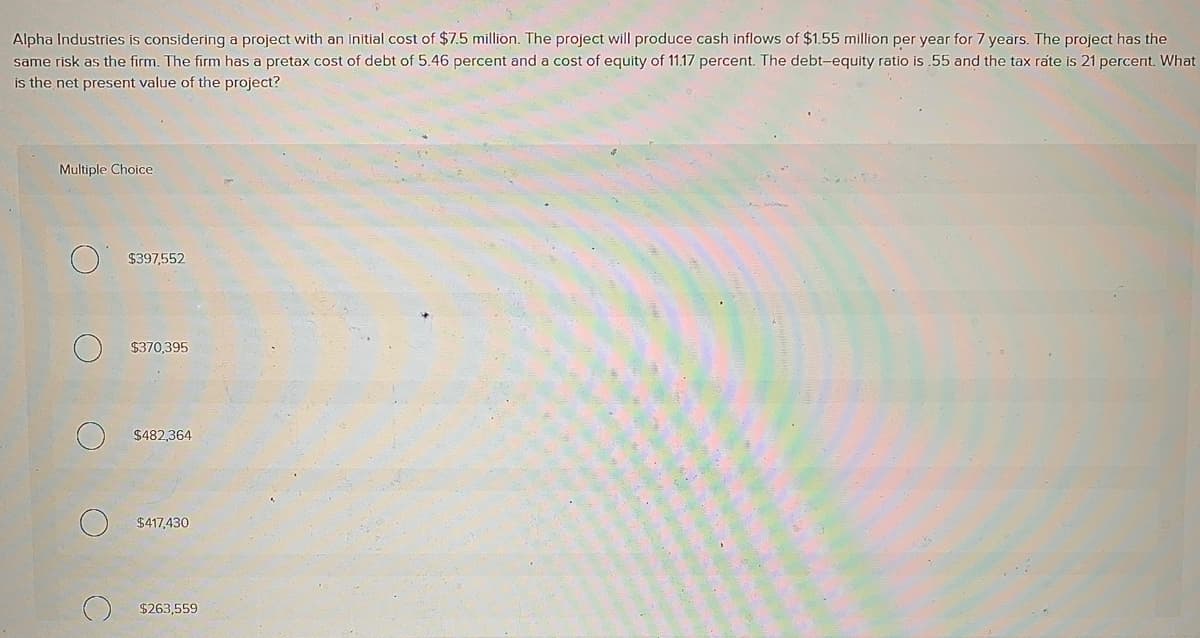

Alpha Industries is considering a project with an initial cost of $7.5 million. The project will produce cash inflows of $1.55 million per year for 7 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.46 percent and a cost of equity of 11.17 percent. The debt-equity ratio is .55 and the tax rate is 21 percent. What is the net present value of the project?

Alpha Industries is considering a project with an initial cost of $7.5 million. The project will produce cash inflows of $1.55 million per year for 7 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.46 percent and a cost of equity of 11.17 percent. The debt-equity ratio is .55 and the tax rate is 21 percent. What is the net present value of the project?

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

suppose your company needs $43 million to build a new assembly line. your target debt-equity ratio is .75. the flotation cost for new equity is 6 percent, but the flotation cost for debt is only 2 percent. your boss has decided to fund the project by borrowing money because the flotation costs are lower and the needed funds are relatively small.

Transcribed Image Text:Alpha Industries is considering a project with an initial cost of $7.5 million. The project will produce cash inflows of $1.55 million per year for 7 years. The project has the

same risk as the firm. The firm has a pretax cost of debt of 5.46 percent and a cost of equity of 11.17 percent. The debt-equity ratio is .55 and the tax rate is 21 percent. What

is the net present value of the project?

Multiple Choice

$397,552

$370,395

$482,364

$417,430

$263,559

aft

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning