is TRUE. If FALSE, write "F" and underline the word that makes the statement incorrect. i 1. A knowledge of the costs of doing business is needed to estimate a job or to bid for jobs or contracts. The order generally goes to the highest bidder. 2. Cost accounting is also used in preparing a company's budget which is the overall financial plan for present activities. 3. Raw material to one manufacturer is not considered finished goods by the supplier of those materials. 4. In the manufacturing of clothing, the earnings of cutters are indirect labor costs. _5. All costs incurred in the factory that cannot be considered direct materials or direct laber are classified as factory burdon

Instruction: Write "T" if the statement is TRUE. If FALSE, write "F" and underline the word that makes the statement incorrect. i 1. A knowledge of the costs of doing business is needed to estimate a job or to bid for jobs or contracts. The order generally goes to the highest bidder. 2. Cost accounting is also used in preparing a company's budget which is the overall financial plan for present activities. 3. Raw material to one manufacturer is not considered finished goods by the supplier of those materials. 4. In the manufacturing of clothing, the earnings of cutters are indirect labor costs. _5. All costs incurred in the factory that cannot be considered direct materials or direct laber are classified as factory burdon

Chapter1: Accounting As A Tool For Managers

Section: Chapter Questions

Problem 1EB: Indicate whether the statement describes reporting by the financial accounting function or the...

Related questions

Question

100%

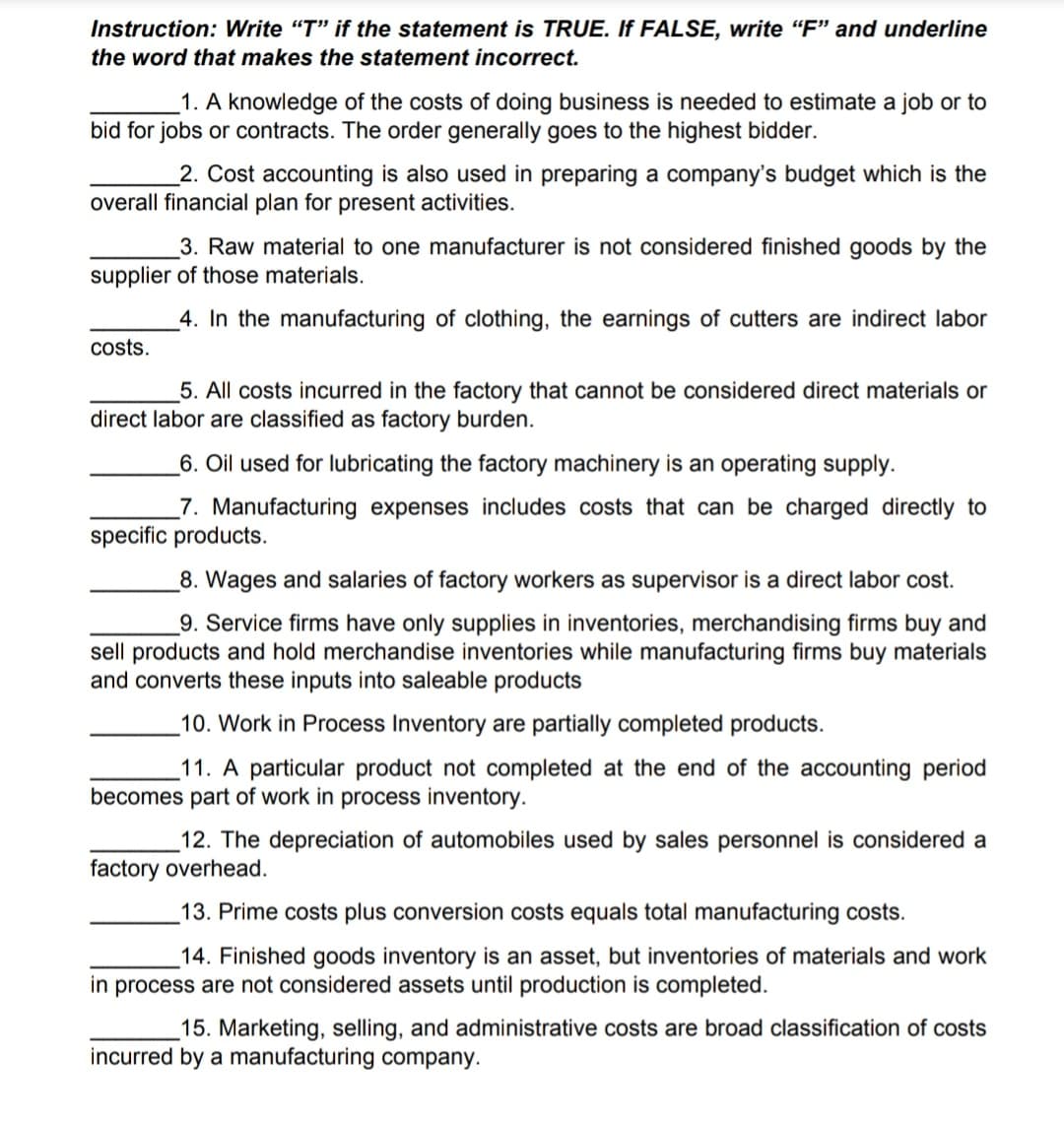

Transcribed Image Text:Instruction: Write "T" if the statement is TRUE. If FALSE, write "F" and underline

the word that makes the statement incorrect.

1. A knowledge of the costs of doing business is needed to estimate a job or to

bid for jobs or contracts. The order generally goes to the highest bidder.

2. Cost accounting is also used in preparing a company's budget which is the

overall financial plan for present activities.

3. Raw material to one manufacturer is not considered finished goods by the

supplier of those materials.

4. In the manufacturing of clothing, the earnings of cutters are indirect labor

costs.

5. All costs incurred in the factory that cannot be considered direct materials or

direct labor are classified as factory burden.

_6. Oil used for lubricating the factory machinery is an operating supply.

_7. Manufacturing expenses includes costs that can be charged directly to

specific products.

8. Wages and salaries of factory workers as supervisor is a direct labor cost.

_9. Service firms have only supplies in inventories, merchandising firms buy and

sell products and hold merchandise inventories while manufacturing firms buy materials

and converts these inputs into saleable products

_10. Work in Process Inventory are partially completed products.

_11. A particular product not completed at the end of the accounting period

becomes part of work in process inventory.

12. The depreciation of automobiles used by sales personnel is considered a

factory overhead.

_13. Prime costs plus conversion costs equals total manufacturing costs.

14. Finished goods inventory is an asset, but inventories of materials and work

in process are not considered assets until production is completed.

15. Marketing, selling, and administrative costs are broad classification of costs

incurred by a manufacturing company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning