Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1dM

Related questions

Question

also solve for the future worth method

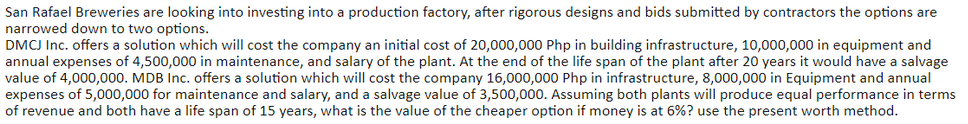

Transcribed Image Text:San Rafael Breweries are looking into investing into a production factory, after rigorous designs and bids submitted by contractors the options are

narrowed down to two options.

DMCJ Inc. offers a solution which will cost the company an initial cost of 20,000,000 Php in building infrastructure, 10,000,000 in equipment and

annual expenses of 4,500,000 in maintenance, and salary of the plant. At the end of the life span of the plant after 20 years it would have a salvage

value of 4,000,000. MDB Inc. offers a solution which will cost the company 16,000,000 Php in infrastructure, 8,000,000 in Equipment and annual

expenses of 5,000,000 for maintenance and salary, and a salvage value of 3,500,000. Assuming both plants will produce equal performance in terms

of revenue and both have a life span of 15 years, what is the value of the cheaper option if money is at 6%? use the present worth method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning