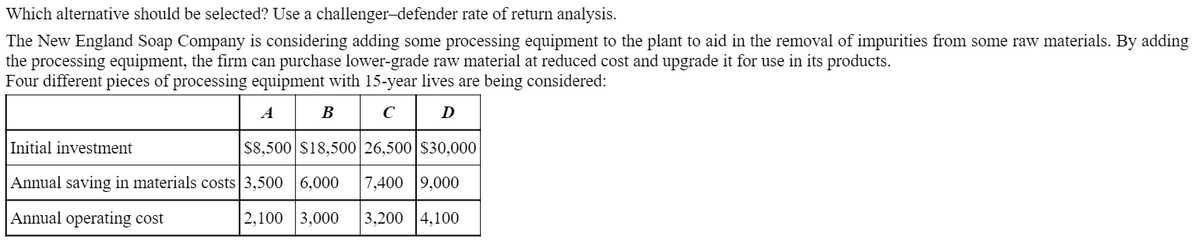

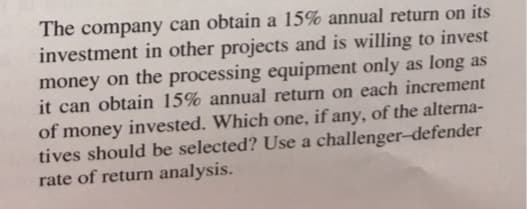

Which alternative should be selected? Use a challenger-defender rate of return analysis.

Q: Which is the better investment option?

A: The process of finding the present value using the future value, interest rate and the compounding…

Q: What are the implications of the weak‐form, semi-strong-form, and strong-form of the EMH for…

A: The Efficient Market Hypothesis (EMH) describes a stock market that is both operationally and…

Q: What is investment timing option?

A: Option with reference to investment or project refers a significant option that can affect the…

Q: Define then discuss Value-at-Risk.

A: The stock market is full of new policies and procedures. It get impacted by change in the government…

Q: a. What is the IRR of cach alternative? b. What is the present value of costs of cach alternative?…

A: Capital budgeting is a technique that is used widely by companies to evaluate projects to make the…

Q: is the intuition behind multiples or comparables valuation? What are the advantages of this m

A: Multiple method is very common method of valuation of stock in market.

Q: Which of the following best explains the limitations of usin discount rate for evaluating projects?

A: Note: 'Since you have asked multiple questions, we will solve the first question for you. If you…

Q: What is the significance of the Value at Risk (VaR) method?

A: The question is based on the concept of Value at Risk (VaR). VaR is a statistical measure of risk in…

Q: What are the shortcomings of the internal rate of return criterion?

A: Solution- Internal Rate of Return (IRR)- The Internal Rate of return (IRR) is that the discount…

Q: How widely used is real option analysis?

A: Real option analysis is the analysis of a company’s opportunity cost of an investment or a…

Q: Determine which of the following two alternatives is the most efficient and which is the most…

A: Internal rate of return (IRR) of an alternative refers to the rate at which the Net present value…

Q: Describe the method of Payback Screening?

A: Answer: The company has several investment opportunities. It is vital that you opt for the right…

Q: Besides the dollar cost, what other costs should you consider when comparing alternative solutions…

A: A company will incur various costs to earn revenue. The costs can be either direct or indirect costs…

Q: What are some possible financial decisions in which using the Present Value (PV) formula might be…

A: The present value (PV) is the current value provided a defined rate of return of a future amount of…

Q: What techniques can be used to analyze real options?

A: A choice accessible to the organization's managers related to the investment opportunities is known…

Q: The internal rate of return (IRR), despite its shortcomings, can be a useful analysis tool for…

A: IRR is the required rate of return for the project to have zero Net Present value.

Q: Should the analyses show the sensitivity of the discounted net present value and other outcomes?

A: The question is based on the concept of a sensitivity analysis, used as a analysis tool in capital…

Q: What is required // calculate the required rate of return with an opinion on acceptance or rejection…

A: Rate of return is the return is the return received from an investment. It is the real return…

Q: Required: i. Using present-value method, determine the best alternative ii. Using the internal rate…

A: By using present value method , debt alternative carrying interest of 10% is the best alternative…

Q: Why do most of the engineers prefer Rate of Return Analysis to the PW method?

A: Answer: They would be calculating the present worth of cash flows using a net present value…

Q: Which alternative offers you the highest effective rate of return?

A: Investment appraisal is the method of evaluating and selecting investments from various investment…

Q: What is the difference between the possible returns and the expected return?

A:

Q: What is the intuition behind multiples or comparables valuation? What are the advantages of this…

A: Answer : What is the intuition behind multiples or comparable valuation? The intuition behind…

Q: Would you expect an abandonment option to increase or decrease a project’sexpected NPV and risk (as…

A: Net present value (NPV) is the contrast between the present value of money inflows over some…

Q: What is the gradient-series present-worth factor with formula?

A: Step 1: When there is a uniformly change in rate of interest is a gradient series of cash flow. It…

Q: choose the best alternative A or B using net present worth method ?

A: The net present value is one of the modern methods used for evaluating the feasibility of a…

Q: What is the potentially acceptable investment alternative?

A: An alternative investment is a financial asset that doesn't can be categorized as one of the…

Q: Compare the mutually exclusive alternatives based on the rate of return?

A: Mutually exclusive projects are the projects out of which one best project is selected due to lack…

Q: What is option value (of project)?

A: Option value of the project is the real option approach of evaluating projects that views selecting…

Q: What is a minimum attractive rate of return (MARR)?

A: Definition: Minimum Attractive Rate of Return (MARR): It is the minimum rate of return on the basis…

Q: What are the shortcomings of the internal rate of return criterion? How do you make an investment…

A: Internal rate of return is the discount rate at which the present value of the future cash flow and…

Q: Describe the Replacement Analysis using the Opportunity-Cost Approach?

A: The company always considers the replacement projects when the old machinery or plant in the project…

Q: What is internal rate of return (IRR) method?

A: NPV shows the excess of PV of all the cash inflows over the initial outlay of the project. It is a…

Q: which investment is preferable?

A: The present value is the present worth of the amount that will be paid or received at present.

Q: Beside the dollar cost, what other costs should you consider when comparing alternative solutions to…

A: There could be lot of factors which are to be considered while comparing alternative solutions to a…

Q: Considering the unequal investments, which of the following techniques would be most approprlate for…

A: Payback Period: It is the period in which the project recovers the cash outflow. Net Present…

Q: Can we consider Project Risk by Discount Rate?

A: The discount rate is an interest rate that is used in computing the present value of the future cash…

Q: Present the internal rate of return criterion and its strengths and weaknesses.

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Illustrate Investment Decision for a Nonsimple Project?

A: Investments: Companies invest in stocks and bonds of other companies or governmental entity to…

Q: Calculate the average rate of return, and conclude your results with your comments about the ARR for…

A: Calculation of Accounting Rate of Return (ARR) Year Net Cash Flow 1st…

Q: Which are two types of financially sound RPI strategies?

A: RPI refers to responsible property investing.

Q: What are some pros and cons of computing an expected return using a user-specified model versus…

A: Expected Return: As opposed to observed returns that are measured at the end of a given period, the…

Q: Is the investment risk concerned with the range of possible outcomes from aninvestment?

A: For a business, there are many types of risks associated with it. Some of the risks are credit risk,…

Q: What is Modified Internal Rate of Return (MIRR) method?

A: Internal rate of return (IRR): The internal rate of return (IRR) is a measure utilized in capital…

Q: How can we Consider Project Risk by Discount Rate?

A: In corporate finance, a discount rate is the rate of return used to discount future cash flows back…

Q: Describe the advantages of using CAPM model to determine the expected return.

A: The question is related to Capital Asset Pricing Model.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- The J.R. Ryland Computer Company is considering a plant expansion to enable the company to begin production of a new computer product. The companys president must determine whether to make the expansion a medium- or large-scale project. Demand for the new product is uncertain, which for planning purposes may be low demand, medium demand, or high demand. The probability estimates for demand are 0.20, 0.50, and 0.30, respectively. Letting x and y indicate the annual profit in thousands of dollars, the firms planners developed the following profit forecasts for the medium-and large-scale expansion projects. a. Compute the expected value for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of maximizing the expected profit? b. Compute the variance for the profit associated with the two expansion alternatives. Which decision is preferred for the objective of minimizing the risk or uncertainty?The Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 8%, and the projects’ expected net costs are listed in the following table: What is the IRR of each alternative? What is the present value of the costs of each alternative? Which method should be chosen?Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.

- Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.Den-Tex Company is evaluating a proposal to replace its HID (high intensity discharge) lighting with LED (light emitting diode) lighting throughout its warehouse. LED lighting consumes less power and lasts longer than HID lighting for similar performance. The following information was developed: a. Determine the investment cost for replacing the 700 fixtures. b. Determine the annual utility cost savings from employing the new energy solution. c. Should the proposal be accepted? Evaluate the proposal using net present value, assuming a 15-year life and 8% minimum rate of return. (Present value factors are available in Appendix A.)Austins cell phone manufacturer wants to upgrade their product mix to encompass an exciting new feature on their cell phone. This would require a new high-tech machine. You are excited about his new project and are recommending the purchase to your board of directors. Here is the information you have compiled in order to complete this recommendation: According to the information, the project will last 10 years and require an initial investment of $800,000, depreciated with straight-line over the life of the project until the final value is zero. The firms tax rate is 30% and the required rate of return is 12%. You believe that the variable cost and sales volume may be as much as 10% higher or lower than the initial estimate. Your boss understands the risks but asks you to explain the alternatives in a brief memo to the board, Write a memo to the Board of Directors objectively weighing out the pros and cons of this project and make your recommendation(s).

- Southland Corporation’s decision to produce a new line of recreational products resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: What is the decision to be made, and what is the chance event for Southland’s problem? Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?Talbot Industries is considering launching a new product. The new manufacturing equipment will cost 17 million, and production and sales will require an initial 5 million investment in net operating working capital. The companys tax rate is 40%. a. What is the initial investment outlay? b. The company spent and expensed 150,000 on research related to the new product last year. Would this change your answer? Explain. c. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for 1.5 million after taxes and real estate commissions. How would this affect your answer?

- Newmarge Products Inc. is evaluating a new design for one of its manufacturing processes. The new design will eliminate the production of a toxic solid residue. The initial cost of the system is estimated at 860,000 and includes computerized equipment, software, and installation. There is no expected salvage value. The new system has a useful life of 8 years and is projected to produce cash operating savings of 225,000 per year over the old system (reducing labor costs and costs of processing and disposing of toxic waste). The cost of capital is 16%. Required: 1. Compute the NPV of the new system. 2. One year after implementation, the internal audit staff noted the following about the new system: (1) the cost of acquiring the system was 60,000 more than expected due to higher installation costs, and (2) the annual cost savings were 20,000 less than expected because more labor cost was needed than anticipated. Using the changes in expected costs and benefits, compute the NPV as if this information had been available one year ago. Did the company make the right decision? 3. CONCEPTUAL CONNECTION Upon reporting the results mentioned in the postaudit, the marketing manager responded in a memo to the internal audit department indicating that cash inflows also had increased by a net of 60,000 per year because of increased purchases by environmentally sensitive customers. Describe the effect that this has on the analysis in Requirement 2. 4. CONCEPTUAL CONNECTION Why is a postaudit beneficial to a firm?Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?Hemmingway, Inc. is considering a $5 million research and development (R&D) project. Profit projections appear promising, but Hemmingway’s president is concerned because the probability that the R&D project will be successful is only 0.50. Furthermore, the president knows that even if the project is successful, it will require that the company build a new production facility at a cost of $20 million in order to manufacture the product. If the facility is built, uncertainty remains about the demand and thus uncertainty about the profit that will be realized. Another option is that if the R&D project is successful, the company could sell the rights to the product for an estimated $25 million. Under this option, the company would not build the $20 million production facility. The decision tree follows. The profit projection for each outcome is shown at the end of the branches. For example, the revenue projection for the high demand outcome is $59 million. However, the cost of the R&D project ($5 million) and the cost of the production facility ($20 million) show the profit of this outcome to be $59 – $5 – $20 = $34 million. Branch probabilities are also shown for the chance events. Analyze the decision tree to determine whether the company should undertake the R&D project. If it does, and if the R&D project is successful, what should the company do? What is the expected value of your strategy? What must the selling price be for the company to consider selling the rights to the product? Develop a risk profile for the optimal strategy.